The investor Diego Parrilla is well known for making the analogy between constructing a successful investment portfolio and building a successful soccer team. It’s possible to extend this analogy to private debt, which can provide a winning blend of attack and defence in an investment portfolio. Let’s look at how this analogy works.

Attacking and defending

In soccer, the aim is to score as many goals as possible to win. In investing, earning income and generating capital gains are akin to scoring goals. But it’s not enough just to score goals to win the game. The successful team also needs to stop the other side from scoring by defending their position. We can think of this as the portfolio manager’s role of preserving capital and reducing drawdowns.

Let’s put the whole team together. The table shows the role of each asset class in a portfolio corresponding to the role in a soccer team.

|

Role in an investment portfolio

|

Role in a soccer team

|

|

Investor/allocator

|

Coach/manager

|

|

Listed equities

Venture capital

Private equity

|

Strikers

|

|

Commercial property

Infrastructure

Hedge funds

|

Midfielders

|

|

Corporate bonds

Gold

Inflation-linked bonds

|

Defenders

|

|

Private debt

|

Attacking Defender/Wing Back

|

|

Sovereign bonds

|

Goalkeeper

|

|

Cash to buy attackers or defenders as required

|

Interchange bench

|

|

Unlisted assets

|

Players on long-term contracts who are more difficult to transfer out of the team than their listed counterparts on short-term contracts

|

A successful team in both soccer and investing has a diversity of players or investments. To succeed, each has different strengths, skills and roles to play. Fielding a team that’s full of attacking players is like building an investment portfolio with too much equity beta (share market volatility risk) and is only effective in a raging bull market.

As it’s skewed too much towards attacking and not focused enough on defending, this unbalanced team or portfolio will get caught offside too often and ultimately concede too many goals or drawdowns in most circumstances.

In a well-balanced portfolio, private debt plays the role of the attacking defender or wing back. This is a critical position in every successful investment portfolio and soccer team. Its purpose is to enter the final attacking third and help their team to score, without neglecting the defensive duties at the other end of the field.

In the same way, private debt provides a regular and stable source of income, akin to the soccer team’s attacking qualities, while maintaining a core focus on capital preservation, which is about defence.

Some of the best attacking defenders of all time include Dani Alves, Cafu, Roberto Carlos, Ashley Cole, Bixente Lizarazu, Phil Neal and Javier Zanetti. While they may not be as well-known as famous strikers and attacking midfielders like Messi, Pele, Ronaldo and Zidane, these wing backs have played crucial roles in some of the most successful international and club teams of all time. In a world of zero interest rates where income is hard to source, private debt can also provide that winning blend of attack and defence.

Positioning for downturns with private debt

Investors turn to defensive alternative allocations to diversify risk and supplement income. In a world of market uncertainty and low interest rates, private debt is an increasingly important fixed income option. It can protect capital, provide a reliable income stream and is uncorrelated to traditional bond and equity markets.

As markets work through the impact of the COVID-19 pandemic, accessing stable income is becoming difficult for investors to achieve without climbing too far up the risk curve. Unlike other asset classes, private debt can also give investors more certainty they will get their money back, alongside interest or coupon payments. The regular income can either be spent on living expenses or used to rebalance the portfolio as opportunities arise.

What is private debt?

Private debt or private credit involves lending capital as an investment to an entity in exchange for a defined amount of interest and the return of the original capital at a defined point in the future. The investment manager originates and structures the debt via fully disclosed contracts that typically include security over assets and other structural protections.

Like private equity, private debt involves a private company or entity that needs capital for growth or other business plans. Private debt is patient capital and the investment managers who work in this area appreciate the benefits of investing in illiquid assets that can provide excess return over the long term.

Negative correlation key to downside protection

As its performance is largely uncorrelated to equities, returns from private debt help dampen listed market drawdowns in times of market stress.

To illustrate this, we provide a study using the last 20 years of data combining a private debt benchmark based on BBSW plus a gross credit spread of 450 basis points (4.5%) less 50 basis points (0.5%) of modelled credit losses, which is consistent with big four bank loan books, and using the actual net returns from the Revolution Private Debt Fund I for the most recent two years.

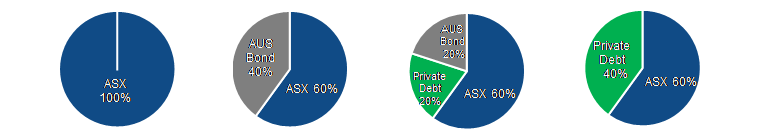

Let’s compare the correlations, compound returns and volatility outcomes for a range of portfolio constructions shown below:

- 100% exposure to Australian equities based on the ASX 200 Accumulation Index.

- 60% exposure to Australian equities and 40% exposure to traditional fixed income with the Bloomberg AusBond Composite 0+ Yr Index.

- 60% exposure to Australian equities, 20% exposure to fixed income and 20% exposure to private debt.

- 60% exposure to Australian equities and 40% exposure to private debt.

