The Weekend Edition includes a market update plus Morningstar adds free links to two of its most popular articles from the week, including stock-specific ideas. You can check previous editions here and contributors are here.

Well done to Ashleigh Barty, off to a flyer to win the first set, fighting hard after losing the second, then bringing home the Championship. And to Dylan Alcott for continuing the success in the wheelchair event.

Weekend market update

From AAP Netdesk: Shares had their second week in the past three of losses on the ASX as investors fret that the coronavirus Delta variant may hamper economic recovery. The Aussie market fell by as much as 1.4% on Friday before a late climb trimmed losses to less than 1%. Technology shares fared worst and dropped 2.8%. The benchmark S&P/ASX200 index closed down 68 points or 0.9%. For the week, the index lost 0.5%, and it has shed 1.3% over the past three weeks. However, it remains on a nine-month winning streak and is little more than 100 points from a record close.

From Shane Oliver, AMP Capital: US shares managed a 0.4% gain for the week as 'dip buying' possibly helped by news of monetary easing in China drove a strong gain on Friday. However, Eurozone shares fell -0.2%, Japanese shares lost -2.9% and Chinese shares fell -0.2%. Consistent with the risk off tone, bond yields fell. Commodities were mixed with metals and iron ore up but oil down partly due to an output dispute amongst OPEC members. From their highs early this year, US 10-year bond yields have fallen 0.4% from 1.74% to 1.36% and Australian 10-year bond yields have declined by 0.5% from 1.9% to 1.33%.

Eurozone shares rose 1.6% on Friday and the US S&P 500 gained 1.1%. The positive global lead saw ASX 200 futures gain 76 points or 1.1%, indicating a strong open for the Australian share market on Monday.

***

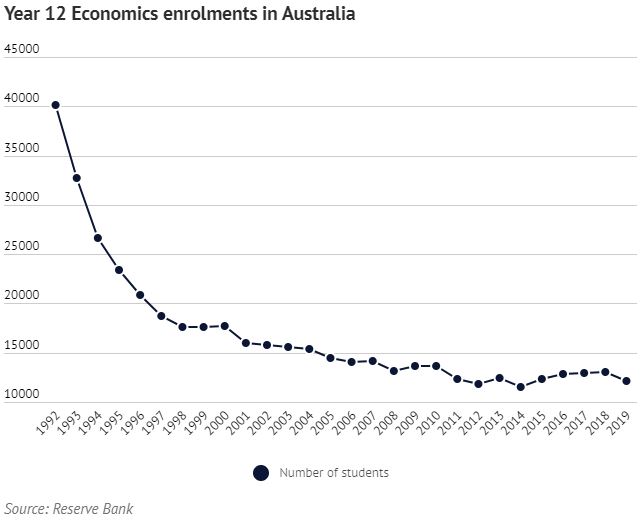

My undergraduate degree majored in economics, a popular subject in the 1970s and 1980s. It was my favourite HSC study and in the Randwick Boys High School hall (yes, folks, we don't all go to private schools) is an economics honour board with my name on it. What's not to like? Well, apparently, a lot, because economics is less popular in schools than ever. In NSW, of the 76,000 HSC students in 2020, only 5,072 sat the economics exam. Many drop out in year 11 due to the heavy emphasis on mathematics.

There's an easy fix. Judging by the number of young people in the sharemarket for the first time in FY21, call the subject 'Investing and Economics', update the syllabus and enrolments would go through the roof.

The authors of the study of 4,800 students in years 10 to 12 (15- to 18-year-olds), Tanya Livermore and Mike Major of the Reserve Bank, report:

"We find that high school students typically have positive perceptions of economics as a field; however, the perceptions of Economics as a subject tend to be negative ... students from a lower socio-economic background are more likely to believe that ‘it is a risk to study Economics because I don't know what it's about’".

Unfortunately, the students from lower socio-economic backgrounds who would probably most benefit from understanding economics don't know what it's about.

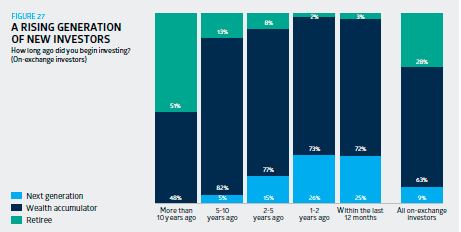

Some version of economics/finance/investing should be compulsory in schools, and it should be easy to make it interesting. One major trend from COVID-19 is the big increase in young people investing or trading on stock exchanges for the first time, which we have written about before. According to the ASX Australian Investor Study:

"The last two years have seen an influx of younger investors into the market. Among those who began investing on a securities exchange within the last two years, a quarter are next generation investors. And this trend looks set to continue, with 27% of intending investors (those planning to begin investing within 12 months) also under 25."

