From time-to-time equity markets are enveloped by short-term irrationality and aspirational future cash flows. While some investors embrace this fantasy world, others choose to keep their feet on the ground.

I’ve likened this situation to The Matrix, the film in which people were offered the choice between taking a blue pill or a red pill.

The blue pill effectively plugged them into this sort of fantasy machine-led world. The red pill would reveal the truth and what’s occurring in the real world.

Today we have blue pill investors and red pill investors. The question is which investor do you want managing your money?

Blue pill investors

These investors at the forefront of market irrationality have been driven by various forces, including:

- Historically low rates – you can’t get yield on bonds; you can’t get yield on cash in the bank.

- A belief that central banks will remain all powerful and they’d keep buying bonds forever and keep interest rates incredibly low.

- The rise of passive machine-led investing, which sees capital blindly flow into the biggest stocks in an index, regardless of fundamentals and valuations.

In this context, market disruption, trends and stories become even more of a drawcard. Growth stocks are all the rage. Especially small and microcaps. Afterall, there are few other options.

In this environment, the market went, what I call upside-down – it inverted. With rates being extraordinarily low, blue pill investors chased hyperbolic returns.

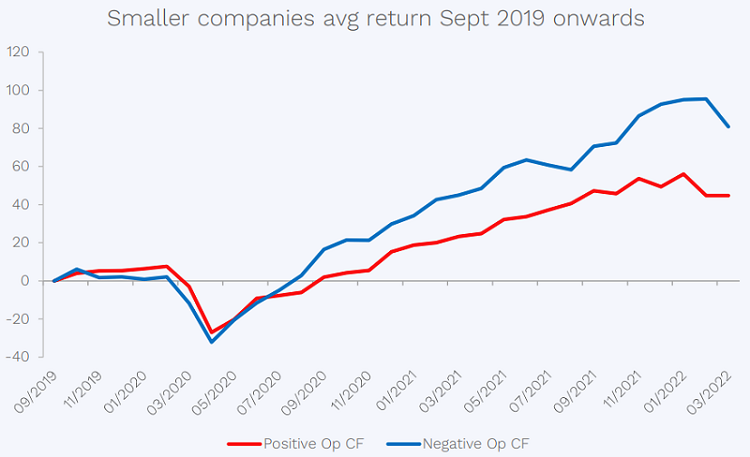

Case in point - the graph below. It summarises the ASX small and microcap universe of stocks between $50 million and $3 billion in market cap. It shows what would've happened if you bought a portfolio equally weighted of stocks that had negative operating cash flow from September of 2019.

Source: Bloomberg, as at 28th February 2022. Australian listed stocks between $50m and $3bn market cap divided into positive op cash flow and negative op cash flow as at 1/1/2019. Average returns measured across basket of stocks.

You can see that perversely, negative operating cash flow companies (blue line) materially outperformed positive operating cashflow companies on average over that period of time.

This is the blue pill fantasy world that we’ve experienced in recent years.

But as history tells us, it won’t last forever. The stock market can be irrational short term, but in the long run, we have found that the laws of economics, a little like gravity are hard to escape. We think the market is actually very rational in allocating capital over time.

Red pill investors

Also in the above chart, you can see the curve does come down towards the end of the period. We are starting to see negative cash flow operating companies pulling back as rates tick up and people wake up to the fact that inflation is likely here to stay.

A rising interest rate environment also sees the cost of capital rise and a “risk off” environment emerge. This is what happens in the real world.

While blue pill investors have dominated markets in recent years, red pill investors realised that for a long period of time, capital has been very cheap and the way capital has been allocated (by both companies themselves and investors) has perhaps been a little loose. They stuck to fundamentals and never forgot that valuations matter. All the while, as blue pill investors dominated markets, red pill investors were presented with an abundance of opportunity.

Now a critical juncture is emerging. Rising interest rates have a flow on effect that means cash burning companies are actually becoming more costly to hold. With interest rates on the rise this does tend to lead people back to the notion that cash is actually worth more today than tomorrow.

Disciplined red pill investors always focus on sustainable free cashflow and look at numbers through the cycle.

Long term investors would have seen all types of stocks go through cycles. We like the idea of trying to smooth out aggressively over-earning companies and not punishing companies that are temporarily under-performing on a short-term basis. This is the reason we look at ‘through the cycle’ cash flows and earnings.

Furthermore, we like to buy stocks that have low debt levels. Why? With rates rising, the cost of debt is increasing, and this puts pressure on the earnings of these companies with massive amounts of debt on the balance sheet. Additionally, we are trying to buy stocks at a discounted valuation. We try to value the stock on a mid-cycle basis and pick these stocks up at a decent discount.

And the final point is that we do keep an open mind for inflection points and changes in a company’s strategy or management teams.

A red pill stock idea

Michael Hill (ASX:MHJ) is one of our key portfolio holdings and one we think is a great illustration of long-term red-pill thinking.

It is a specialty jewelry retailer with operations in Australia, New Zealand and Canada, with a 40-year-plus track record. It is also a company that has been completely ignored in recent years by blue pill thinkers who favoured hot tech companies and concept stocks.

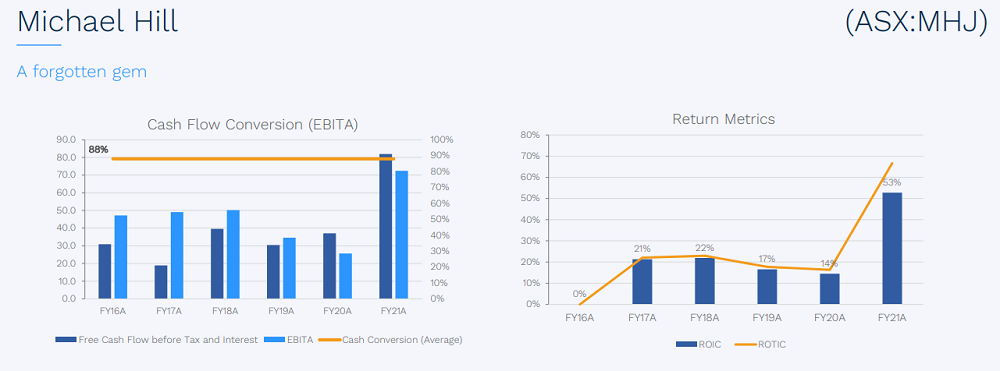

However, the graph below demonstrates some of the reason why we think it is a compelling opportunity for red pill investors.

Source: Morningstar, IRESS, Spheria

By looking at cash flow conversion (left graph) you can see how much of the earnings reported on an accounting basis that transfers into cashflow.

Additionally, we look at return on capital metrics (right graph). If earnings are growing on a fixed cost base and fixed capital base, there’s little doubt that earnings and returns will improve over time.

Current CEO, Daniel Bracken was hired several years ago. Since joining Michael Hill, Daniel has invested in technology, changed the pricing strategy, introduced a loyalty program and driven increased online sales. These changes have diversified the revenue stream and have led to dramatically improved results.

So much so that even the first half numbers just reported showed strong returns and earnings growth, despite approximately 20% of trading days being lost due to COVID lockdowns in Australia.

Investing for the long term

We believe that a focus on fundamentals and valuations will lead to long term outperformance for investors who are patient. For those caught up in irrational exuberance, they could very well find themselves caught in a capital landslide.

Ultimately, we live in the real world. And investors can’t continue to escape reality.

Marcus Burns is Co-founder and Portfolio Manager at Spheria Asset Management, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.