Commonwealth Bank of Australia (CBA) will raise $1.25bn via a Tier 1 hybrid issue, to be listed on the ASX, called CommBank PERLS XII Capital Notes. This issue will provide Additional Tier 1 (AT1) regulatory capital. The offer comprises a broker firm offer and an eligible securityholder offer. Unlike recent PERLS issues, this note is not a replacement of an existing issuance, hence there is no reinvestment offer.

CBAPI is a fully paid, convertible, transferrable, redeemable, subordinated, perpetual, unsecured note with a $100 face value and mandatory exchange date of 20 April 2029. Mandatory exchange is subject to several exchange conditions. CBAPI may be exchanged earlier as a result of a trigger event or CBA exercising an option to call the security two years early on 20 April 2027. Distributions are discretionary, noncumulative and fully franked with a dividend stopper. Distributions will be paid quarterly in arrears, based on the 90-day Bank Bill Swap (BBSW) rate plus a margin of 3.00% per year. For example, using the current 90-day BBSW rate of 0.85%, this equates to a gross running yield of 3.85% per year.

Key takeaways

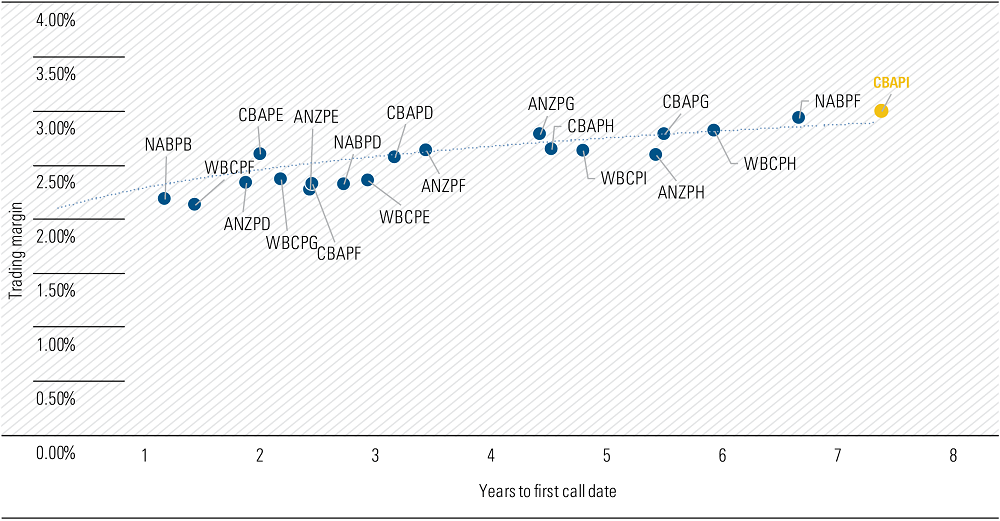

- We recommend investors subscribe to the offer for CBAPI. CBAPI’s issue margin of 3.00% provides a relatively attractive premium to our current fair value curve of major bank AT1 securities in the 7.5-year term to call range.

- Following completion of the bookbuild, CBA has finalised the issue size at $1.25bn and a margin of 3.00%. Initially only seeking $750m and an indicative margin range of 3.00% to 3.20%, investor demand was clearly strong. The hunt for yield continues, triggered by low cash rates and growing expectations the RBA will cut further and even implement some form of quantitative easing in Australia.

- Our near-term outlook for hybrid pricing remains constructive. The major banks are profitable, have strong AT1 capital positions and need to raise more Tier 2 Capital. Supply should remain tight in the near term, as corporate issuances have dried up with little signs of revival and major banks face a near-term shortage of AT1 reinvestment opportunities. Risks include a global backdrop of increased market volatility, or a major bank AT1 supply spike in the next six months should the banks take advantage of the prevailing low rate environment to execute large, long-dated deals.

- It is important to reiterate hybrid securities should not be viewed as traditional fixed-income products, nor should they be considered a substitute for low-risk investments such as term deposits. We consider hybrid securities suitable only for investors with a medium to high risk tolerance due to their subordination on the capital structure.

Recommendation

We assign CBAPI a medium investment risk rating, the same as other Basel III-compliant Tier 1 major bank hybrids. The terms and conditions, such as nonviability and capital conversion triggers, in this new breed of hybrid securities make them more equity-like and, consequently, riskier than the “old-style” issues. Investors should understand these risks and be incrementally compensated in return. Nevertheless, for investors willing to take a position on the lower end of a company’s capital structure, hybrid securities can represent an attractive yield investment.

