The 2017 financial year was a good one to be a passive (index-tracking) investor in large cap Australian equities. The S&P/ASX200 returned 14.1%. Add to this the other attractions of passive investing – fees are typically lower than active management, taxes and transaction costs are lower, and investors know what they are getting. These attractions no doubt explain why around US$500 billion globally is leaving active equity strategies each year.

Large superannuation funds in Australia caught up in this global trend have an additional factor to consider. Australia, almost uniquely, taxes the investment returns of super funds. This makes passive investing an after-tax optimisation problem for Australian funds. While the headline 14.1% return is eye-catching, there is little insight as to what this looks like after tax or what tax management could have added to this good news story. ‘Dumbing down’ the after-tax optimisation problem to a simple ‘keep turnover low’ mantra does a disservice to the smart, sophisticated investment thinking most funds apply to other parts of their investment portfolio.

The forgotten effect of taxes

Most talk is on the extra tax a fund pays when moving from a passive to a factor-based or full active management style. But there are meaningful increases in tax just from moving from a theoretical ‘buy and hold’ strategy to a real-life index-tracking strategy which typically turns over 5-10% each year due to index reconstitutions, corporate actions and day to day fund cash flows.

It is a step in the right direction for a super fund to ask how much more tax could be payable by moving from a passive to factor-based or active investment approach. But given the massive flows in the other direction (towards passive), funds must also explore the whether there are ways to pay less tax in the way the passive investment strategy is implemented. Funds and asset consultants seem to stop short of asking this second question. It is not in the interests of the traditional passive managers (the beneficiaries of the flight to passive management) to raise it.

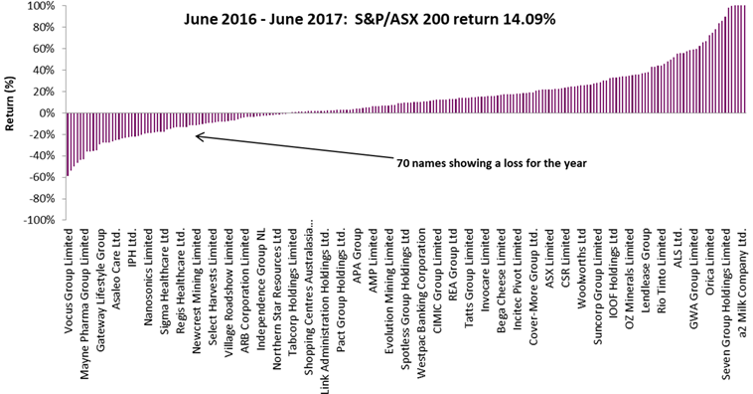

One way to differentiate a genuine tax-managed passive strategy from a simple ‘keep turnover low’ approach is in how loss stocks are treated in the portfolio. Consider the stock-level returns comprising the S&P/ASX200 over the 2017 financial year, as set out below:

Source: S&P, Parametric. Provided for illustration purposes only. It is not possible to invest directly in an index.

Utilising the losses to offset gains

A portfolio tracking this index could claim to be ‘tax efficient’ by naturally avoiding the realisation of gains on the 142 stocks which appreciated in value during the year. The accrued gains count for performance measurement purposes, but not for tax purposes – a good combination. But note the 70 loss stocks in the portfolio that depreciated in value over 2017. A traditional passive strategy has done nothing with these loss stocks, even though realised losses are valuable as assets which shelter from tax capital gains realised anywhere else in the fund’s portfolio (not just Australian equities).

In contrast, a genuine tax-managed passive strategy could naturally accelerate the realisation of these losses (within legal limits) to unlock their tax value and improve the after-tax returns of the portfolio further. In fact, the real opportunity set for an after-tax focused passive manager is not the 70 stocks in the S&P/ASX200 that returned a net loss but the 178 stocks that, through natural fluctuations in the market, were showing a loss at some point in time in 2017.

Using super fund capital gains tax rates, our published research indicates that this kind of intelligent after-tax thinking can add (pre-fees) around 25 basis points (0.25%) to an S&P/ASX200 portfolio and 30 basis points (0.30%) to an international equity portfolio each year. Franking credit strategies could add more. These extra returns are relative to traditional passive approaches which claim to be ‘tax efficient’.

An interesting sideline is that volatility, the enemy of most investors, actually becomes a useful tool in this exercise. This illustrates how the S&P/ASX200’s good news story for 2017 could have been even better if super funds were genuinely approaching passive investing as an after-tax challenge. Of course, if the index’s returns move closer to long-term averages (less than half of the 2017 return) in coming years, the extra return increments will be even handier.

Finally, genuine after-tax investing will report portfolio and benchmark performance both pre- and post-tax, which is the only legitimate way to show whether a ‘tax efficient’ strategy is living up to its claim.

Raewyn Williams is Managing Director of Research at Parametric Australia, a US-based investment advisor. This information is intended for wholesale use only. Parametric is not a licensed tax agent or advisor in Australia and this does not represent tax advice. Additional information is available at parametricportfolio.com.au.