The Factfulness book includes 13 questions at the beginning which you should have completed before reading this, as well as receiving your results. How did you go?

We will provide a full summary of the results from Cuffelinks readers in a couple of weeks, comparing them with Australian and worldwide results.

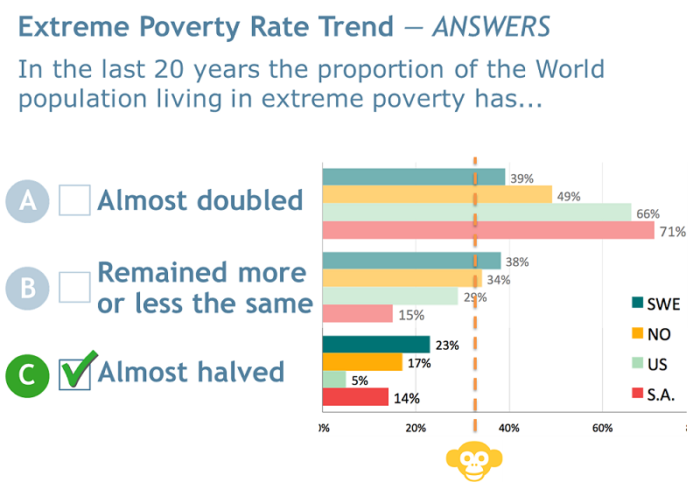

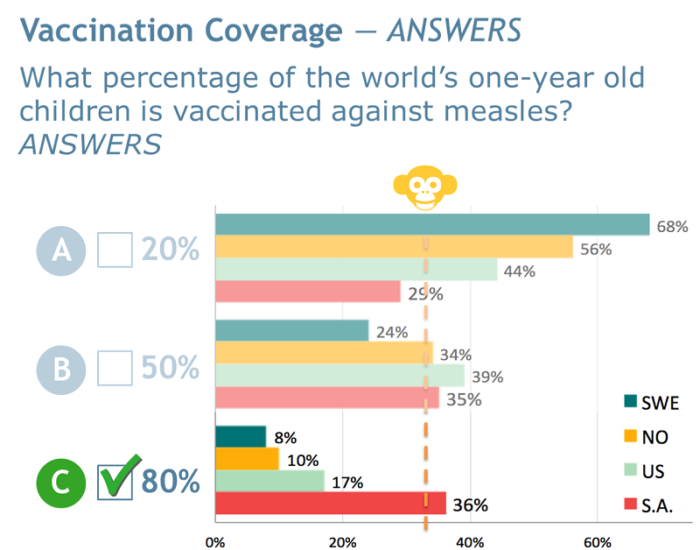

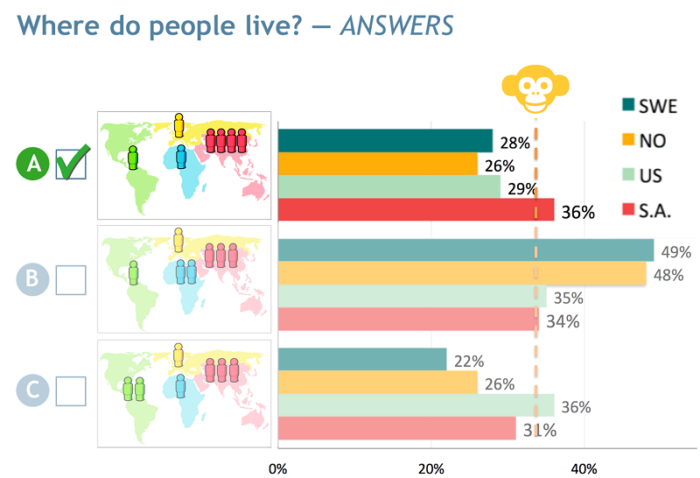

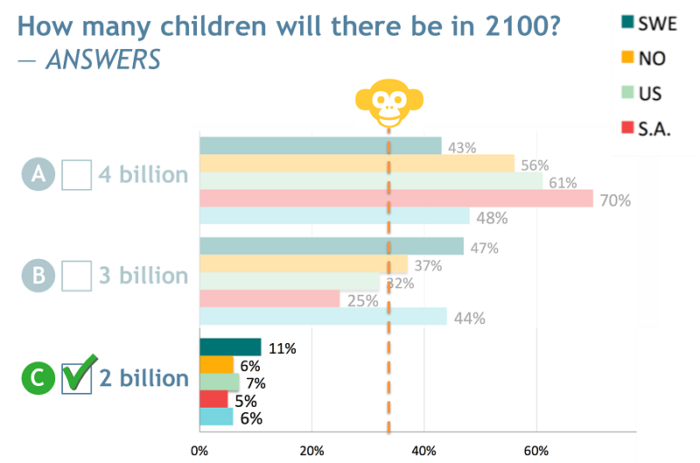

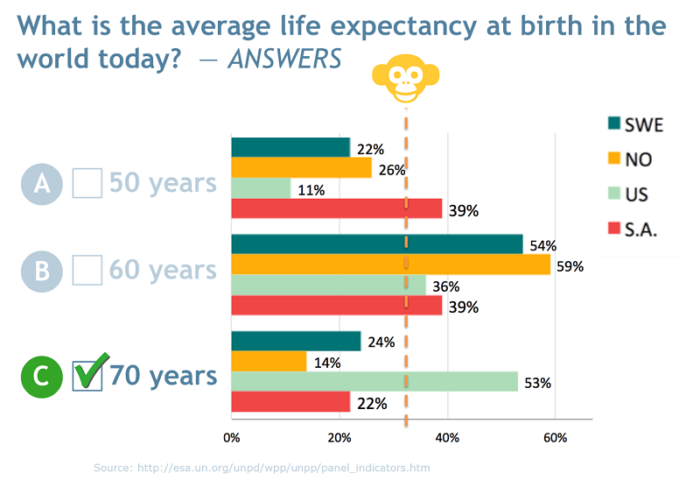

On the Gapminder website where the work of the Rosling family is shared, they include the results for five of the questions by respondents in Sweden, Norway, the US and South Africa.

They also highlight with a chimp logo and a yellow line where a random response would occur, such as with three possible responses, a chimp would average a 33% correct response. The amazing finding is that in most questions in most countries, people do far worse than simple random guesses. We are so badly informed about the world, with such bias built into the way events and numbers are reported, that we perform worse than if we had a blind stab at the answer.

To read each of these charts: the four coloured bars show the proportion of people from each country who selected answers A, B or C, and the darker shading shows the correct answer. For example, in question 1 for the US, 66% of responders said the proportion of people living in extreme poverty has 'almost doubled' in the last 20 years, whereas the correct response of 'almost halved' was recorded by only 5%.

Question 1

Question 2

Question 6

Question 9

Question 11

Look out in a couple of weeks for a report on all the questions, and how we compare with Australia-wide results.