In October 2022, a renowned analyst at one of the world’s leading investment banks published a report that downgraded the stock of Meta Platforms (formerly Facebook) and halved his price target to $105 per share. The analyst had been spooked by Meta’s guidance on the scale of its future capital investments – largely for AI. The spending was simply too much, too scary. It was 'thesis changing', the analyst said. After the analyst’s report was published, Meta’s stock crashed 24% the next day.

But fast-forward 10 months, and the market now loves AI investments, and the more the better, seemingly. From the lows reached in late 2022, Meta’s stock has nearly quadrupled.

Put simply, the market was wrong on Meta.

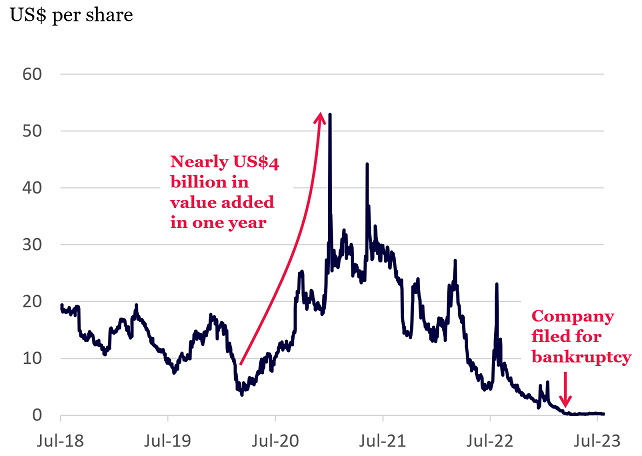

Here is another example. In 2020, Bed Bath & Beyond, a US big box retailer of homewares and furniture – a company that had earnings declines each year since 2013 – experienced something unusual.

Bed Bath & Beyond – Five year stock price

Source: Bloomberg

Over a 10-month period, its stock increased by 14x, adding nearly US$4 billion in value to the company. To put this in perspective, the value of the entire company – including all its indebtedness – amounted to only $3 billion at the beginning of this escapade.

Did this share price surge fairly represent the intrinsic value of the business? Or was the market simply swept up in some Covid-stimulus-related exuberance at the time? It was surely the latter. Two years later, Bed Bath & Beyond filed for bankruptcy.

The dangers and opportunities in a market that misleads

The conventional, academic view is that markets are ‘efficient’ – they price in all available information effectively and are therefore fairly valued. But as you can see in the stock stories above, the truth is that the market is often wrong: that is, stock prices can deviate from true value from time to time, and sometimes significantly. Ben Graham was certainly right to dub the stock market ‘Mr. Market’, a manic-depressive character prone to bouts of pessimism and optimism.

And that means stock prices are not reliably good at telling you whether your investment ideas are right or wrong. Shareholders of Silicon Valley Bank, for example, probably ‘felt right’ for nearly 40 years based on the continual steady rise in the bank’s stock price. But ultimately, their investment would turn out to be worthless.

So what should investors do when investing in a market that can be wildly wrong? The secret to navigating periods of market mispricing is simple, but not easy: remain focused on business fundamentals – revenues, earnings, cash flows – and how these evolve relative to prior expectations.

Investors should view a stock price as simply a window of opportunity to buy or sell. The window might be closed most of the time, but sometimes a window opens to buy a stock when its price becomes cheap – that is, the market is pricing-in the future earnings power of a business too low. Conversely, a window of opportunity may open to sell a stock, even the stock of a world-leading company, if its price becomes too expensive.

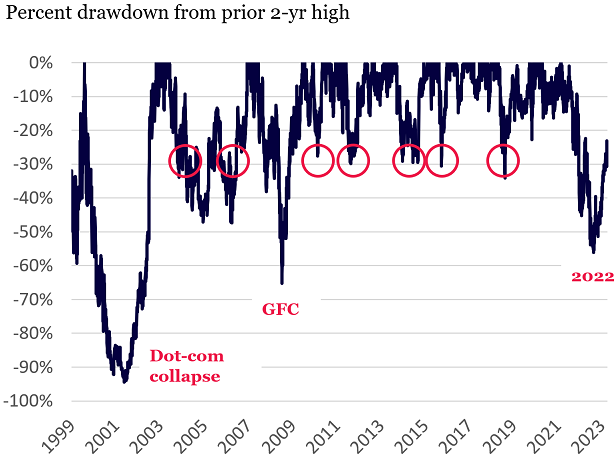

The huge rewards to holding onto Amazon when the market was wrong

With this approach, investors would view the large stock price drawdowns that Amazon has suffered throughout its history, for example, as nothing more than an opportunity to buy more shares – and not an indictment on their original investment thesis.