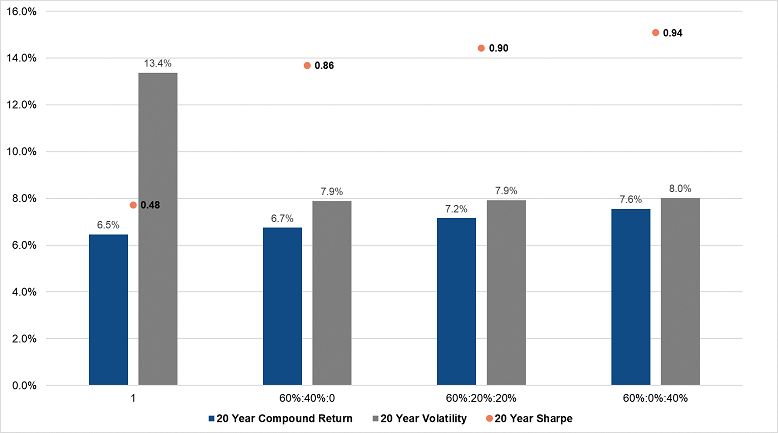

Portfolio inclusion of Australian and New Zealand private debt

Compound returns and volatilities over a 20-year period (2001 to 2020)

Sources: Bloomberg, analysis by Revolution Asset Management. Past performance is not indicative of future performance. Provided for illustrative purposes only. ASX refers to the S&P/ASX200 Accumulation Index and AUS Bond is the Bloomberg AusBond Composite 0+ Yr Index.

Australian private debt is negatively correlated with the ASX200 Index

| |

S&P/ASX Total Return 200 Index

|

Bloomberg AusBond Composite 0+Yr Index

|

Revolution AUS Private Debt Index

|

|

S&P/ASX Total Return 200 Index

|

100%

|

|

|

|

Bloomberg AusBond Composite 0+Yr Index

|

-21%

|

100%

|

|

|

Revolution AUS Private Debt Index

|

-8%

|

13%

|

100%

|

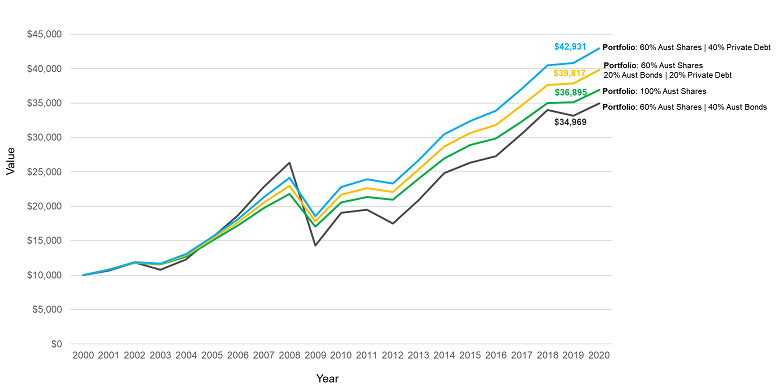

Let’s examine the potential growth of an initial $10,000 investment over this 20-year period. This analysis demonstrates how an allocation to private debt can help to achieve better return outcomes and smooth out returns in a balanced portfolio.

Growth of $10,000 over a 20-year time horizon

Sources: Bloomberg, analysis by Revolution Asset Management. Past performance is not indicative of future performance. Provided for illustrative purposes only.

This portfolio delivers superior returns and lower volatility or capital stability when an exposure to Australian and New Zealand private debt is included in the portfolio, which translates to a higher portfolio Sharpe ratio. This ratio helps investors understand an investment’s return versus its risk.

These results are impressive given 20 years ago the 10-year government bond yield and the RBA cash rate were both above 5%. These starting points are far more favourable to traditional fixed income versus the current 10-year government bond yield of 1.1% and RBA cash rate of just 0.10%.

Private debt complements other exposures

Much like private equity is often considered a core allocation alongside listed equity, private debt is an increasingly popular allocation to complement existing traditional fixed income allocations. The illiquidity premium is one of private debt’s key attributes. Private debt, just like private equity, doesn’t have a liquid secondary market. Liquidity risk needs to be carefully and individually assessed by each investor. Investors suited to this type of investment tend to have a long-term investment horizon and a buy-and-hold approach to this part of their portfolio.

One criticism of this study may be the modelled level of losses is too low. The manager’s ability to add returns is critical, assuming the big four banks’ loan books are a proxy for the market exposure to private debt.

As a soccer team prepares for an unfamiliar opposition each week, it makes sense to include an attacking defender in the line-up. As markets evolve, investors will continue to seek returns that provide genuine diversification in their portfolios. Protecting against downside risk, generating uncorrelated and reliable income, and being prepared to protect against either inflation are also key concerns.

Revolution’s goal is to be the attacking defender in investor portfolios and deliver private debt strategies that solve the need for income with capital protection.

Simon Petris Ph.D. is Senior Portfolio Manager at Revolution Asset Management (ACN 623 140 607 AFSL 507353), a Channel Capital partner. Channel Capital is a sponsor of Firstlinks. This information is not advice or a recommendation in relation to purchasing or selling particular assets. It does not take into account any individual's investment objectives or needs.

For more articles and papers from Channel Capital and partners, click here.