The start of a new year is a good time to review portfolio performance and consider long-term settings for a financial future.

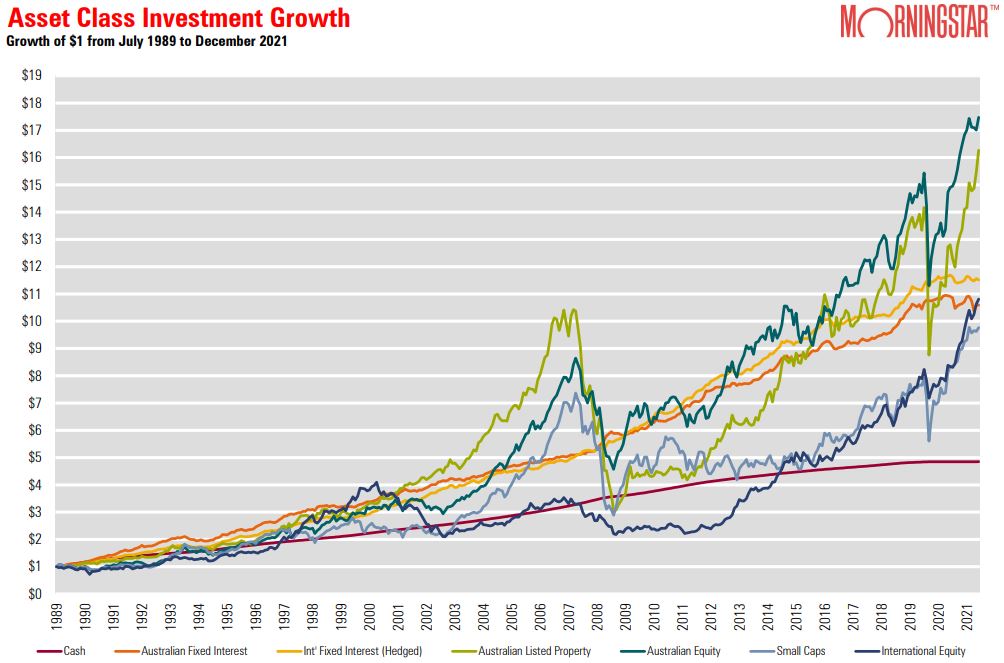

This article breaks Morningstar reporting into five tables to show market performance over all time periods to 30 years, as well as measures of risk and drawdowns. The chart on long-term performance shows Australian equities and listed property doing best since 1989.

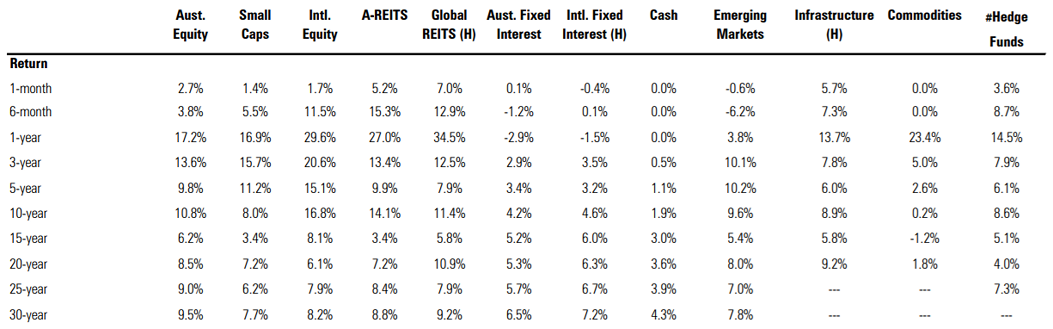

Table 1: Asset class performance from 1 month to 30 years

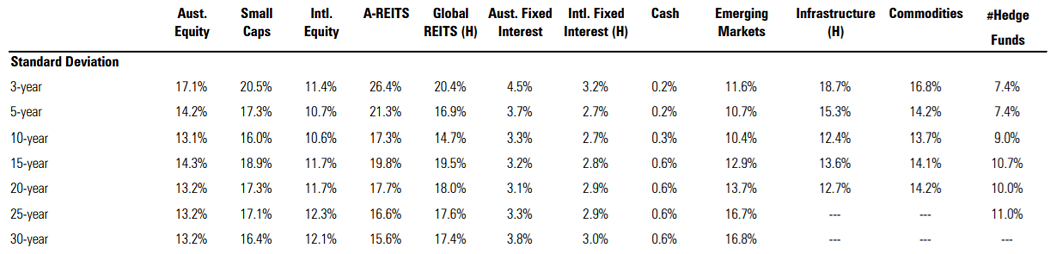

Table 2: Standard deviation (a measure of risk) by asset class

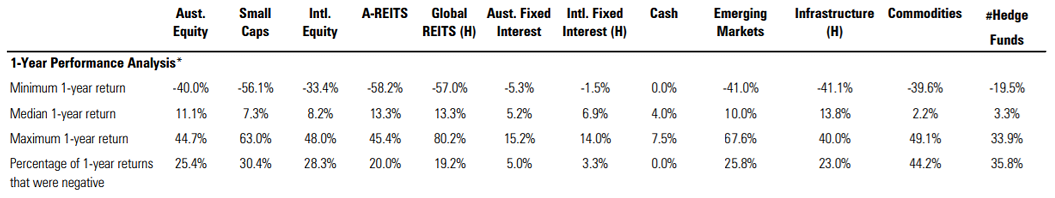

Table 3: Historical 1-year returns

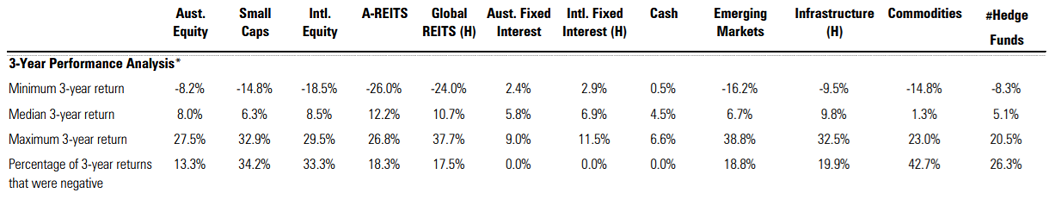

Table 4: Historical 5-year returns

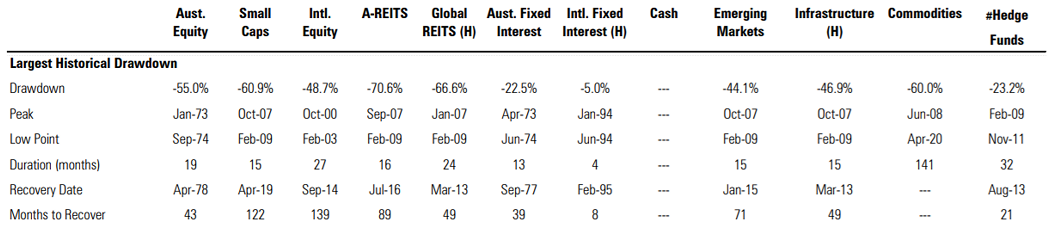

Table 5: Historical drawdown (market falls)

Tables sourced from Morningstar Adviser Research Centre.

Chart

Source: Morningstar Adviser Research Centre.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free, four week trial below:

Try Morningstar Investor for free