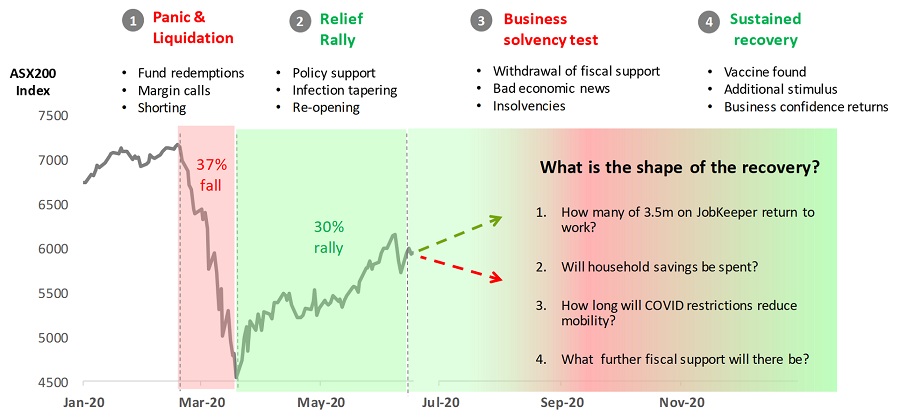

Investors may well be feeling a bit seasick following the swings and roundabouts of the past few months. The market freefall in March was followed by a sharp snap-back in April and May. Growing turbulence from the perceived disconnect between economic and healthcare outcomes and markets, and rising geopolitical tensions, has been tumultuous for even the most seasoned participants.

Much of the rally seems to come from news of a slowdown in the number of covid-19 infections, coupled with the extraordinary speed and scale of the stimulus from central banks and governments around the world.

The burning question is, where to from here?

We have been surprised by how sharp and rapid the rally has been. History shows that it is typical for markets to bounce sharply in ‘event’-driven bear markets, but this time has broken all records on the way down and on the way back up.

It appears the rally has been driven more by fading tail risk owing to policy support rather than optimism around a pick-up in growth. We feel that markets have paid too much for the prospect of a return-to-normal in the short term.

Of course, the unpredictable and unique nature of the shock to the system means there is no data set to draw on. If lockdowns continue to be eased and economies open up over the coming months, the sequential growth will look strong, which seems to be what markets are reflecting.

But it is hard to see the pace of growth being anything but weak given the massive economic dislocation, higher expected unemployment and cautious approach to gradual reopening of economies. This at best seems to point to an intermission and markets trading sideways, but the greater risk seems to be that investors become disappointed relative to current expectations and markets fall back.

Our concern locally is that as the massive support packages start to roll-off around August-September, we will see a fiscal cliff and sharp fall in household income and rise in unemployment.

Even if existing measures are recalibrated and extended to the more vulnerable sectors and weaker areas of the economy, unemployment remains key. The headline unemployment rate remains noisy and an unreliable indicator. It is unclear how many jobs have been temporarily furloughed and will cease to exist post JobKeeper and as businesses recalibrate to the new normal.

Phases of market cycle - Tug of war between stimulus and unemployment

Source: SG Hiscock, IRESS (prices at 30 June 2020)

More risks on the horizon

We are also becoming increasingly concerned with geopolitical risks. The riots in the US and the divisive nature of US politics seems destined to see greater social unrest heading into the US Presidential election in November.

A more optimistic view is that the impact on consumption will be mitigated by households spending savings from enforced hibernation and pent-up demand, along with the possibility of the government extending existing support measures and announcing additional fiscal initiatives.

However, the greater risk is any pick-up in earnings is likely to be short-lived, with the real costs of social distancing under-appreciated. We continue to think a V-shaped recovery underestimates the medium-term risks. We expect until a vaccine is found, social-distancing measures will remain in place and weigh on both consumer activity and workplace productivity, impacting both revenues and margins.

China, the leading template so far for what a re-start might look like, is hardly sending a positive signal for the consumer. Various bottom-up China activity trackers have seen upstream industries (such as basic materials) already recover to 80-90% of 2019 levels, but discretionary spending categories are recovering at a much slower pace.

Although investor panic around the covid-19 crisis might seem over, the effects of the panic are not, and are still to fully play out. This doesn’t mean that good opportunities don’t exist, but it is likely to require a more nuanced and active approach, making stock picking more important.

Beyond the inflection-driven 'hope' phase of the recovery, we see the market is less likely to be driven by valuation expansion as interest rates are already at their lower bound. We expect bond yields to remain low, which favours longer duration growth stocks, including IT and healthcare and selective infrastructure like assets. We also expect nominal GDP growth to remain low, with the risk companies will face rising costs, including wages as the social contract and profit share shifts more to labour, and margins come under pressure. This favours higher quality companies and companies exposed to secular growth over the medium to longer term. In the short run, we also expect there will be the potential for more cyclical businesses to benefit from any inflection in economic activity, particularly where supported by fiscal stimulus and infrastructure building projects.

Four examples of better opportunities

Ultimately stocks with good earnings growth and strong cash generation and balance sheets have the best chance to outperform. We therefore continue to participate with prudence and look to:

1. Build positions in higher growth companies that are structural leaders and typically trade at significant valuation premiums, but currently discounted. For example, SEEK (ASX:SEK), the leading online job placement company in ANZ and Asia, and Aristocrat Leisure (ASX:ALL), a global leader in the design and manufacture of slot machines and online digital game content. While neither company is immune from the impact of covid-19, recent price weakness has provided an opportunity to buy two high quality companies with market leading positions, a strong competitive advantage and pipeline of growth at an attractive margin of safety.

2. Invest in companies which will emerge stronger from the crisis with a better sustainable market position and competitive advantage. Arguably the most profound change as a result of the virus has been the acceleration in digital disruption and technology trends already in place prior to the pandemic. NextDC (ASX:NXT) has been a material beneficiary with a surge in data centre demand and a number of hyper-scale players including Google committing to new space in recent months. The increase in demand for telecommunication and online services is also driving strong secular growth for fibre and telco infrastructure services like Uniti Group (ASX:UWL).

3. Buy deeply oversold, large, liquid quality cyclical stocks that will benefit as the cycle turns. Infrastructure spending and financing has been a secular portfolio investment theme for some time. Federal and state government fiscal stimulus to support the post pandemic economic recovery and stimulate job creation is only expected to enhance the growth opportunity. This is likely to be skewed to ‘shovel ready’ social infrastructure projects, as well as education and transport, rather than the recent ‘mega’ projects and should underpin earnings for Seven Group Holding’s (ASX:SGH) Coates Hire business (Australia’s largest equipment hire company). Gold also remains attractive given the explosion in money supply and growing government debt levels, particularly where augmented by attractive underlying volume growth as in the case of Saracen Minerals (ASX:SAR).

4. Remove companies that will struggle to recover from the covid-19 crisis or are likely to suffer longer term structural issues as a result. We remain wary of more consumer-facing companies, particularly those exposed to discretionary retail, travel and airlines. We are also cautious around commercial real estate developers, and associated lenders to these sectors.

Hamish Tadgell is Australian equities portfolio manager at SG Hiscock & Company. This article contains general information only and does not take into account any person’s individual financial circumstances.