There are three investment rules by which to live in the current volatile environment – the same three rules we think by which investors should always live.

Very simply, they are:

- Diversify sensibly but not gratuitously

- Be opportunistic only at the margin

- Stick to the plan and give your strategy the time it needs to work (this infers the actual existence of a plan. Surprisingly, not everyone has one!).

Most people do not want markets to fall. However, declines can be a useful experience for investors because they provide a real-world test of your investment strategy, your expectations and fortitude. When people invest in equities, for example, they often expect them to go up 10% a year or some similar figure. However, what is often conveniently forgotten is that even if they do that on average, they rarely do it year in and year out. What falling markets provide is the valuable experience all investors need to have when investing; particularly in ‘growth’ assets.

Develop your own plan and stick to it

This is why you need to stick to the plan. Typically 90% of the movement in the value of a standard 70/30* balanced fund comes from one asset class: equities. Now as you become more defensive, so your ‘factor risk concentration’ (or sensitivity) to volatile assets diminishes. This is why conservative funds are less volatile than growth funds, but it is also why their expected return is lower. Swings and roundabouts. The amount of diversification you employ should be consistent with your tolerance for risk and appetite for return. ‘Over-diversifying’ may save you in the short run, but will cost you when you retire.?

In volatile times such as these, there is a natural, human temptation to just do something. Our view is that if your investment strategy was correctly matched to your risk tolerance to begin with then market gyrations (down and up) should just be part of your long-term investment journey. So does that mean that we don’t advocate short term adjustments to the strategic asset allocation? Not quite. If you believe you (or your investment manager) have skill in short-term investing, by all means give it a go … but only at the margin, i.e. in small size.

Our tactical asset allocation process has been proven to add returns for minimal risk over 3+ years at a time but its risk budget is small. It relies on being right on average on many small investments held over the long term, rather than taking a few large bets over short periods, as is often the temptation. Savvy investors can still take advantage of opportunities when they arise, but they should still rely on the main game plan to deliver the vast majority of their investment outcomes.

Difficult to buy when others are selling

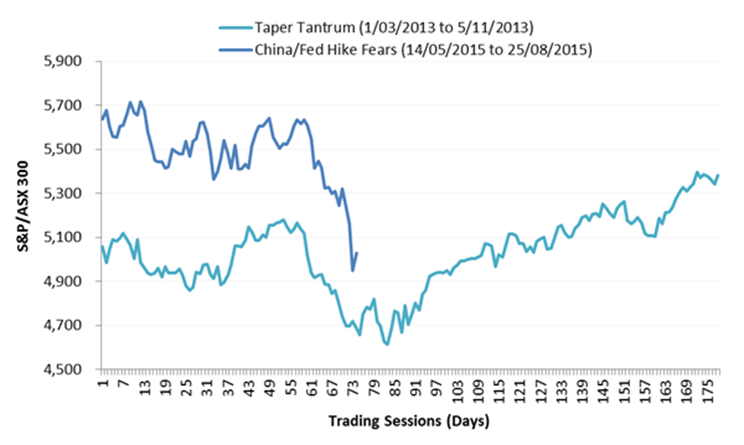

It may be instructive to consider the effects of prior sharp selloffs. Driven by specific events, fear can feed on fear to produce an oversold situation. For example, the so-called ‘taper tantrum’ of 2013 took the Australian market from above 5,100 to 4,600. As it turns out, it was the start of a significant market rally. But who’s willing to take a punt on this market correction?

Use the past and the present to clarify your future expectations by all means, but stick to your plan. Let’s say you have decided to take 5% of your portfolio to chase tactical opportunities. Plan ahead so that you know what your reaction will be should it go against you. Therefore, before making the tactical trade, ask yourself the question: “What loss can I take before I have to pull up stumps?” and write it down. As required, reconstruct your portfolio on the basis of your findings.

*70/30 refers to a multi-asset balanced fund with 70% growth assets and 30% defensive assets. Defensive assets are generally fixed interest securities and cash. Growth assets are everything else.

Martyn Wild is Head of Diversified Strategies at BT Investment Management. This article is for general education and does not consider the circumstances of any person. Investors should take professional advice before acting on any information.