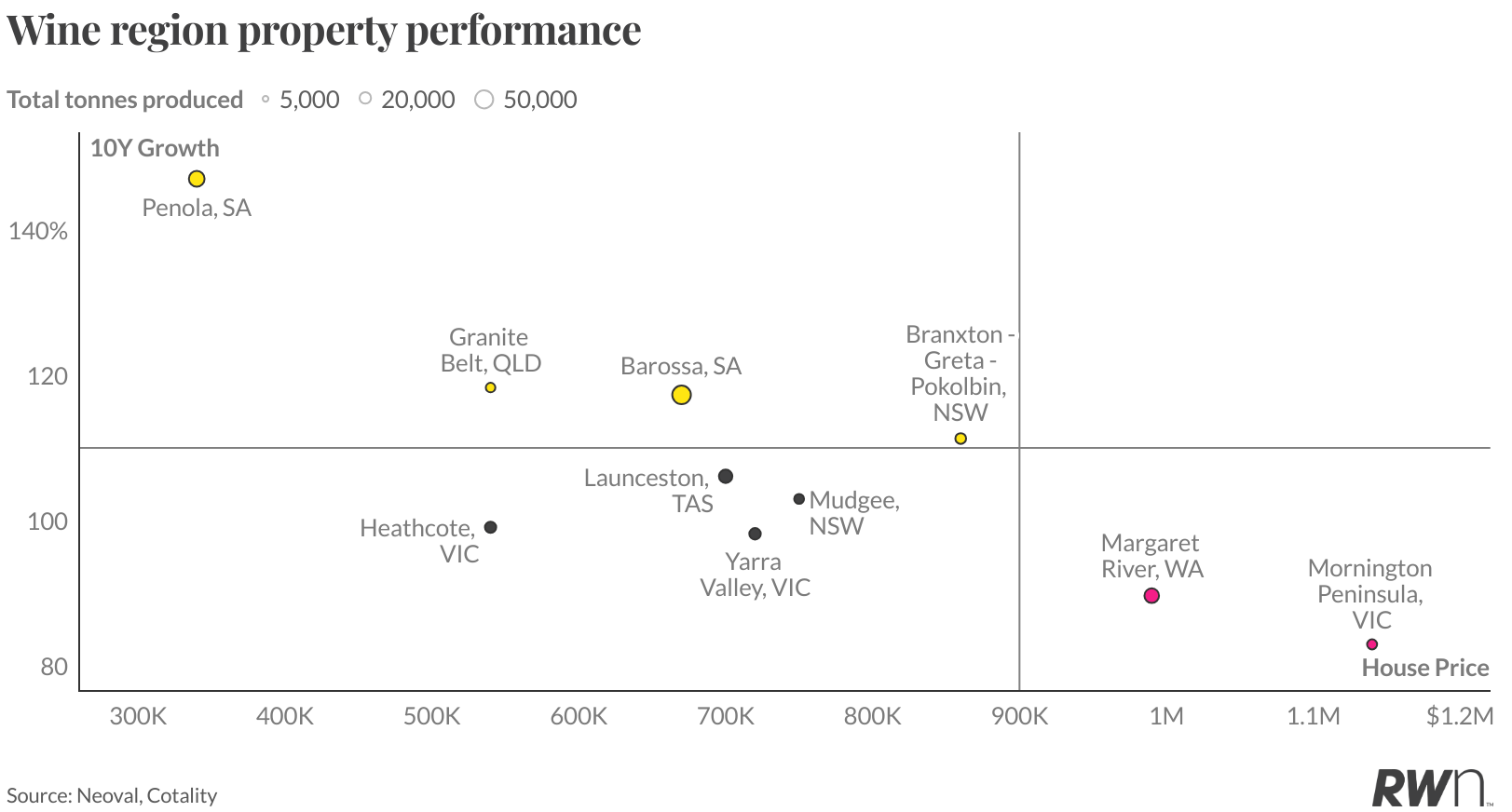

Australia's wine regions present a property paradox: the most prestigious wine areas don't necessarily command the highest prices or strongest growth.

The relationship between wine industry fundamentals and residential property performance reveals that production volume, export economics, and infrastructure investment often matter more than reputation alone.

This production flows through regional communities, creating economic activity that impacts property values, though not always as expected.

