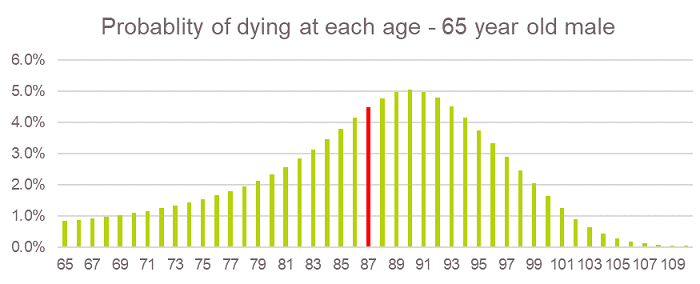

A feature of life expectancy is that over half the people of a certain age will live longer than their life expectancy. Retirees using these widely-published figures as a reference point when planning how to spend their savings, are more likely than not to run out. The chart below shows how likely someone retiring today is to pass away at each age into the future.

Source: Australian Life Tables (ALT) 2015-17 with 25-year improvements.

More prudent retirees who plan for their savings to last longer than life expectancy can reduce the risk of outliving their savings, but this comes at the expense of a more frugal retirement.

In the example above, a 65-year-old male has less than a 1 in 10 chance of living past age 97. However, if the retiree spread out his spending so that his savings lasted to age 97, the annual retirement income from his savings might be around 20% lower than if he’d planned for life expectancy (assuming savings are spent over the planning horizon and a 3% p.a. real net investment return). It is this uncertainty that makes planning how to spend your retirement savings so difficult.

There is a growing acceptance from super funds that current account-based retirement products, where members bear all the risks (including longevity risk) lead to poor outcomes for many members. With prompts from the government, forward-looking funds are considering retirement products that pay members an income for life.

Benefits of pooling

Pooling a group of retirees of the same age will tend to have a more reliable distribution of ages at death. As the pool gets larger, the distribution of lifespans around the mean is more predictable.

The benefits of pooling can be passed on to retirees in a number of ways. Super funds can provide lifetime income products by pooling together retirees’ capital through a product known as a group self-annuity (GSA). With enough members, they can reduce the uncertainty for individual in the group.

How many members make a pool?

To understand whether a pooled product is viable for a particular super fund, it is necessary to know what size of pool is needed to reduce the longevity risk for members.

The benefit payments made to members in a GSA are determined based on assumptions about how long members will live. Benefit payments are then adjusted to the extent that the actual experience of members differs from those assumptions.

To take a simplified example, consider a GSA with 500 male members, all 70 years old. It can be expected that 493 would survive to the following year, and the projected payment in the following year is based on this playing out.

If fewer members pass away, then the benefit payments going forward are reduced, as benefits are being paid to more members than assumed. The greater the deviation from the assumed number of survivors, the larger the adjustment that is needed to members’ benefits.

This is why the size of the pool is important. The larger the pool of members, the less likely it is that assumptions will be deviated from, as a proportion of the total membership. Adjustments to members’ benefits due to mortality experience are therefore likely to be smaller for larger pools of members.

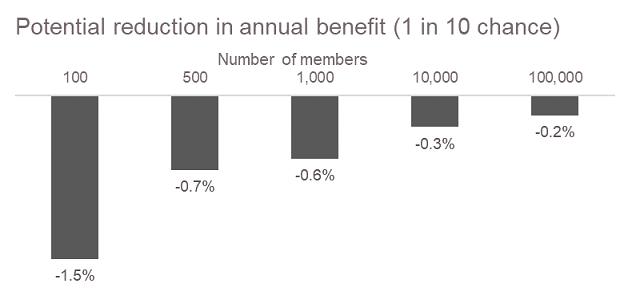

The chart below shows the impact on members’ benefits when fewer members than assumed die in a particular year.

It considers a hypothetical GSA where benefit payments are adjusted each year in line with experience and looks at the reduction the payments members receive year-on-year as a result of mortality experience differing from the assumptions. It assumes all other experience, such as investment returns, is in line with what was assumed when payments were set.

For example, for the GSA product with 500 members, there is around a 1 in 10 chance that the actual number of survivors is 496 rather than 493. With more survivors the annual payment for each member would need to be reduced by 0.7% in the following year. In smaller pools, it only takes a few more survivors in a given year to drive a material change in benefits for all members.

Source: Challenger analysis. Assumes a pool of 70-year-old male members, with fixed annual benefit payments, no death or withdrawal benefit and a net investment return of 5.0% p.a. Mortality rates in line with ALT 2015-17 with 25-year improvements. The number of survivors for a given probability is rounded to the nearest whole number of lives.

Consistent with other research, this suggests that a pool of at least 10,000 members would be preferable to reduce the risk of a member’s payments falling significantly from one year to the next due to mortality experience.

Of course, members of super funds aren’t all the same age when they retire, and their health and longevity traits will vary widely too. This heterogeneity can lead to greater volatility in payments.

For super funds that are confident of reaching the scale needed to operate a pooled retirement product, a second issue is the time needed to get there. If mortality experience is passed on continuously (e.g. in annual benefit indexation) to members, then it is likely they will experience volatile benefit payments in the first few years of the product’s life.

Reserving as an alternative approach

Rather than letting members bear all the volatility of benefit payments that can result from a pool that is too small, super funds can look at other ways to manage that risk.

Like a traditional defined benefit fund, super funds could hold reserves to support a pooled product, either permanently or until the pooled product reaches scale. The reserves can be used to smooth benefit payments and reduce the volatility for members.

Equity for other classes of members requires that reserves are established from part of the pooled product members’ initial contributed capital. This will necessarily reduce the benefit payments members receive, at least initially. The reserves will need to be managed which can add costs. Added complexity can reduce the transparency to members, making communicating with them more difficult.

It is also possible for super funds to insure longevity risk to provide greater certainty for members. In a longevity swap, a counterparty takes on this risk for the fund, for a cost, to remove members’ exposure to longevity risk.

An alternative to a pooled product is for super funds to offer a holistic retirement product that includes an account-based pension and a lifetime income stream, which offers both flexibility and longevity risk protection for members.

Conclusion

Pooled retirement products can significantly reduce or remove personal (idiosyncratic) longevity risk, providing better outcomes for members than current account-based products. However, to be effective, pooled products need sufficient scale and it can take time to get there.

Doug McBirnie is a General Manager and Senior Actuary at Accurium. This article contains general information only and is not intended to be financial product advice. No warranty is given on the information provided and Accurium is not liable for any loss arising from the use of this information.