The first half of 2022 has been a volatile period for most asset classes. Equities are well off their highs, and for the traditional fixed income investor, the spectre of rising interest rates – which correlate negatively with bond prices – is an unwelcome sign.

But things aren’t all terrible, and we would argue that there is a possibility the world an avoid recession. Within this outlook, there are still opportunities for the fixed income investor.

Global macroeconomic outlook

Around the developed world, central banks have been adjusting their monetary policy settings in response to increasing inflation.

The combination of COVID-19 stimulus, supply constraints and the invasion of Ukraine by Russia, has led to meaningful increases in inflation. The labour market, particularly in the US, is also very tight, with around two job openings for every person looking for a job.

This has caught the US Federal Reserve (the Fed), and many other central banks including Australia’s Reserve Bank, off guard. The resulting central bank policy actions with regard to interest rates are clearly behind the curve. The Fed itself has already acknowledged this:

“There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability.”

Markets are now forecasting a number of rate hikes before the end of the year in most developed markets.

However, we believe that inflation may be near its peak, and while it may be a little bit sticky, we are optimistic that central banks acting ‘expeditiously’ now, will result in inflation moving lower over the next quarter to 12 months.

Growth will slow as interest rates rise but a strong employment backdrop provides good fundamental support and some degree of stickiness for the broad economic outlook.

These are strange times indeed, but COVID-19 was a once in a lifetime experience and its policy ramifications – both good and bad – will take some time for markets to work out. As such, a Wall Street slowdown may not impact Main Street to the degree it might have in prior recessions.

Fixed income opportunities

Given those conditions, let’s examine some opportunities for fixed income investors looking for yield in the next 12-18 months.

Government and sovereign bonds will be impacted in the short term by rising interest rates. But that does not rule out all fixed income opportunities, especially those in corporate bonds or credit. As outlined above, the labour market is currently very durable and companies are generally in a good position with regards to profitability and the ability to service debt. The combination of these factors mean the likelihood of broad defaults is quite low.

In this environment you can buy BBB-rated investment grade credit in very solid businesses with yields of around 5%. That is a higher yield than currently available in most equity markets. This has not been the case in the low yield environment for the past two to three years.

There is an opportunity to own solid investment grade corporate debt in companies with sound fundamentals and at yields that are attractive in both an absolute sense and relative to alternative yield options like shares. The price decline in recent months provides an element of price appreciation in-tandem with the aforementioned yield. Investing in short duration fixed income of three- to four-year maturities means less price risk than longer-term bonds.

Looking beyond residential property

Another area we like is commercial property and commercial mortgage-backed securities (CMBS) as they offer a way of incorporating stable income across a targeted set of property types and assets. Commercial mortgage-backed securities can also offer resistance to the inflation backdrop as real property prices will often go up during inflationary periods.

Our investment strategy maintains a favourable view on multi-family, industrial and select office property where fundamentals remain strong despite COVID-19. Commercial real estate debt continues to provide a higher return to that of similarly, or sometimes lower, rated corporates.

Emerging market sovereign debt

There are some markets where sovereign debt is attractive and emerging markets have been particularly interesting over the past 12 months. The past year has been one of the rare times when central banks in emerging markets have raised rates ahead of the developed world. Typically, you see the reverse, with developed markets like the US, Australia or Europe raising rates first.

However, emerging markets have experienced much more elevated inflation levels in the past year or two, coming out of COVID-19, relative to the developed world and their central banks have been raising rates much faster than the developed world. That now puts them in a position to be able to actually cut rates. And if there is a global slowdown from an economic standpoint, the emerging market world will be able to ease relative to the developed market.

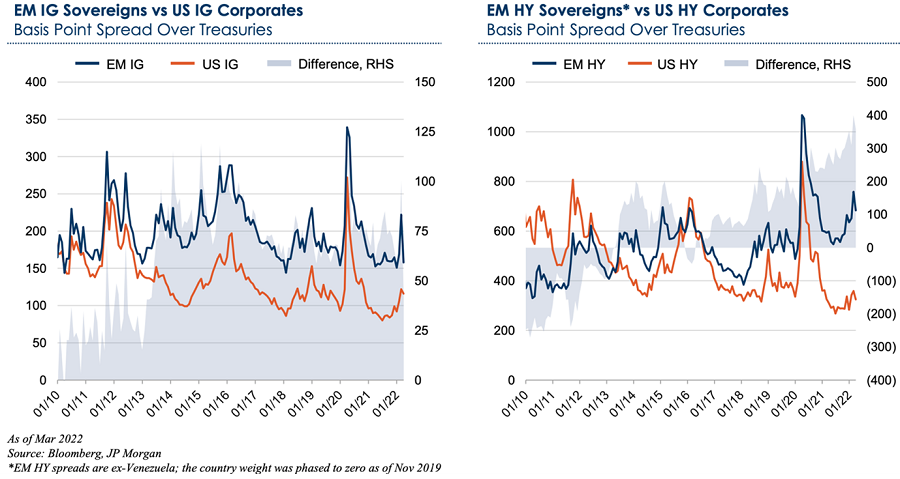

In this kind of environment, emerging market investment grade debt provides relative value and long-term additional spread compensation. As the below charts show, spreads in emerging market high yield debt also show value compared to US alternatives.

Relative value in emerging market sovereign debt

Bottom line

The economic outlook might look volatile and uncertain but there is still good news for investors with the right attitude.

We believe there are good opportunities in investment grade corporate debt where yields of 5% can be found. We like commercial real estate and are maintaining a preference for securitised debt with an emphasis on collateralised loan obligations and commercial banked mortgage securities given stable fundamentals, relative value, and broad demand for the asset classes.

Eric Souders is portfolio manager of the GFSM Payden Global Income Opportunities Fund. Payden & Rygel is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. The information in this article is provided for informational purposes only. Any opinions expressed in this material reflect, as at the date of publication, the views of Payden & Rygel and should not be relied upon as the basis of your investment decisions.

For more articles and papers from GSFM and partners, click here.