The outstanding performers

Penola, SA: Penola serves as the commercial hub for the famous Coonawarra wine region, renowned for premium Cabernet Sauvignon.

The town benefits from the economic activity generated by one of Australia's most respected wine areas without commanding vineyard-adjacent pricing.

Coonawarra's focus on premium reds has benefited significantly from the resumption of China trade, where exports grew from virtually zero to 59 million litres in six months following duty removal.

Granite Belt, QLD: Queensland's high-altitude wine region demonstrates how emerging areas with solid fundamentals can outperform established markets.

The region benefits from accessibility to Brisbane while maintaining authentic wine country character at reasonable price points.

Barossa Valley, SA: The Barossa's substantial production footprint of 53,100 tonnes represents 3.7% of Australia's national crush, supporting diverse economic activity beyond tourism.

This volume creates employment across logistics, processing, and support industries, underpinning consistent property demand.

The region's combination of volume production and premium export positioning has benefited strongly from renewed Asian market access.

Hunter Valley, NSW: Branxton-Greta-Pokolbin represents the heart of the Hunter Valley wine region, combining premium wine production with strong tourism infrastructure and proximity to Sydney.

The 5,635 tonnes crushed in the broader Hunter Valley creates solid economic fundamentals, while the region's established cellar door culture and events calendar support consistent property demand from both lifestyle buyers and tourism-related investment.

The established premium markets

Margaret River, WA: Despite producing wines that contribute significantly to Australia's $3.72 per litre export average, Margaret River's premium positioning may have reached natural growth constraints.

The region's 25,661 tonnes represents just 1.6% of national production, creating a boutique economic base that supports high absolute prices but limits broader economic impact.

Mornington Peninsula, VIC: Australia's most expensive wine region property market shows how lifestyle premiums can reach saturation points.

While the Peninsula commands top prices due to proximity to Melbourne and prestigious Pinot Noir production, moderate growth rates suggest these premiums may have natural ceilings.

The balanced performers

Mudgee, NSW: Mudgee exemplifies successful regional wine area economics, balancing accessibility with wine industry fundamentals.

The region benefits from reasonable distance to Sydney while maintaining authentic agricultural character and growing wine tourism infrastructure.

Heathcote, VIC: Heathcote outperforms the more prestigious Yarra Valley despite lower wine tourism profile, suggesting production fundamentals and infrastructure investment drive better long-term returns than reputation alone.

Yarra Valley, VIC: Despite strong wine tourism credentials and proximity to Melbourne, Yarra Valley's 8,982 tonnes represents just 0.6% of national production.

This limited agricultural scale may constrain broader economic impact compared to regions with more substantial output.

Infrastructure and economic fundamentals

Wine regions require substantial fixed infrastructure that provides economic stability beyond vintage fluctuations.

Australia's wine inventory of 1.96 billion litres represents approximately $5 billion in stored value, demanding warehouses, cellars, and processing facilities that create ongoing employment.

The domestic market absorption of 457 million litres annually, roughly 24 bottles per Australian, provides crucial economic stability for regions with strong cellar door profiles. Vineyard establishment costs between $25,000-$40,000 per hectare, while modern winery construction represents millions in regional investment.

The Tasmanian turnaround

Launceston, TAS: Tasmania's property market has clearly responded to the state's wine industry expansion. With the state recording its second consecutive record crush in 2025 at 18,764 tonnes (up 61% over two years), Launceston's strong 106.1% decade-growth reflects the broader economic benefits flowing from Tasmania's emerging wine reputation and increasing production scale.

The wine-property connection

The data reveals that successful wine region property markets share common characteristics:

- Substantial production volumes creating economic stability

- Strong export exposure benefiting from global wine trade

- Infrastructure investment providing employment beyond agricultural cycles

Regions with pure premium positioning without volume may struggle to generate the broad economic activity that drives sustained property growth.

Conversely, high-volume commercial regions without lifestyle appeal face challenges commanding significant property premiums.

The strongest wine region property performers balance solid industry fundamentals with accessibility to major population centres and reasonable pricing that allows continued growth rather than hitting lifestyle premium ceilings.

Export exposure, particularly to recovering markets like China, provides additional economic momentum that regional property markets clearly respond to.

Vanessa Rader is Head of Research at Ray White Group.