The Weekend Edition includes a market update plus Morningstar adds free links to two of its most popular articles from the week, including stock-specific ideas. You can check previous editions here and contributors are here.

Weekend market update

From AAP Netdesk: Shares finished the week at a record closing level on the ASX. Materials and technology stocks powered the main index as investors stayed cool despite rising US inflation data. BHP and Fortescue gained more than 1% after iron ore prices climbed. Rio Tinto was little changed. There were whopping increases for some technology vendors. Artificial intelligence provider Appen surged 5.56 per cent to $13.85. Buy now, pay later provider Afterpay climbed 3.68 per cent to $103.52. Technology stocks were the biggest beneficiaries on US markets following the May consumer price index (CPI) data.

Experts reasoned the higher US prices mostly came from commodities and airfares, and the surge would be short-lived.

From Shane Oliver, AMP Capital: Global share markets mostly rallied over the last week. The big surprise perhaps was the US where shares rose 0.4% for the week to a new record high and bond yields fell despite another surge in inflation, because investors (rightly in my view) interpreted the make-up of higher than expected inflation for May as consistent with the Fed’s assessment that the spike in inflation would be transitory.

Eurozone shares rose 0.9% and Japanese shares were flat but Chinese shares fell 1.1%. Bond yields fell on expectations the Fed will remain dovish and as the ECB committed to maintaining its increased rate of bond buying for another quarter. Oil, iron ore and copper prices rose. The $A fell as the $US rose.

Global inflation readings continued to rise over the last week with producer price inflation accelerating in China and Japan and US inflation surging again in May to 5% year on year with core inflation rising to 3.8% yoy (its highest since 1992).

***

Investing 101: When employment rises, the economy is stronger and the stock market rises.

Investing 102: When employment rises, interest rates rise and the stock market falls.

Investing 201: When governments spend, the economy grows and inflation rises.

Investing 202: When governments spend, central banks buy the debt and there is no impact on inflation.

Economics (and investing) is more art than science. Analysts can pick whichever scenario suits them. Markets rise because there are more buyers than sellers. Shares are liquid until they aren't. Tight bid/offer spreads evaporate when most needed. Asset prices fall in a pandemic. Unregulated markets are efficient and the best way to allocate resources. Take your pick.

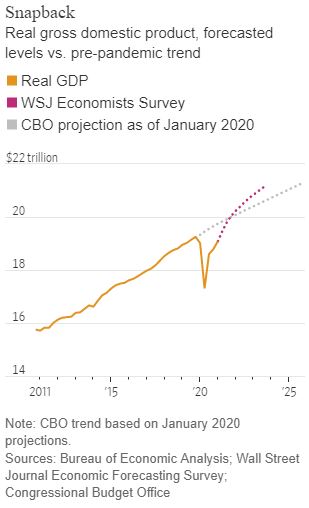

The theories on the ways governments, markets and assets behave have been thrown into more doubt than ever in the last year. The Wall Street Journal polled US economists last week on real GDP growth forecasts and the 'snapback' is stronger than anyone thought possible.

Meanwhile, it's so crazy in some segments that a declining company that has not made a profit for two years, AMC, trades 750 million shares a day when it only has 500 million on issue, its market value is up from US$500 million to US$30 billion in a few months priced at 200 times revenue (not profit because there isn't any), so what does AMC management do? Raise new capital, of course, advising in bold on the front page of its prospectus:

"We caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment."

Investing 301: Look back on this moment in a few years.

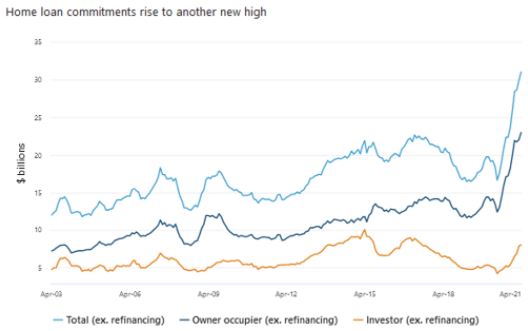

In Australia, residential property shows no sign of easing as investors compete against owner-occupiers, with the ABS advising:

“The value of new loan commitments for owner-occupier housing reached another all-time high in April 2021, up 4.3% to $23.0 billion. New loan commitments for investors rose 2.1% to $8.1 billion, which was the highest level since mid-2017.”

