Most of the time share markets are relatively calm and don’t make the headlines. But every so often they have a tumble and make the 'front page' with headlines (or these days clickbait) like “billions wiped off share market” and “biggest share plunge since…”.

Each one is met with analysis and prognostication from experts. Sometimes the plunge ends quickly and the market heads up again and is forgotten, like last September when I last wrote a note like this. But once every so often share markets keep falling for a while. Sometimes the falls are foreseeable, but rarely are they forecastable (which requires a call as to timing and magnitude) despite many (who got lucky) claiming otherwise. In my career, I have seen many sharemarket falls, and I even saw the market fall 25% one day.

And so it is again, with sharemarkets starting the year on a sour note. From their highs, US shares have fallen 8%, with the tech heavy Nasdaq down 14%, global shares are down 7% and Australian shares are also down 7%. Always the drivers are slightly different but from the point of basic investment principles, it’s hard to say anything new. So apologies if you have seen my “seven things for investors to keep in mind” before, but at times like this they are worth reiterating.

What’s driving the fall in share markets?

The decline in share markets reflects a range of factors.

- Inflation readings have continued to surprise on the upside most recently for the US where inflation is now 7% and is at its highest in nearly 40 years. But Europe, the UK and Canada have also reported sharp increases in inflation.

- Along with hawkish comments from central banks, this has seen increased expectations for central bank interest rate hikes this year. Markets now expect four or more rate hikes from the Fed, Bank of England, Bank of Canada, Reserve Bank of New Zealand and the RBA this year.

- This has come at a time when the surge in Omicron cases globally has disrupted economic activity, recent economic releases have been mixed and investors fret the rate hikes will depress economic activity and hence profits.

- There is a high-risk Russia will invade Ukraine or part of it as talks around its demand for Ukraine not to join NATO and NATO countries not to station strategic weapons there failed to resolve the issue. While it’s hard to see NATO countries going to war with Russia in Ukraine, an invasion will likely trigger sanctions on Russia, further worsening Europe’s gas shortage and threatening European growth and inflation.

- And share markets have had huge gains since their March 2020 lows. US shares rose 114% and Australian shares rose 68% to their recent highs. Shares are no longer dirt cheap. There has been froth with meme stocks, SPACs and the crypto craze. And relatively calm years – with the biggest drawdowns last year being 5% in US shares and 6% in Australian shares – are often followed by a rough year. So, some are talking of crashes (as they often do).

Seven things for investors to bear in mind

Sharp market falls are stressful for investors as no one likes to see their investments fall in value, but keep these things in mind.

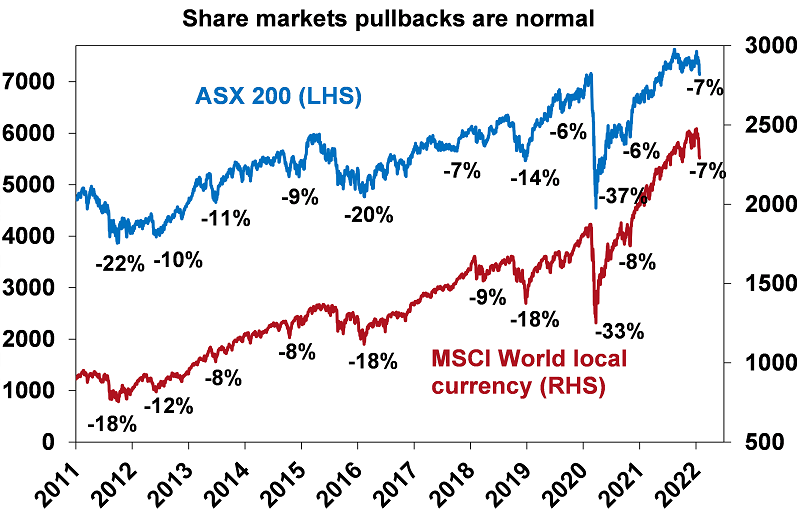

First, while they all have different triggers and unfold differently, periodic share market corrections of the order of 5%, 15% and even 20% are healthy and normal. For example, during the tech/dotcom boom from 1995 to early 2000, the US share market had seven pullbacks ranging from 6% to 19% with an average decline of 10%. During the same period, Australian shares had eight pullbacks ranging from 5% to 16%. All against a backdrop of strong returns every year. During the 2003 to 2007 bull market, the Australian share market had five 5% plus corrections ranging from 7% to 12%, again with strong positive returns every year. And the last decade regularly saw major pullbacks. See the next chart.

