Weekend market update: Friday continued the strong run in global markets on vaccine optimism and the nomination of the dovish Janet Yellen as US Treasury Secretary. The S&P500 rose another 0.25% on Friday to close at a record high, up 2.3% for the week, while NASDAQ put on almost 1%. The market only hears good news for tech. And so much for the uncertainty of the US election ... the Australian market is up 11.4% in November so far and Europe has risen an amazing 18% despite more lockdowns.

***

The Retirement Income Review was a welcome surprise packet. Far from being simply a 'fact based' set of statistics or rules, the Review takes a firm stance on many controversial subjects and gives momentum to superannuation alternatives. While not formally making recommendations, its findings are no less powerful. We explore five ways the Review will guide future policies, setting up retirement planning for significant changes.

It will stand as a turning point in the way we think about superannuation and retirement incomes, although as far back as 12 April 2018, I wrote an article pre-empting a major finding of the Review, saying:

"Superannuation involves a calculated drawdown of capital for most people. This is not only about 'income' but access to money and cash flow."

Two other pieces on this important document. David Bell highlights how the Review focusses on this need to draw money from assets (including super and the home) and not only live on income. Then we provide an edited transcript of Paul Keating's discussion with Leigh Sales on the ABC's 7.30, plus links to the full video. Keating was critical of major findings and not surprisingly, took the opportunity to make a passionate defense of the existing superannuation system.

My interview this week is with Steve Bennett of Charter Hall, who is also Chairman of the Property Funds Association. Many property sectors have been resilient during the pandemic, and he explains how funds with long-term leases to prestige clients provide an income alternative for investors, as well as exploring various property trends.

The rapid rise in share prices of tech stocks (and Tesla's market cap is now an extraordinary USD520 billion) is leading to portfolio concentrations that many investors may not have expected. In the US, the broad S&P500 is now one quarter tech. Amy Arnott asks whether it is time for some diversification into other sectors.

On a similar theme, for those looking for diversification opportunities in Emerging Markets, there is an even stronger index dominance of 'China tech', with the top 5 companies making up 40% of the index. The White Paper from Realindex is a warning to everyone to check what's in an index before assuming it delivers broad-based exposures.

For the moment, all governments are providing fiscal stimulus with a bottomless pit of debt, but at some point, it will need to be repaid. Kate Howitt looks at how the problem was faced in the past, Australia's adoption of similar policies and the likely future drag on share prices.

Amid all this market and political action, we can't avoid the need to manage our SMSFs. Graeme Colley warns of a little-discussed consequence of the new bankruptcy rules, that there is no forgiveness of the need to meet pension payments simply because an asset is no longer throwing off the required income.

What else is happening?

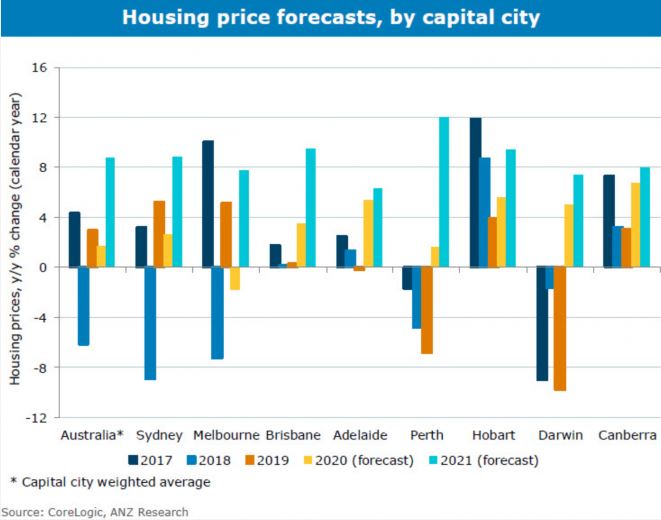

The one market most analysts expected to fall during the pandemic was residential property prices. How could they withstand the loss of migrants, rise in unemployment and businesses closing? Enter 2% borrowing rates, an easing of lending restrictions, fiscal spending and ex-pats returning. Among many who have changed their forecasts, ANZ Bank now expects a combined capitals small price rise in 2020 and up 9% in 2021. Loan servicing is easier than ever for most people, as a 2% fixed rate on $1 million in only $20,000 a year (assuming no repayment of principal).

Matt Comyn, CEO of CBA, said last week:

"I don't think the housing market is a risk anymore. I mean we've substantially upgraded our forecast in and around housing versus where we were in May and even in August."

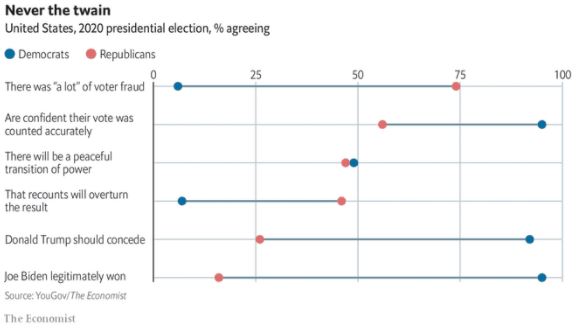

Finally, while there are signs Donald Trump has slowly realised he has lost the election, his Twitter feed shows he continues to stoke the flames with fraud claims. He also takes credit for the strong US stock market.

Despite his failure to prove anything in courts, his stance on election legitimacy is widely supported by Americans. As a poll last week in The Economist showed, three-quarters of Republican voters believe there was 'a lot' of fraud in the election, although only 6% of Democrats held the same view. This chart illustrates how stark the blue/red divide has become.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website