One concern is where these new investors find ideas. ASIC Senior Manager of Retail Complex Products and Investor Protection, Somer Taylor, recently admitted at the MarketLit conference that social media presents a "degree of risk" as a source of information and creates challenges for the regulator.

“There’s a fragmented nature when we’re talking about social media and the internet, there’s the scale of information that we have to monitor, there’s ease of access to that information and the rapid churn rate – these are all factors that make it a complex environment for us.”

We know from the GameStop saga, the millions of new players on Robinhood and similar cheap trading apps in Australia, an NFT worth US$69 million, influencers such as Elon Musk driving up prices of joke cryptocurrencies like Dogecoin ... and on it goes ... that investors will jump on any fad. Robinhood recently informed the market that its Robinhood Snacks newsletter and podcast had 32 million subscribers, and it's a business based on options, leverage and selling its customers' orders to traders.

These new investors need reliable information or their investing will suffer, so let's rename the Economics subject, teach it in schools, add some investment content and bring everyone into the tent.

Each year, Hugh Dive of Atlas Funds Management looks at the worst performers of the previous year (in this case FY20) and checks how they went in the next year (FY21). Hugh says the average of the FY20 dogs rose 32.5% in FY21, ahead of the ASX200 Accumulation Index of 27.8%. Here are the dogs of FY21:

Hugh does not think much of their prospects in 2022:

"Looking through the list of the underperformers of 2021, the key theme again is that the falls are from factors that are outside the company's control, such as Chinese import restrictions on Australian goods, falling electricity prices or the gold price ... the Chinese Communist Party gave little indication that investors can expect China to relax import restrictions on Australian goods in the near term. Similarly, it is difficult to see a significant increase in wholesale power prices for AGL Energy and Origin Energy in the face of government policies designed to drive down prices."

And yet the dogs often beat the index in the next year.

As we head into a new financial year, this edition is packed with good ideas for young and old.

Starting at the retirement end, former leading consultant to super funds, Don Ezra, provides a fascinating article on how he approached his own retirement spending. He walks through three steps to decide how much he could safely spend each year and not run out of money.

After over 2,000 listens of our new podcast with Peter Warnes (Head of Equities Research at Morningstar), the next episode features the latest cash rate outlook, demographic change, debt serviceability and Peter's view on Telstra. Join our chat with a simple click.

Then Andrew Macken explains why the six leading tech companies of the world remain excellent investments, despite the US market pricing at all-time highs. They continue to change the ways we live and monetise their assets, and exposure to these companies has a role in every global portfolio.

We expect the Your Future Your Super to have a profound impact on super funds, some of it undeserved, and Nick Callil and Tim Unger show the high proportion of funds likely to fail the performance test over time. A new era of fund consolidation is upon us.

Continuing our series of four articles on modern retirement products, the second piece is Emma Rapaport's check on Magellan's new FuturePay. Magellan spent three years on the development to find a way to add support to its equity funds.

It was also notable that Magellan announced its intention to convert its High Conviction Trust (ASX: MHH) to an open-ended Active ETF from a closed-ended LIC. Another victory for the ETF structure. Robin Bowerman provides a primer on ETFs, LICs and managed funds to show the major features investors should know. Don't assume they are all the same.

The start of the FY is a good time to check the asset allocation of your portfolio as prices shifted over the year, and Sophie Antal Gilbert explains the importance of rebalancing. With sharemarkets rising, do you have more risk than you want?

Michael Collins writes on the switch to electric vehicles as he highlights some problems they face which are often overlooked. The move to this new power is inevitable but EVs face challenges.

And at this time of year, we remind our readers about the risks involved in the timing of investments in ETFs and unit trusts which must distribute earnings (income and capital gains) to investors. With some funds rebalancing and realising large capital gains, investors need to watch they are not incurring an unexpected tax bill.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

A consortium of infrastructure investors has its sights on Sydney's international airport. Alexander Prineas thinks the acquisition will succeed but at what price? And Lewis Jackson surveys the managed fund performance numbers for the 2021 financial year. Not one of the over 300 funds finished FY21 in the red, even if many underperformed their benchmark.

Finally, as a counter to the criticisms LICs face, our Comment of the Week comes from Danny, in response to our article explaining when LICs have a role.

"I love LIC's. ETF's are my larger holding but LIC's are my fix for individual shares. They still keep spitting dividends and have done really well for me for many years. When I say LIC's, for me, its the grand daddy's (AFI, MLT, ARG etc.)"

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

LIC (LMI) Monthly Review from Independent Investment Research

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website