The 2017-2018 financial year was strong for both microcap and small caps indexes. Once again, microcaps significantly outperformed large caps. The S&P/ASX All Ordinaries Accumulation Index returned 13.7% for FY18, a healthy return. In contrast, the S&P/ASX Emerging Companies Index posted a stellar return of 23.2% for FY18, leading to an outperformance of 9.5% for microcaps over large caps in the Australian market.

Standout manager performances

Standout performances from active managers for the year came from microcap vehicles managed by Perennial, Eley Griffiths and Acorn with FY18 returns of 50.2%, 41.9% and 30.6% respectively, all easily outpacing the index and their own selected benchmarks. Given these results are net of all fees it makes them even more impressive as the index has no fees in its performance measure.

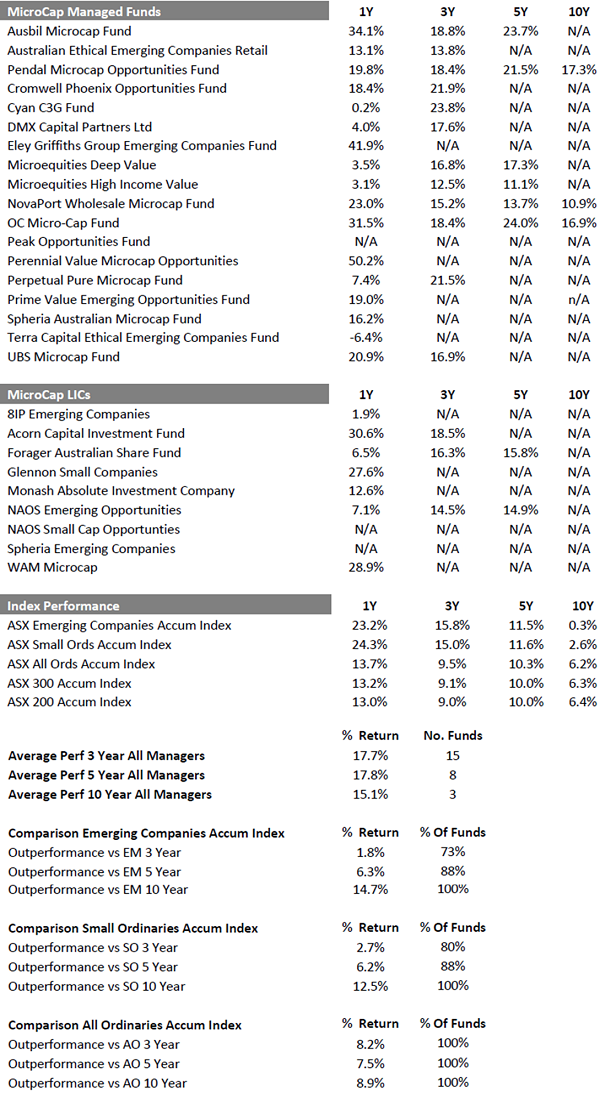

However, as always there are the managers which lagged both the index and their peers for FY18. Managers who struggled in FY18 were 8IP, Microequities and DMX who all delivered low single-digit returns. Now, my usual caveat applies, that no investor should judge a manager on a single year’s performance no matter how positive or negative the performance was. Microcap manager returns vary significantly year-to-year, as shown in the table below.

The table gives the 1, 3, 5 and 10-year returns for fund managers who have such track records. This gives investors some perspective on the longer-term performance record of all managers. It also shows returns for the indexes over similar timeframes.

Click for pdf version

Microcap outperformance versus large caps and ETFs

Over a medium-term time horizon or longer, active microcap managers usually have an excellent track record of delivering alpha (performance above the index) to their investors as can be seen from the data. In addition, they have delivered superior returns versus mainstream index funds and ETFs.

This is continuing evidence that active microcap managers can provide attractive relative and absolute returns to investors. The data also suggests that despite an increase in the number of microcap-focused vehicles that have come to the market in the last three years, microcap managers as a group have been able to provide continued strong performance.

Standout performers over a medium-term 3-year horizon continue to be Cyan, Perpetual and Cromwell, all posting annualised returns in excess of 20%.

The curious case of the microcap benchmark

One of the most curious things about looking at the universe of microcaps managers is the disproportionate use of the S&P/ASX Small Ordinaries Accumulation Index as the benchmark for the funds and performance fee calculations. No fewer than 15 of the 28 vehicles in our universe use this index as its benchmark.

Now some of the funds in our universe could be classed as small cap funds as they straddle the line in terms of the market caps of their holdings. This makes classification a bit of a grey area. However, if we take the Perpetual Pure Microcap Fund, for example, you would think that it would use the S&P/ASX Emerging Companies Index as its benchmark given the name of the fund and its investment strategy and mandate? Yet, it uses the S&P/ASX Small Ordinaries Accumulation Index for its benchmark.

Indeed, just two funds in our universe use the S&P/ASX Emerging Companies Index as their benchmark. Now, I am not saying one benchmark is better than the other but it is curious that so many funds use a benchmark which in name at least is perhaps not the most relevant or appropriate for the fund's strategy and mandate. This is perhaps something investors current or prospective can query with the relevant managers to getter a better understanding as to why one was selected over the other.

Mark Tobin is a Senior Analyst at Independent Investment Research.