Amazon, one of the world’s best businesses, has arguably remained structurally undervalued by the market for most (if not all) of its corporate lifetime.

Amazon – plenty of large draw-downs

Source: Bloomberg; Montaka

Not only has Amazon’s stock halved on three occasions – the dot com bust, the GFC, and the 2022 price downturn – it has experienced a 30% decline on numerous occasions. History has always shown these drawdowns to be unreasonable.

But if an investor could have held on when the market was wrong, they would have been rewarded with an annual return of 33% for 26 years, or compound growth of 1,800x).

Is Mr. Market wrong today?

So where could the market be wrong today? Two areas are AI and China.

There is clearly a lot of hype about AI. And while the technology itself appears to be genuinely revolutionary, history shows that mercurial Mr. Market is not always as discerning as he should be in periods of great hype.

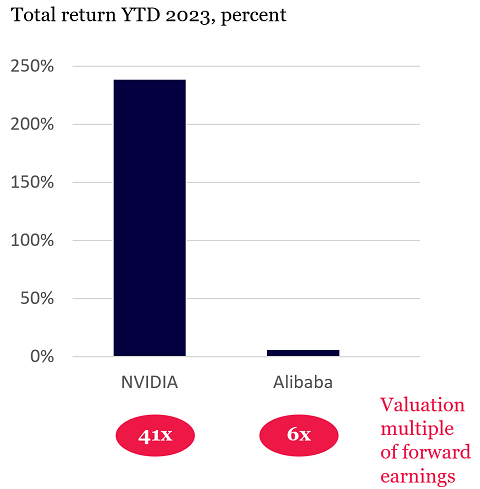

Take NVIDIA, the designer of the world’s most in-demand accelerator chips for AI today. The stock has rallied more than 3x this year alone. The stock now trades at 41x next year’s (substantially upgraded) earnings. Has the market got this valuation right? Time will tell.

Today, NVIDIA’s AI chips are essentially the only game in town. This is an extraordinarily attractive position for the company to find itself in. But the competition in the chip design space is intensifying. Most of NVIDIA’s largest customers are investing in their own competing chip designs. It would not be a complete shock to look back in a few years and conclude that today’s valuation was unreasonably elevated.

On the other end of the spectrum, Chinese equities have had a miserable time of late. A weakening economy, combined with geopolitical concerns, has led many investors to sell.

NVIDIA vs Alibaba – YTD stock returns

Source: Bloomberg; Montaka

As a result, shares in Alibaba, China’s largest e-commerce platform and cloud computing platform, are flat year-to-date (but down by two-thirds from its 2020 peak). Yet investors might be surprised to learn the following:

- Alibaba’s revenue is growing at double-digit percentage annual rates,

- Its employee count is down 7% compared to last year,

- Group profit margins are expanding,

- Free cash flow is double where it was a year ago,

- Cash is being returned to shareholders via large buybacks (the equivalent of 1/6th of today’s enterprise value has been returned in the last two years alone), and

- The stock now trades at just 6x next year’s earnings.

Has the market got this valuation right? Or is it being overly pessimistic?

Again, time will tell. In this instance, one needn’t dispute the risks of investing in China. Instead, it’s a question of what price for Alibaba is simply too cheap. It would not be shocking to look back in a few years and observe an Alibaba stock price that is materially higher than current levels.

Remain anchored in fundamentals, not stock prices

It’s human nature to view stock prices as a feedback mechanism – an adjudication of investments that were right and wrong. So it’s important to remember the market can mislead and is often wrong.

Instead, view stock prices as nothing more than offers to buy and sell. And divorce prices from your assessment of business fundamentals. Own businesses when your fundamental expectations greatly exceed those embedded in stock prices. And sell those when the reverse is true.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments, a sponsor of Firstlinks. This article is general information and is based on an understanding of current legislation.

For more articles and papers from Montaka, click here.