Source: Bloomberg, AMP

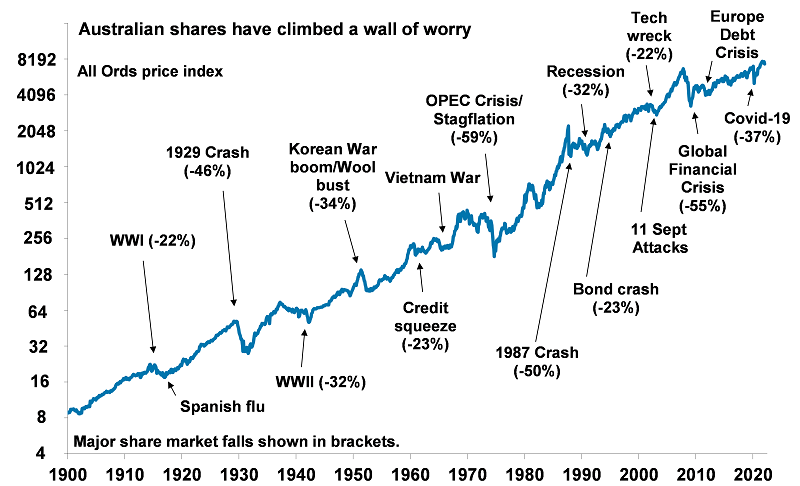

But while sharemarket pullbacks can be painful, they are healthy as they help limit complacency and excessive risk taking. Shares climb a wall of worry over many years with numerous events dragging them down periodically (see the next chart), but with the long-term trend ultimately up and providing higher returns than other more stable assets. Bouts of volatility are the price we pay for the higher longer-term returns from shares.

Source: ASX, AMP

Second, historically, the main driver of whether we see a correction (a fall of say 5% to 15%) or even a mild bear market (with say a 20% decline that turns around relatively quickly like we saw in 2015-2016 in Australia or in 2018 in the US) as opposed to a major bear market (like that seen in the global financial crisis (GFC), or the 35% or so falls seen in early 2020 going into the coronavirus pandemic) is whether we see a recession or not. The US sharemarket tends to lead most major global markets.

Of course, short-term forecasting is fraught with difficulty and should not be the basis for a long-term investment strategy, but right now, while inflation and worries about monetary tightening are concerning, it seems premature to expect a US, global or Australian recession:

- New coronavirus cases in the US, Europe and Australia are slowing with vaccines providing protection against serious illness and the Omicron variant proving less harmful than prior variants. This should see business conditions indicators rebound. While the risk remains high, coronavirus could finally be moving from a pandemic to being endemic.

- Excess savings of around $US2.3 trillion in the US and $250 billion in Australia will provide an ongoing boost to spending.

- While central banks will tighten monetary policy this year it will still be easy as rates will still be very low.

- It’s usually only when monetary policy becomes tight that it ends the economic cycle and the bull market and that’s a fair way off.

- Inventories are low and will need to be rebuilt which will provide a boost to production.

- Positive wealth effects from the stronger than expected rise in share markets and home prices since early 2020 are still feeding through and will help boost consumer spending.

- China is starting to ease policy which will boost Chinese growth over the next 6 to 12 months.

Global growth is likely to slow this year but to a still strong 5%, with Australian growth of around 4%, despite the Omicron wave resulting in a brief set back in the March quarter.

Third, selling shares or switching to a more conservative investment strategy whenever shares suffer a setback turns a paper loss into a real loss with no hope of recovering. Even if you get out and miss a further fall, trying to time a market recovery is hard. And the risk is you don’t feel confident to get back in until long after the market has fully recovered. The best way to guard against deciding to sell on the basis of emotion after weakness in markets is to adopt a well thought-out, long-term strategy and stick to it.

