Without a doubt real returns are the most crucial measure of investment outcomes for an individual saving for retirement. I believe any industry professional who understands the purpose of superannuation would concur. Real returns, which are simply the return relative to inflation, measure the growth in purchasing power of a portfolio of assets. It does not matter if we generate 10% nominal returns (that is, without adjusting for inflation) if inflation over the same period is also 10% - our portfolios can only purchase the same amount of goods and services in retirement. And so if real returns are the most crucial measure of investment return then it follows that the crucial measure of risk is the volatility of real returns.

Need to focus on real returns

Yet in terms of reporting, objectives and risk management, we find that ‘real returns’ plays second fiddle to ‘nominal returns’, to the point where by default we all think of ‘returns’ as nominal returns. There are few institutional superannuation funds or managed funds that explicitly target or actively manage real return risk (though real return or target return funds are an interesting emerging segment of the market, particularly offshore).

Why is the need to focus on real outcomes so important? Three reasons:

The first is retirement adequacy. Inflation has been positive over the long term and this means that real returns are lower than nominal returns. The real value of a portfolio compounds at a slower rate. As an example let’s assume 7% nominal returns and 4% real returns (ie inflation of 3%). Then applying the ‘rule of 72’ (discussed in Cuffelinks on 26 April 2013), it takes approximately 10 years for the nominal value of a portfolio to double but about 18 years for the purchasing power of the portfolio to double. And this leads to the second reason. As an industry, by not focusing on the most important return outcome, we are failing to effectively educate individuals. Finally, it is difficult to manage risk if we are not focusing on the most important risk, that being real returns, the risk which most directly affects retirement outcomes.

It seems that nominal returns are an entrenched concept, and mention of real returns appears the exception rather than the rule. I illustrate using two examples:

- Superannuation fund returns, whether quoted by superannuation funds themselves or by ratings groups, are nearly always referred to on a nominal basis. While accounting standards require a nominal return statement to allow reconciliation, surely the real return outcome can be calculated and communicated. Recently I looked at a major super fund’s annual report. The commentary on returns was as follows (with fund name removed, numbers slightly changed):

“With the Australian stock market returning negative 7% for the year, the Fund option generated 1%. Though above the return of the median balanced fund of 0.5%, it’s a disappointing result.”

Where is the mention of real returns? It would be better written like this:

“With inflation at 2.3% during the financial year, we delivered a -1.3% real return for the year. Even accounting for contributions, the purchasing power of your superannuation balance may be less than a year ago. This is an important consideration if you are approaching retirement.”

What is bewildering is that this fund has a stated real return target (CPI + 4% pa over the medium to long term) but does not report on their performance relative to their stated objective!

- In October 2012 it was reported in mainstream media that superannuation funds had recovered their GFC-related performance drawdown. However this is the nominal drawdown. The quote from a senior super fund ratings group executive was:

“It may have taken a while, but despite difficult market conditions, it is great news for members to see the median fund back in line with the pre-GFC high.”

However the real value of those assets would still be about 15% below GFC levels (ignoring contributions etc) due to the effects of inflation, quite a haircut to take on one’s retirement lifestyle. A subsequent quote was “The trouble is the focus on super has been on short-term returns.” In my view, the quote is only half correct – we need to focus on medium-to-long term real returns.

Why the focus on nominal returns?

I suggest three possible explanations for the use of nominal returns rather than real returns:

- Legacy of where the industry has come from. Nominal returns have to be reported as they are the accounting returns and the basis on which taxes and account balances are calculated. So this is a logical starting point for communications.

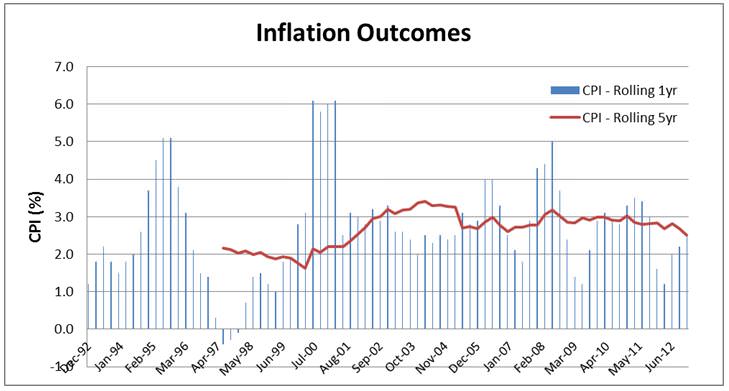

- Confidence in the ability of the RBA to control inflation. Bernie Fraser first announced that the RBA would target inflation in a speech made in 1993. From this time to today, inflation outcomes have been relatively low and consistent. Chart 1 shows what a good job the RBA has done in meeting its stated objectives over the medium term. This period has largely coincided with the experience of institutional superannuation funds (Superannuation Guarantee was created in 1992). This could be used as the basis of an argument that risks to real return outcomes are largely explained by the variability in nominal outcomes. In making this argument one is taking the view that the RBA can manage inflation risk with a single lever (monetary policy), that external risks to inflation are not significant (eg. imported inflation and supply effects are non-issues) and that the RBA is guaranteed to remain 100% free of political input in designing and implementing its mandate. Stranger things have happened and there is a risk that inflation can break out again at some point in the future.

Chart 1: Inflation outcomes since RBA announced inflation rate targeting policy

Source: RBA.

- Education issues, at a member level, but also possibly at a trustee level. It is understandable that if members receive a collection of returns framed in different ways they may find this confusing. Of course there may be trustees of super funds that may also find this confusing!

Little guidance from regulators

Unfortunately, APRA provides little guidance regarding a focus on real returns. Prudential Standard SPS 530 Investment Governance, which will come into effect on July 1, 2013, simply states that an RSE (Registrable Superannuation Entity) licensee must “formulate specific and measurable investment objectives for each investment option, including return and risk objectives.” APRA provide no direction as to the specifics of the return and risk objectives. Cooper’s Super System Review makes general reference to consideration of inflation but makes no specific recommendations, “trustees would have a duty to address longevity, inflation and investment risks for retirement phase members in developing their strategies.”

Defining the investment outcome to be managed by super funds is crucially important. Real outcomes are the most important outcomes for the retirement lifestyle of Australians. Leadership from the trustees of super funds is required on this issue, particularly in the absence of compulsion from regulators and system reviews.