Where are the Customers’ Yachts? is an all-time classic book about the investment and stockbroking industry in 1930s New York, written by Fred Schwed Jr and first published in 1940. It was a time of high brokerage fees, wide trading spreads and poor price discovery. The book's title came from a question by a visitor to Manhattan in the late 1800s, who admired the beautiful boats nearby which were all owned by bankers and brokers.

While many aspects of investing have not changed much over the decades, financial innovation and competition have reduced spreads and fees on many products and it is now possible to invest in professionally-managed funds for free, or very close to it. Investing has become increasingly democratised and accessible.

Of course, thousands of funds available in Australia still charge relatively high fees. When Treasury released its Your Future, Your Super proposals in 2020, the background paper estimated that Australians were paying $30 billion a year in superannuation fees alone, expected to rise to $46 billion by 2034. Plus according to Rice Warner’s Personal Investment Projections, Australians hold non-super investments (other than the family home) worth about the same as their super balances. It’s reasonable to expect, therefore, that within a decade, personal investment fees could top $100 billion a year. Investors have the choice not to add to the largesse.

Index funds are at the forefront of reducing investment costs, supported by cheap distribution via stock exchanges of Exchange-Traded Funds (ETFs). In the US, passive fund balances have exceeded active funds since 2019, with BlackRock and Vanguard the largest fund managers in the world, holding about $12 trillion each. Adoption in Australia has been significantly slower, where managed funds still dominate, but ETFs have grown strongly to over $150 billion.

While investment selection should not be based solely on cost, as the Treasury report says:

“Every dollar that an Australian pays in higher fees is a dollar that they will not benefit from in their retirement.”

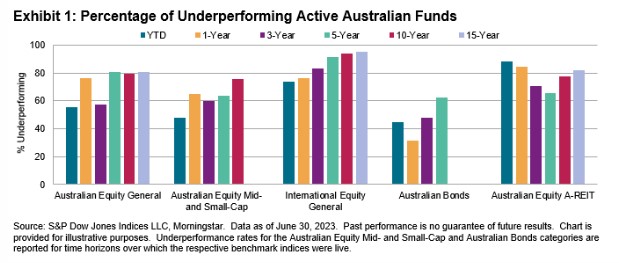

Some investment advice and portfolio management is worth paying for. If a fund manager consistently outperforms an index after fees, then the skill might be worth the cost. The challenge is in identifying the performing manager. The well-known Standard & Poor’s SPIVA research suggests about 80% to 90% of active fund managers in Australian and international equities fail to match their benchmarks after fees over five, 10 and 15 years.

Charlie Munger, Warren Buffett's offsider, knows more about active management than most. He told the Daily Journal:

“How many managers are going to beat the indexes, all cost considered? Maybe 5% consistently beat the averages. Everyone else is living in a state of denial. [Active managers] are used to charging big fees for stuff that is not doing their clients any good … If a widow comes to you with $500,000 and you charge 1% a year, you could put them in the indexes but you need your 1%, so you charge someone a considerable fee for worthless advice.”

Investing should aim for maximum returns for a given level of risk, consistent with long-term goals, but let’s explore some ways investing in funds can be free, or almost free.

1. ETFs

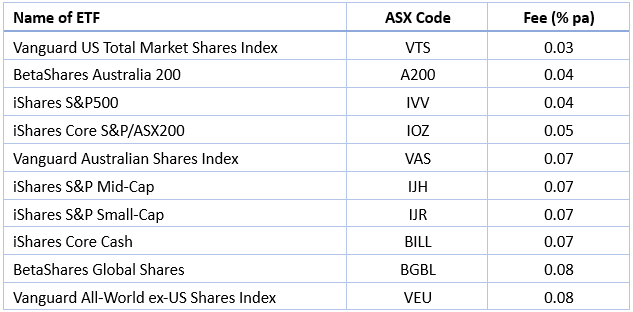

There is a wide range of index funds, either ETFs or unlisted managed funds, with such tiny management fees that the cost is almost irrelevant, say, less than 0.1%. The stockmarket regularly moves more than this every few minutes. While brokerage is paid to buy ETFs, there are online brokers offering trades for $10 or less, and brokerage is only payable once if the investor does not sell. It is not an annual fee.

Here are 10 Australian ETFs with an annual fee of 0.08% (8bp) or less:

These funds provide diversified access to small, mid and large cap equities both in Australia and around the world.

The lowest cost does not always make for the best investment. For example, a January 2023 episode of Morningstar’s podcast, Investing Compass, called ‘Build a Portfolio with 3 ETFs’ used Morningstar ratings rather than cost to build a simple diversified fund. They chose Vanguard MSCI Index International Shares (ASX:VGS) for broad global equity exposure, VanEck Australian Equal Weight (ASX:MVW) for a less concentrated exposure to Australian equities which has outperformed the index, and iShares Core Composite Bond (ASX:IAF) gives bond exposure to reduce risk.

