Heading into 2025, some of the most exciting opportunities that we find are in the often-overlooked small and mid-cap space.

Small boats, big sails

As growth investors at Munro Partners, we seek companies that demonstrate sustainable earnings growth over the long run. We are finding compelling opportunities in companies that are small in size today but are positioned to benefit from massive long-term structural growth trends.

We identify these trends as ‘Areas of Interest’ (AOI) – trends that we think represent enduring tailwinds that will shape the global economy for decades to come. Some AOI themes include Security, Climate, High-Performance Computing, and Digital Media & Content.

The small companies that are strategically aligned with these long-term trends have the potential to achieve exceptional growth. Furthermore, the application and deployment of artificial intelligence may give their growth an extra boost.

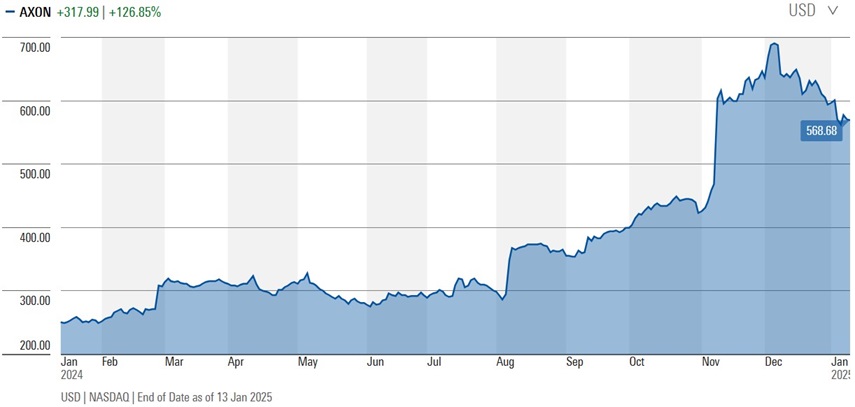

Take Axon Enterprise as an example (NASDAQ: AXON). Axon is the leading provider of tasers and body cameras to US law enforcement agencies. Its innovative AI-powered software, Draft One, uses the vision captured by the Axon body camera to draft police reports, reducing a mundane task that consumes hours of an officer’s day. The Fort Collins Police Department has claimed a 67% decrease in time spent by officers writing incident reports since deploying the technology. We believe Axon is at the forefront of modernising law enforcement, with its technology poised to expand into private security, defence, and international markets. We see this as just the beginning of a long growth trajectory.

Source: Morningstar.com

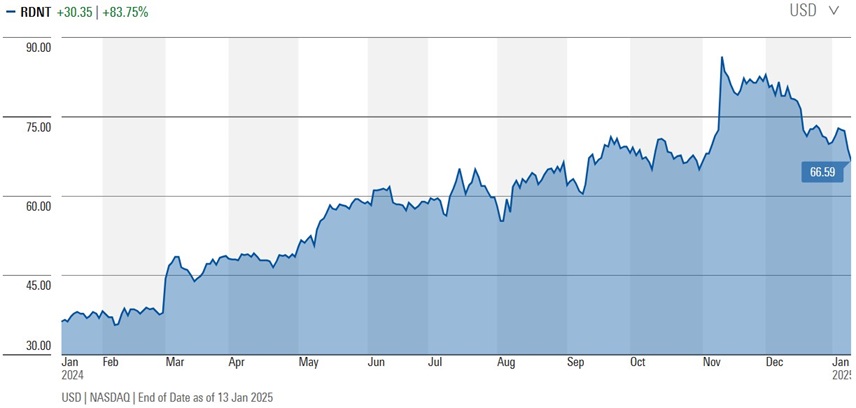

RadNet (NASDAQ: RDNT) is another example. This company owns and operates diagnostic imaging centres and is pioneering the use of AI in mammography. It developed an AI algorithm that analyses MRI and CT scans with greater speed and accuracy than human radiologists, detecting cancers up to a year earlier and reducing false positives by nearly 20%. This innovative technology has far-reaching implications, with potential applications across various therapies including lung and prostate cancer detection and vascular scans. Furthermore, wider insurance coverage is expected to drive further adoption and growth. We anticipate RadNet's earnings acceleration to continue for years to come.

Source: Morningstar.com

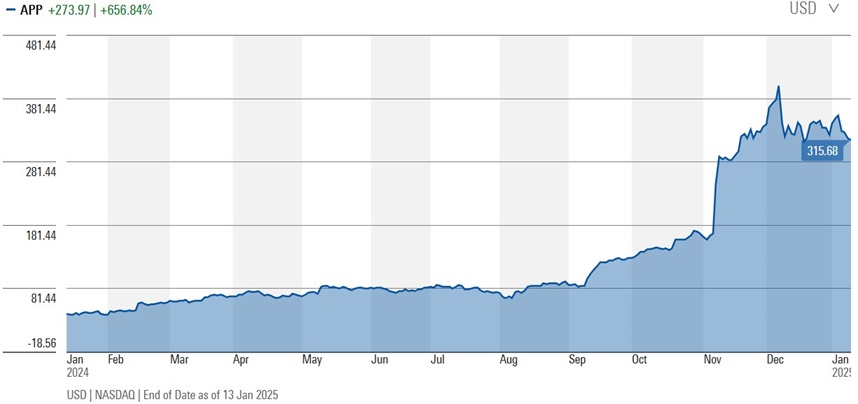

An additional example is AppLovin (NASDAQ: APP), a founder-led company based in Palo Alto, California. The Company is a mobile app technology company that provides a platform for developers to help them grow, monetise, and optimise their mobile apps. With approximately 1.4 billion daily active users within their mobile gaming ecosystem, AppLovin has one of the largest user bases in the world, allowing them to take share within the mobile gaming advertising ecosystem, where its improved Axon 2.0 AI model is generating superior returns on ad spend for its advertisers. Axon 2.0 has seen a meaningful step change for the company’s financials with accelerated revenue growth, as well as expanding margins and free cashflow. AppLovin is now beginning to test the merits of its Axon 2.0 product outside of mobile gaming, specifically, they are now testing the product for e-commerce advertising. This product remains in beta testing, with initial feedback from advertisers suggesting that the company is gaining a lot of traction, with some sources suggesting their returns are superior to Meta. Advertisers are indicating that if these returns hold, AppLovin could quickly become a large portion of their advertising budgets. This is creating a lot of interest across the industry, with a long tail of advertisers keen to try the platform. We expect, the e-commerce opportunity more than doubles AppLovin's addressable market. The market has become very excited about the e-commerce opportunity, which would be incremental to management’s guidance of 20-30% revenue growth over the next few years.

Source: Morningstar.com

Little attention from Wall Street

A significant valuation gap persists between smaller companies and their mega-cap counterparts, presenting a compelling investment opportunity as we move into 2025 and beyond. This disparity is largely driven by a simple factor: lack of attention.

Consider this: when industry giants like Nvidia and Microsoft release their earnings, they are met with a deluge of analysis, with over 40 analysts dissecting every detail of their performance. In contrast, when the smaller semiconductor or software companies in our portfolio report results, they often receive minimal coverage, with only one or two analysts providing limited commentary.

This lack of attention creates an information inefficiency, where the true value of these smaller companies remains obscured from the broader market. This presents unique and significant opportunities for discerning investors seeking strong returns.

Qiao Ma is the Lead Portfolio Manager for the Munro Global Growth Small & Mid Cap Fund and a partner at Munro Partners.

Munro Partners is a fund manager partner of GSFM, a sponsor of Firstlinks. This article is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons.

For more articles and papers from GSFM and partners, click here.