Fourth, when shares and growth assets fall, they’re cheaper and offer higher long-term return prospects. So, the key is to look for the opportunities pullbacks provide. It’s impossible to time the bottom but one way to do it is to 'average in' over time.

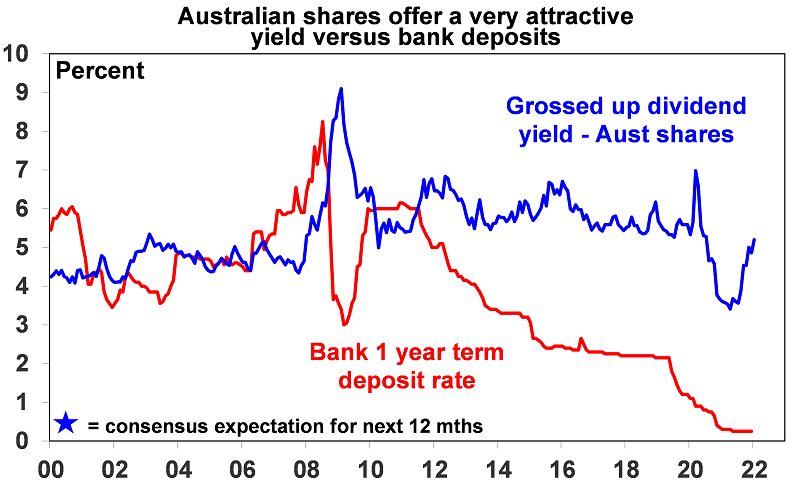

Fifth, Australian shares are offering attractive dividend yields compared to banks deposits. Companies don’t like to cut their dividends, so the income flow you are receiving from a well-diversified portfolio of shares is likely to remain attractive, particularly against bank deposits.

Source: RBA, Bloomberg, AMP

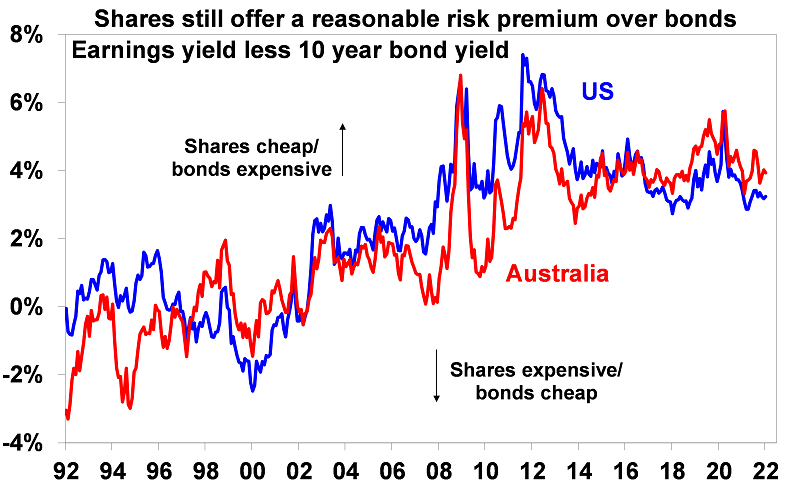

More broadly, while bond yields are well up from their lows, the risk premium shares offer over bonds – as proxied by their earnings yield less the bond yield – remains relatively attractive. And in the last few days bond yields have started to fall again, reflecting safe haven demand which along with the fall in share markets has helped improve share market valuations.

Source: Reuters, AMP

Sixth, shares and other related assets often bottom at the point of maximum bearishness, ie, just when you and everyone else feel most negative towards them. So, the trick is to buck the crowd. The last month has seen investor sentiment swing negative again which is positive from a contrarian perspective. Of course, investor sentiment could still get more negative in the short term before it bottoms.

Finally, turn down the noise. At times like the present, the flow of negative news reaches fever pitch and this is being accentuated by the growth of social media. Talk of billions wiped off share markets and talk of 'crashes' help sell copy and generate clicks and views. Such headlines are often just a distortion. We are never told of the billions that market rebounds and the rising long-term trend in share prices adds to the share market.

All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So best to turn down the noise and watch Brady Bunch, 90210 or Gilmore Girls re-runs!

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP Capital, a sponsor of Firstlinks. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs.

For more articles and papers from AMP Capital, click here.