What if you could invest to grow your nest egg and take a regular, predictable income without having to sell down any of your capital? Sounds like the dream, right? Magellan's new FuturePay fund aims to do just that.

FuturePay (FPAY), issued by Australian fund manager Magellan, invests in a portfolio of high-quality, low volatility global listed companies which the manager believes can deliver attractive, risk-adjusted returns over the medium to long term. Portfolio constructions will be focused on protecting investors on the downside. Alongside returns and capital growth, the fund provides its investors with a predictable monthly income that grows with quarterly inflation.

Magellan will pay out returns from the global equity portfolio’s regular income in good times and draw on the cash reserve (called a Support Trust) attached to the fund in the bad. At inception, the fund is targeting an initial yield of 4.3%, paid monthly.

Magellan Chief Executive Brett Cairns said the product sought to address the challenges faced by investors seeking to establish a reliable income stream in retirement.

"The challenge is thinking about the other side of accumulating savings," he said.

"Once you have some money, you then look to maintain access to those savings, and grow those savings such that you have a regular and predictable income that keeps pace with inflation.

"But it's also important that you don't erode your capital. This need shows up most in retirement where your savings need to replace your pay cheque. Here we wanted to re-establish some sense of a pay cheque that's regular and predictable, and into the future which is unknown.

Cairns added that he believed the investment needed "some sort of growth aspect" as a hedge to longevity risk and aid to intergenerational wealth transfer.

"Not knowing how long you're going to need that capital for means you're dipping into and eroding it over time. It leaves you with risk for how long you're going to live."

Cairns said that the idea for the fund, which was three years in the making, was drawn from a technique already used between advisers and their clients. This involves setting aside a "cash bucket", alongside the "growth bucket", to be drawn upon in down markets. As such, investors aren't forced to sell their investments when the markets fall but can dip into the cash. This, he says, is an acknowledgement that sequencing risk can work against retirees, but also that markets do recover over time.

$50 million commitment

Magellan Financial Group will initially seed the Support Trust with $50 million, paid in increments. The listed company has also committed a reserve facility equal to 2% of the fund, capped at $100 million to "provide additional support during poor market conditions".

Additional payments into the Support Trust will flow from two key sources:

1) When investors purchase units in the fund, a small amount of capital will be contributed from the fund to the trust. This is known as the 'adequacy contribution' and on the first day of trading stood at 6.71%. This ensures that investors coming into the fund pay for the value that's already in the trust and that the reserve remains adequate.

2) In rising markets, where the portfolio is outperforming its inflation-adjusted index, FuturePay may reserve a portion of its outperformance by contributing capital to the trust.

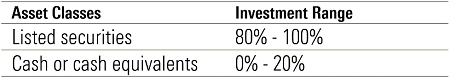

Magellan FuturePay | Asset classes and allocation ranges

Source: FuturePay PDS

The fund launch comes as Australian retirees seek to navigate a treacherous strait in the market. Today's rock-bottom interest rates have made drawing a regular, liveable income from a traditional ‘retirement portfolio’ with its higher allocation to bonds and cash near impossible. Meanwhile, retirees are generally reluctant to draw down their capital due to complexity, a lack of guidance, longevity risk and concerns about possible future health and aged care costs. This forces retirees to take on riskier investments in the search for yield at a time when they have less capacity to recover from market setbacks.

"Investing was once relatively straightforward for highly-conservative investors," Morningstar Editorial Director Graham Hand wrote in late 2019.

"As recently as 2012, the cash rate was greater than the 4% annual minimum drawdown required from a superannuation pension account. Further back to the 1990s, periods of double-digit cash and term deposit rates avoided the need to go into anything riskier than term deposits, although inflation was higher.

"Fast forward to now, as we enter the 2020s, there is nowhere to hide that gives capital security, a return greater than inflation and avoids a continual drawdown on a pension."

Captive cash and equity market exposure

So, what's the catch? The assets in the FuturePay Support Trust do not form part of the assets of the fund. Therefore, if you choose to redeem your units, the price you receive will reflect the value of the investment portfolio. You leave behind the value of your benefit in the reserve so that the remaining investors receive the benefit. Cairns says this reflects the 'mutualisation' of the fund.

"This fund is funded by the investors in FuturePay and it exists for the benefit of the investors in FuturePay – both by upfront contributions and ongoing contributions from outperformance," he says.

"Treating the reserves in this way leads to a material efficiency and while the initial reaction might be ‘well, I'm leaving something behind’, it does actually mean that you don't need as much in reserves."

The exit price from the fund will be the NAV per unit less the mutualisation amount. The NAV comprises the value of the securities the fund owns and the value of the Support Trust rights, but not its assets and liabilities. This structure could encourage investors to remain in the fund in falling markets, or when they need the cash, for fear of losing access to the cash distribution, which their initial investment and continued returns help fund.

The income investors receive, unlike a traditional life company annuity, is not guaranteed. It is a target. In deciding whether to make less frequent payments, the trustee may consider the fund's investment performance, the reserve ratio and prevailing market conditions.

The fee structure is complex. As stated, Magellan will charge a fee of up to 1% a year on the value of the investment portfolio. Fees are not charged for the value of the Support Trust or to Magellan to manage the support assets.

Magellan will also reduce its fee for interest it receives on cash held by the Support Trust. This is expected to result in the fee paid by investors on the total assets being managed by Magellan of around 0.90% per year.

Investors will also fund the reserve contributions made to the Support Trust, with an estimate of this net cost at 0.52% a year. Magellan says this cost will turn into a benefit when FuturePay receives payments from the reserves held by Support Trust.

In the end, this is still an equity fund with assets similar to Magellan’s global and infrastructure funds. It's an equity fund that pays a regular, inflation-linked income, but an equity fund all the same. Equities carry risk to capital. Could you stomach a 50% equity market drop, and for how long? Magellan Global does have a long history of superior downside protection, most notably during the initial covid-19 sell-off, during which it fell 1.2% versus the index's 9% loss. But investors should, as the product disclosure statement recommends, expect to hold their investment in the fund for seven to ten years. There is no silver bullet, as Magellan General Manager Frank Casarotti noted.

"We do believe that this offer will be appealing to some investors, particularly in the retirement income space," he said at the launch.

Like its flagship Magellan Global product, FuturePay will have two access points – directly with the fund (via the unit registry) and via the Chi-X exchange, ticker FPAY. This will allow everyday investors immediate access and liquidity. Cairns also hopes the fund will appear across investment platforms, which could open the fund up to the advice market once it appears on approved product lists.

The first distribution has been set at 2.03 cents per unit, paid on the fifteenth of the month. The current income yield is around 4.25%, based on an initial NAV of $5.75 per unit.

Emma Rapaport is Editor Manager at Morningstar, owner of Firstlinks. This article is general information and does not consider the circumstances of any investor. Magellan is a sponsor of Firstlinks.

This is the second of four articles which will examine alternative solutions to reduce the potential to run out of money for retirees. The first article is here.

A Morningstar Premium free trial is available on the link below, including access to the portfolio management service, Sharesight.

Try Morningstar Premium for free