There are also plenty of ETFs which give diversified exposure across many asset classes in a single trade, such as the Vanguard range of multi-sector ETFs. Across a range of risk levels from conservative to high growth, the management fee is 0.27%. BetaShares offers a diversified growth ETF for 0.19%. However, while these funds are 'cheap', they are compromising my definition of 'free'.

2. Industry funds

Industry funds are confined to superannuation so they are not relevant for non-super investing. The Australian Taxation Office (ATO) has a comparison tool for YourSuper funds including performance and fees.

The cheapest super fund with a management fee of 0.04% pa is the HostPlus Balanced Index Fund. While this is effectively ‘free’ for larger amounts, there are fixed administration fees of $1.50 a week or $78 a year which may be material for small balances.

Many industry funds have balanced options with active management and full functionality including call centres and general advice. UniSuper's Balanced Fund is claimed to charge the lowest fees of all default, balanced, MySuper funds with an administrative fee of $96 or 2% of the balance (whichever is lesser), an investment fee of 0.4% and transaction costs of 0.08%. It should cost around 0.5% for amounts other than small balances. Again, cheap but not free.

3. Retail managed funds

There are significant variations depending on funds and balances, but a favourable factor is the general lack of fixed administrative fees in most retail funds. Although ETFs have a reputation for cheap index funds, passive investing has been offered by unlisted managed funds long before ETFs came on the scene.

For example, the non-super FirstChoice Wholesale platform from Colonial First State (CFS) offers its Index Series across a full range of sector specific assets (Australian bond, global bond, Australian share, global share, property) as well as Diversified, Moderate, Balanced and Growth versions to match an investor’s risk appetite. The cost is a competitive 0.31% to 0.32% with full reporting and call centre access, with no additional administration fee and a minimum account balance of $1,000. For large balances, CFS offers a ‘portfolio rebate’ based on balance, at nil up to $100,000, 0.05% for the next $400,000, 0.1% for the next $500,000 and 0.2% for over $1 million. A portfolio of $2 million would receive a rebate of 0.135% taking total cost to 0.175% including active asset allocation.

In superannuation, small balances should focus on the annual fixed fee. For example, Virgin Money Super LifeStage Tracker charges a low annual fee of $58 regardless of the balance, with competitive fees. Asset allocation is performed by Mercer.

There are also actively-managed funds which charge a nil base management fee and rely on performance fees. A couple of examples are EGP Capital and Solaris Core Australian Equity Fund (Performance Fee Option).

4. Online digital investment funds

There are many roboadvice offers now in Australia, although the ‘advice’ part is usually little more than a few questions about age, risk appetite and financial resources. Portfolios are selected based on the responses but it does not qualify as financial advice. For example, many younger investors should be paying off credit card debt while older people would earn a guaranteed after-tax return by paying off the mortgage on their home. It is better described as digital investing.

One of the cheaper options is Spaceship in both super and non-super form. I was initially highly critical of this company but it seems to have come a long way over the six years since. In non-super investing, it offers the Spaceship Origin portfolio comprising a cap-weighted index portfolio with 15-25% allocated to the Top 100 Australian companies, 70-80% to the Top 100 global companies and 0-10% cash. The cost is $24 a year ($2 a month) plus 0.15% per annum. Spaceship's superannuation options do not fall into the ‘free’ category. For example, their index offering is $78 a year plus 0.577%.

The most successful online platforms in Australia are Raiz (cost around 0.5% or more depending on fund plus fixed fee for small balances) and Stockspot (fees varying from 0.66% for smaller balances to 0.396% for $2 million and over).

5. Funds in Listed Investment Companies

Many of the largest, traditional Listed Investment Companies (LICs) are attractively-priced for active management, with the Total Cost Ratio estimated by Morningstar for the three cheapest being:

- Argo Investments (ASX:ARG) cost 0.15% pa

- Australian Foundation Investment (ASX:AFI) cost 0.14% pa

- Australian United (ASX:AUI) cost 0.10% pa

Arguably, another way to invest ‘fee free’ is to buy LICs or Trusts (LITs) at a discount to the value of their Net Tangible Assets (NTA). For example, if a LIC is trading at a 15% discount to its NTA but carries a management fee of 1%, then in one sense, 15 years of fees are covered by the discount. In addition, if the LIC earns say 6% on its NTA, that will equate to (6%/.85) 7.06% at a 15% discount. That pays the 1% needed to cover the management fee.

However, saying the fee is covered by the discount assumes the discount narrows by 1% each year or 15% over 15 years. If an investor buys at a 15% discount and sells at a 15% discount, then the fees are not covered by the discount.