Over $30 billion of new loan commitments in one month! And in the history of Australian banking, it has never been easier to raise funding, with deposits pouring in despite no real returns, and the RBA's Term Funding Facility (which provides the banks with three-year money at 0.1%) was drawn by an additional $7.6 billion last week, taking outstandings to $127 billion. There is still $73 billion available until 30 June. Anyone for a home loan?

In this week's articles ...

We look at the long-running war between ETFs and LICs/LITs to find a clear winner, in the same way the biggest two movie franchises in the world, Star Wars and Marvel, are on different growth paths. The launch of the first new LICs since 2019 do not indicate a general revival for the structure.

Accessing Morningstar's global analysts, Vikram Barhat reports on attractive value in the biggest tech companies in the world, offering investors an entry point for the winners that blitzed the pandemic economy.

Then Tal Lomnitzer explains why copper has an electronic future that has driven prices to all-time highs. This may be a traditional metal but there is nothing traditional about the ways it is driving technology.

As we are well into June, financial adviser and SMSF specialist Liam Shorte updates his annual definitive list of items to check for the EOFY. It takes a bit of effort to plough through the detail but the rules and regulations are always changing.

Emma Davidson backs up statements made last week by Jeremy Grantham about toxicity and declining birth rates, drawing out implications for retirees and economic growth. Where are the young workers who will pay the taxes to support our pensions and health systems in decades to come?

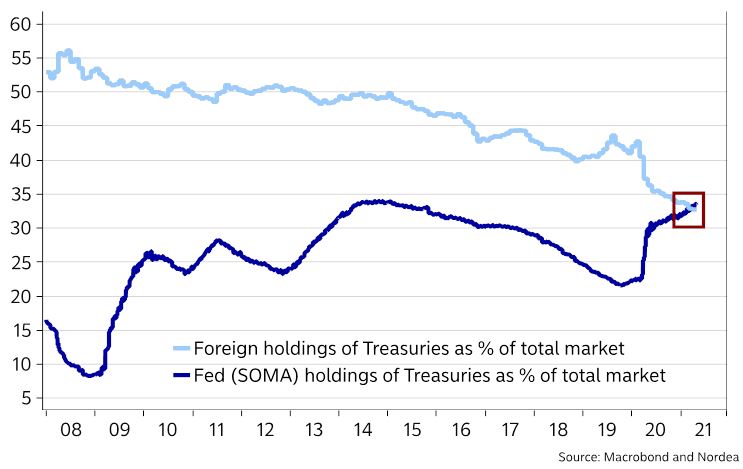

Maybe we no longer need to worry about deficits as governments continue to spend more than their revenues and central banks buy more bonds. It's finally reached the point where the US central bank now owns more US Treasury bonds than all foreigners. It should not be good for the reserve currency of the world when the Fed crowds out countries like China and Japan which hold their reserves in US bonds.

Two articles focus on this world where anything seems possible with government spending. Professor Tim Congdon explains the consequences of rising money supply on inflation (remember when we used to worry about that?). Then back on cosmic forces, Andrew Macken says the rules on who can vote in the US Senate will determine whether Joe Biden and the Fed plunge fully into Modern Monetary Theory. Both are easy-to-read summaries of vital subjects.

This week's White Paper from Neuberger Berman focusses on the transition to net-zero emissions and implications for companies, especially timely with Prime Minister Scott Morrison at G7 to discuss Australia's policies.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Lewis Jackson speaks with Monash Investors co-founder Simon Shields about the company's decision to convert its perpetually-discounted LICs to an Active ETF, a first for the Australian market. Could this set a trend? And Australia's best-known conglomerate Wesfarmers has spent heavily on ecommerce, but the stock market is possibly overestimating its growth potential, writes Lex Hall.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website