Recently, there’s been a lot of discussion about whether the significant government stimulus, combined with record low interest rates and unconventional monetary policy will finally result in rising inflation, something markets have not experienced for some time. It appears that almost every central bank is committed to these measures until they achieve their objective of realised inflation.

It’s a risk of which investors should be aware. On a practical level, it means taking a look to see whether the assets in your portfolio are still match-fit in an environment of rising inflation. We have previously written on the critical role of the attacking defender as it relates to private debt illustrated through soccer, so we’ll extend this soccer team analogy to explore this dynamic and the role private debt can play to help investors navigate an environment of rising inflation.

Moving market dynamics

Long-duration assets like government bonds, infrastructure, property, and high-growth equities benefit when interest rates fall by lowering the discount rate applied to all their future cashflows. These are the first assets selected in your team when rates are falling. We have seen these champion investments perform exceptionally well over the bull market of the last 40-years, when interest rates have dropped from double digits to near-zero levels.

With the potential for rates to rise from zero and with the prospect of inflation, it’s time for the coach and team manager – in markets, the portfolio manager – to make some difficult decisions about whether champion players in the twilight years of their career – for example sovereign bonds – should still be on the field, at least for the whole match.

When inflation expectations rise, interest rates tend to increase, and the yield curve steepens. Long duration assets may no longer be fit for purpose. It might be time for short duration asset classes such as private debt to step into their role in the team.

In a rising interest rate environment, the value of long-duration assets like fixed rate corporate and sovereign bonds fall in value because their future cashflows are discounted more than before. Senior secured private debt is short duration and in a rising interest rate environment does not fall in value, giving true diversification benefit.

The duration of various fixed income investments

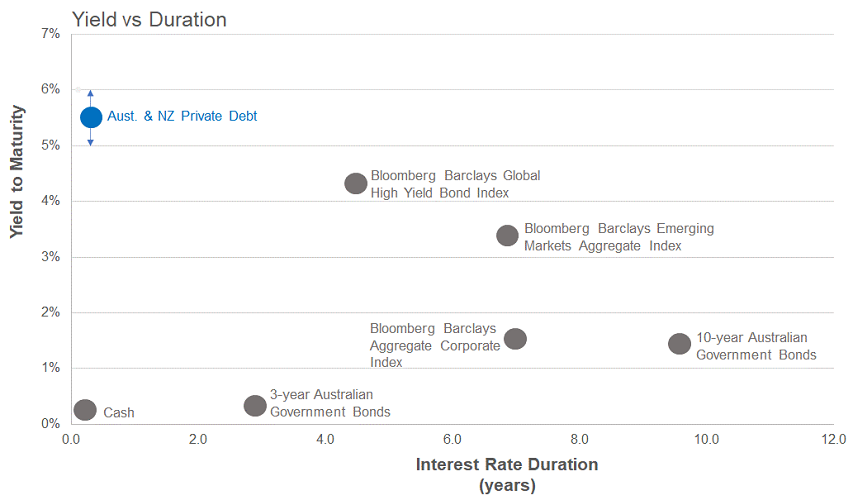

The chart below illustrates various credit and fixed income investments with differing levels of duration. The longer the duration, the more sensitive the investment valuation will be to interest rate changes.

Source: Revolution Asset Management and Bloomberg. ‘Aust & NZ Private Debt’ is based on realised investment experience of the Revolution private debt strategy from December 2018 to May 2021.

The overall yield on floating rate private debt rises in line with interest rate movements because the total interest earned is the floating rate benchmark plus the credit margin. The trade-off is that investors need to be comfortable with increased credit risk and the illiquidity that comes along when investing in private debt.

Re-positioning for the times

Overall, what’s important is to have the right balance of attacking and defensive assets in a portfolio for the current conditions. You pick a different team when the game is played in rain and snow compared with when the conditions are fine. When it comes to investing, what’s important is to choose the right assets for the prevailing economic and market environment.

Think of private debt as the attacking defender or wingback in the team, it provides the right balance in a portfolio because it produces uncorrelated returns to other assets, as we demonstrated in our previous article. It’s an investment that’s first and foremost a defender that aims to preserve capital, but at the same time, it can contribute to the attack and goals in the form of regular income that can either be spent or used to re-balance.

Simon Petris Ph.D. is Executive Director and Senior Portfolio Manager at Revolution Asset Management (ACN 623 140 607 AFSL 507353), a Channel Capital partner. Channel Capital is a sponsor of Firstlinks. This information is not advice or a recommendation in relation to purchasing or selling particular assets. It does not take into account any individual's investment objectives or needs.

For more articles and papers from Channel Capital and partners, click here.