Building a portfolio of funds

The advantage of investing in a large, diversified fund is that the administrative work of rebalancing and selecting the asset allocation is performed by market experts. Even where the exposure is all in cheap index funds, the asset allocation alone may be worth paying for, given the skills provided by the fund and its asset consultant. The bulk of returns over time come from asset allocation, not the selection of specific stocks or bonds.

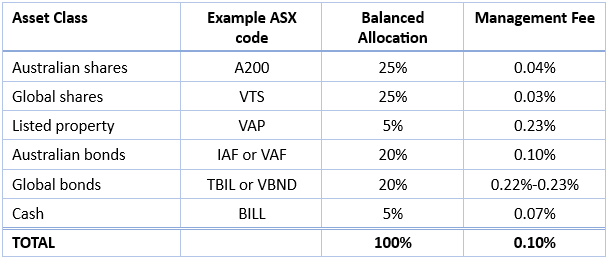

However, ETFs allow construction of a cheap balanced portfolio by selecting inexpensive funds, such as this typical balance fund allocation (about 50% growth, 50% defensive). This is simply an example of what is possible.

This portfolio of ETFs carries annual management costs of only 0.1%.

Where such a portfolio is applied to superannuation, it may be necessary to enter a 'Member Direct' product with a super fund, checking whether such ETFs are available.

Alternatively, setting up an SMSF with an inexpensive administration platform may be worthwhile but an SMSF incurs the ATO annual supervisory levy ($259) and the annual ASIC fee for an SMSF special purpose trustee (around $60). Financial advice is an additional expense if required.

A comment on other costs

Other transaction costs should be checked to ensure execution is as cheap as possible, including:

Brokerage: discount brokerage for execution only for $10 or less.

Spreads: there may be a 5 to 10 point spread between entry and exit prices.

Other expenses: funds will usually charge some expenses of a few points against the fund.

Final remarks

This paper is not suggesting management fees should be the sole determinant in selecting investments. Rather, it shows that investing can be free, or almost free, if desired by an investor. Many people complain about the tens of billions of dollars paid to the asset management industry each year when there are plenty of ways to invest and avoid these fees.

Graham Hand is Editor-At-large for Firstlinks. This article is general information, not taxation or personal advice, and is based on an understanding of relevant products without attempting to identify every option available. Individuals should seek advice from a financial adviser or tax accountant before considering on any of the investments mentioned outlined in this article.

***

Footnote

The following is a footnote on how Morningstar identifies good managers and performs its asset allocation, and it is for individuals and their advisers to determine whether fees for these skills are worth paying.

A note on Morningstar’s Medalist Ratings and Portfolios

Morningstar publishes ratings for over 200 Australia ETFs, as well as model portfolios built around ETFs. There are nine ETFs rated Gold and 20 rated Silver. Morningstar analysts select which ETFs to rate based on investor and adviser demand, and gives the ratings based on three pillars: Parent, People and Process, with the latter making allowance for fees.

What are the Medalist Core portfolios?

They are multi-asset, multi manager portfolios that are founded on Morningstar's strategic asset allocation, or SAA, and therefore they are highly diverse. A ‘whole of portfolio’ look through approach is used for portfolio construction and risk management.

What is the Morningstar Manager Research Medalist RatingsTM process?

The Medalist ratings process are Morningstar's forward-looking assessment of the universe of funds and ETFs covered in Morningstar’s extensive database. Morningstar is a global leader in researching and evaluating fund managers, and it’s been a core part of the Morningstar business for over 20 years. It’s well-established and globally consistent, and starts with assessing the People, the Process and the Parent organisation of each fund, using both our analysts’ insights and machine learning technology.

How do we use the Morningstar Manager Research Medalist RatingsTM process when constructing the Medalist Core portfolios?

The Medalist Core portfolios are made up of strategies that have been assigned a medal rating: gold, silver, or bronze. For active strategies, this means we believe it will outperform its benchmark. For passive strategies, it means outperforming the category average. The managers chosen are all well-regarded in the industry and most or all would be well-known to advisers. Morningstar risk and data tools are used to construct the portfolios to achieve balance and diversification, cognisant of market risks. Portfolios are designed with the intention that managers produce the majority of performance alpha.

What does this mean for advisers and their clients?

The portfolios are professionally managed and use institutional level portfolio construction and implementation tools while incorporating Morningstar's best ideas across manager research. It also means they incorporate a proprietary optimised mix of active and passive allocations. Morningstar only chooses active management when its analysis shows that there is a reasonable chance of achieving outperformance for the asset class, which is greater than the probability of underperformance.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free trial below:

Try Morningstar Investor for free