There’s a never-ending debate about income inequality and how much taxes people at varying income levels should pay. This was brought onto the front pages by the Occupy movement, which highlighted in the United States that the top 10% of households had an income 11 times larger than the bottom 10% (sometimes called the 90/10 ratio). In Australia, income inequality is not this extreme, with the top 10% about 4 times larger than the bottom 10%.

This article does not buy into the social or equity arguments about income and tax distribution, but as we approach the end of another financial year where tax has again been high on the agenda, it’s interesting to see where personal income tax receipts come from.

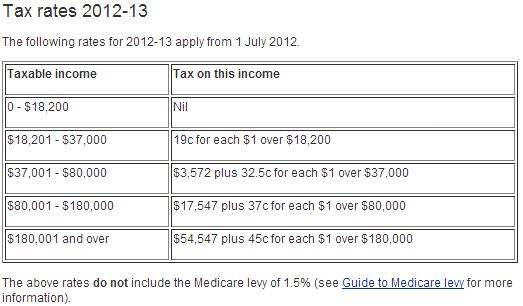

A reminder of the current tax scales (check ATO website for updates):

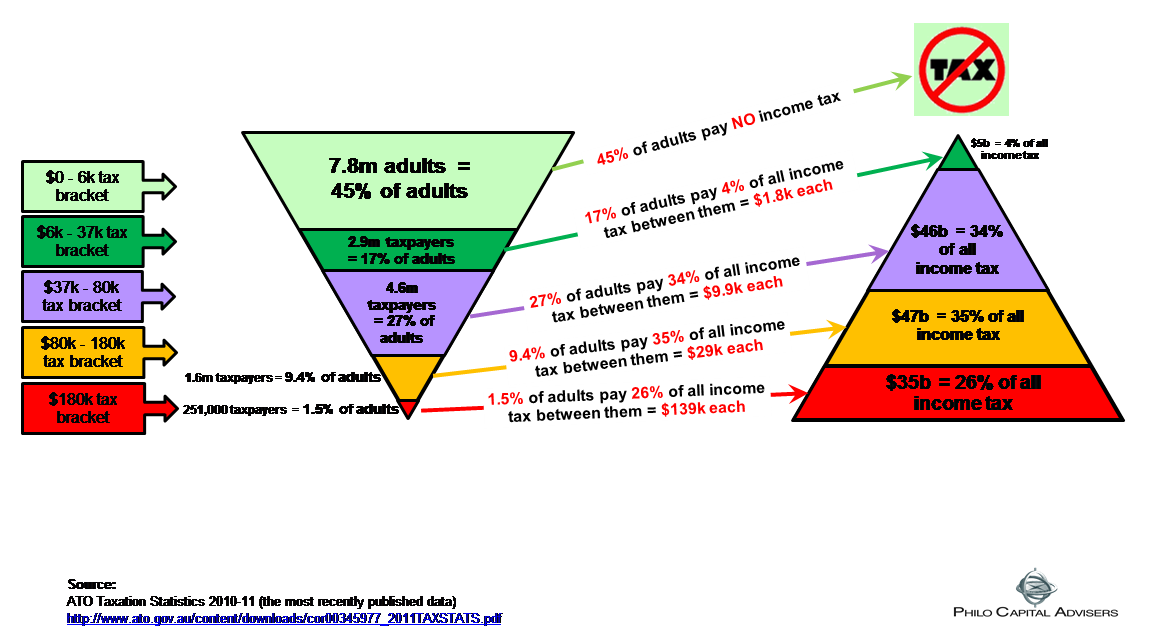

The latest available statistics on numbers and amount in each tax bracket are from 2010/2011, when the bottom tax scale cut out at $6,000. In coming years, there will be far more people paying no tax than indicated in the diagram below. The top marginal tax rate for taxable income over $180,000 is 46.5%, the same in both reporting periods.

The following graph illustrates the amount of tax paid by tax bracket as at 2010/2011, and perhaps the most surprising statistic is the number of people in the bottom category who pay no personal income tax, even when the cut off was $6,000:

- 45% of all adults, almost 8 million, pay no personal income tax. Another 17% or 3 million pay an average of $1,800. Therefore, 62% of Australians pay 4% of total personal income tax revenue

- 26% of personal income tax, worth $35 billion or an average of $139,000 each, is paid by the 1.5% of adults or 260,000 people who earn more than $180,000

- in the middle, 44% of adults or 7.5 million, pay the balance, 69% of income tax.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director of Third Link Investment Managers.