Domestic major bank AT1 hybrids have performed well since 2016, thanks to the search for yield amidst geopolitical/economic uncertainties, as well as record low interest rates globally. While the hybrid market has had a challenging close to 2018, 2019 has been very strong as markets embraced more risk following the Coalition’s victory in May. While average major bank trading margins moved out to 4.00% towards the end of 2018, they have just as rapidly recovered those price falls and at the time of writing sit around the 2.40% mark.

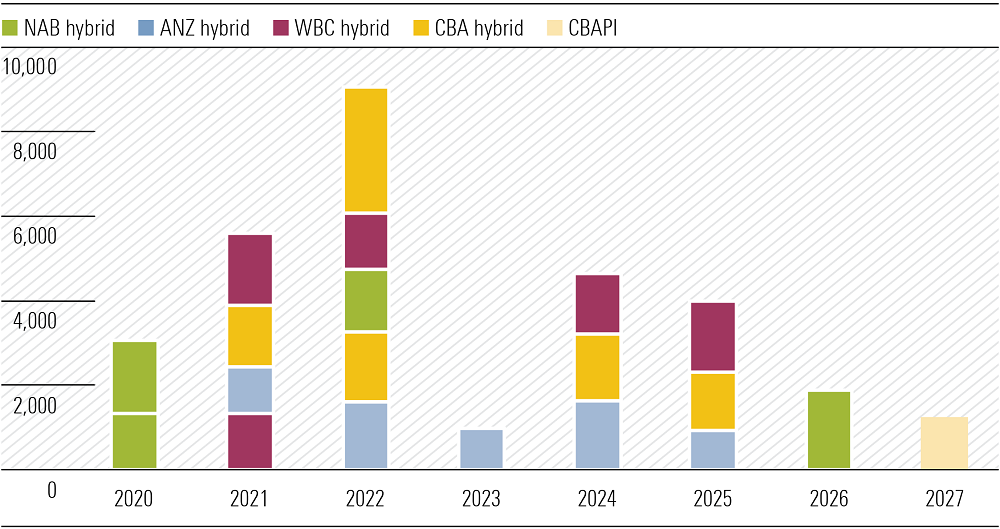

We believe a key reason for the CBAPI issue is to space out the maturity profile of the bank’s hybrids and avoid having clustered, mega deals as it did previously. With more than $14.5bn of major bank hybrids, of which around $6.1bn are CBA’s, due to be called in 2021–2022, future issues could: i) involve having to “outbid” issuers via higher margins; or ii) risk not being fully absorbed by the market. The more clustered the terms to call, the higher the refinancing risk.

Of the four major banks, National Australia Bank (NAB) has the biggest near-term refinancing needs, with both NABPB and NABPC due to be called in 2020. We expect NBA to refinance both hybrids in new issues in 2020, though it (or any other bank) could follow CBA’s lead and launch long-dated, “new money” issues early in order to pre-emptively meet APRA’s requirement for the major banks to have AT1 ratios of at least 1.5% by 2024.

The timing of the CBAPI issue is practical, particularly given favourable funding conditions which are expected to persist. The distribution rate for hybrids are linked to the BBSW has plummeted over the course of 2019 following the repricing of cash rate expectations. The 90-day BBSW has more than halved from 2.08% at the start of January to around 0.85% currently.

Barring an unexpected bout of inflation, we do not envisage a spike in the BBSW in the near term given the RBA’s apparent intentions to ease monetary policy further.

From a capital ratio standpoint, we do not believe any of the major banks are in urgent need of additional AT1 capital, bearing in mind there are limited scheduled redemptions in 2020 (apart from NABPB and NABPC). All four major banks currently have enough AT1 capital, need to raise more Tier 2 capital (which are cheaper than AT1 hybrids) and meet common equity Tier 1 requirements in the near term. So, while near-term supply levels should remain tight, the prevailing low rate environment and strong investor appetite for yield could entice issuers to tap the market anyway.

Despite the relative attractiveness of CBA’s equity dividend yield premium to CBAPI’s yield to call, we still see value in CBAPI due to its lower expected volatility. As we have seen in recent years, hybrid volatility has been significantly lower than that of the equity of the same issuer. The latter bearing the brunt of the headline risks the major banks continue to face.

Exhibit 1: Major Banks AT1 hybrid call dates

Source: Morningstar

Exhibit 2: Major banks AT1 hybrid trading margins vs term to first call date

Source: Morningstar

Adam Fleck is Regional Director of Equity Research, Australia and NZ, and Shaun Ler is Associate, Equity & Credit Analyst, both at Morningstar Australasia. This article is general information and does not consider the circumstances of any investor. Please consultant a financial adviser before taking investment decisions.