“The stakes are high to get this next stage of online growth right.”

Australian retailers are rapidly increasing their online penetration and looking at how best to fulfil the growing demand. Coles recently announced an exclusive partnership with Ocado, who have generally been acknowledged as the world’s best in online fulfilment.

As part of a recent research trip to the UK and Europe, I spent time meeting with local online grocery experts to understand the implications of this deal for Coles, supermarkets and other Australian retailers.

Who is Ocado and why is it a big deal?

UK-based Ocado is the world’s largest dedicated online grocery retailer. They have no physical stores. Their proprietary fulfilment solution is available to commercial partners like Coles, and includes the software, hardware, services and support.

I was interested to find out what makes Ocado’s system special, and the experts tell me that it is how they ‘pick’. Picking, i.e. getting the items off the shelves in the store or warehouse, is said to make up 40% of total fulfilment costs.

There are three main camps on picking, and some UK brands use a combination:

- In-store picking leverages existing capital. Coles have predominantly been doing this until now.

- Dark stores look similar to standard stores but with staff but no customers. Coles is currently trialling a dark store in Melbourne.

- Automated centralised distribution centres or ‘CDCs’. Coles has committed to build two Ocado-system CDCs in Melbourne and Sydney.

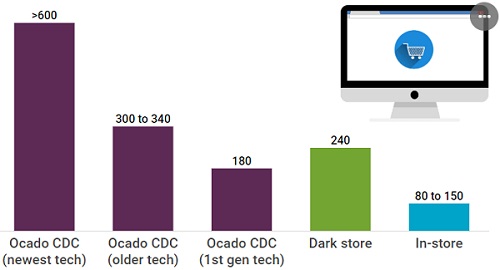

The experts I met with concur that picking costs for in-store and dark stores are way behind the best-in-class offerings from Ocado due to average pick rates for items per hour as shown in Chart 1.

Chart 1: Average pick rates per hour

Source: Martin Currie Australia, interviews with online grocery experts.

How do you want that delivered?

‘Last mile’ delivery is one of the largest costs, so an important factor for success. Physical stores have an advantage due to their proximity to customer homes. Dark stores and CDCs are generally slower as they are based in cheaper industrial areas.

However, in terms of drop rates per hour, my sources tell me that Tesco (in-store) and Ocado (CDCs) are both around 4/hr due to Ocado’s intelligent routing. The question will be whether Coles can achieve this too.

In comparison, food aggregators such as Deliveroo or Uber average even less at 2/hr and are loss making but they make up this cost with a high revenue share from partner businesses.

Interestingly, in March 2019 Coles quietly started an UberEats trial in Sydney, delivering essentials such as milk, bread, fresh fruit and vegetables.

What does it cost to implement?

The capital expenditure on the new CDCs will set Coles back $150 million over the next four years but they are looking to double online deliveries with this initiative. They plan to service metro areas via CDCs, with non-metro orders fulfilled by the store network. This is like the deal that Morrisons has with Ocado.

In less than four years, Ocado’s system has propelled Morrisons to a larger online market share than Waitrose, despite starting much later. Morrisons have however recently loosened ties with Ocado, allowing Ocado to work with other competitors such as Tesco, Sainsbury’s, Asda, Aldi and Lidl.

What’s the alternative for other supermarkets?

Ocado have spent 18 years getting their customised offer right but there are alternatives for Australian companies, such as Woolworths and Metcash, given Coles’ exclusive deal with Ocado. Alphabot, a collaboration between Alert Innovation and Walmart, is said to be the one to watch, as it’s designed to automate an existing store footprint. Amazon’s model works well outside grocery, but has no proven grocery offering (but watch this space). Others include Instacart, Autostore and Picnic.

What’s at stake?

Ocado is a leader with a 20% share of the UK online market. Online is 6% of the total grocery spend and is predicted to grow to 9% by 2021. While UK online growth is starting to mature, Australia has space to grow from its low base. Online currently only makes up around 3% of the total Australian grocery spend.

Coles has a 45% share of the online grocery market but Woolworths is currently in front. Doubling online sales would add around $1 billion to Coles’ books.

In summary

The stakes are high to get this next stage of online growth right. Locking in Ocado may give Coles a boost for now, but Woolworths, with a team of 500+ at the WooliesX headquarters in Surry Hills, will be taking this development seriously.

Sources: Coles and Woolworths company reports, Ocado company reports, IGD, Statista, Martin Currie Australia.

Jim Power is a Research Analyst at Martin Currie, a Legg Mason affiliate. Legg Mason is a sponsor of Cuffelinks. The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable. Please consider the appropriateness of this information, in light of your own objectives, financial situation or needs before making any decision.

For more articles and papers from Legg Mason, please click here.