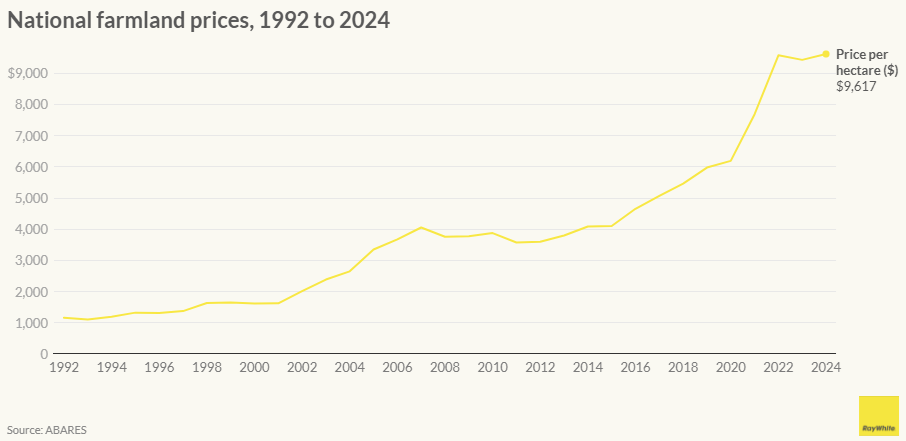

Australia's farmland price boom has hit the brakes. After explosive growth that saw national agricultural land values more than double since the pandemic began, prices have essentially plateaued at around $9,600 per hectare, marking the end of one of the most dramatic rural property cycles in Australian history.

The numbers tell a compelling story of a market that has fundamentally shifted. Where 2021 and 2022 delivered annual growth rates of around 25%, 2024 managed just 2% nationally. It's a dramatic deceleration that signals rural property markets are entering a new phase characterised by regional divergence rather than uniform national growth.

This plateau comes despite continued strong agricultural commodity prices and relatively favourable seasonal conditions across much of Australia. The traditional drivers of farmland demand haven't disappeared, but new dynamics are reshaping how the market operates.

Transaction volumes have collapsed to their lowest levels, with just 2,258 rural properties changing hands in 2024 compared to averages above 4,700 annually in the mid-2010s. This suggests low levels of distress - no one is being forced to sell. But also lower levels of buy demand.

The global economic uncertainty that has characterised 2024 and early 2025 appears to be influencing rural property decisions. Farmers and investors who might previously have transacted are holding off, creating an unusual combination of price stability and market paralysis.

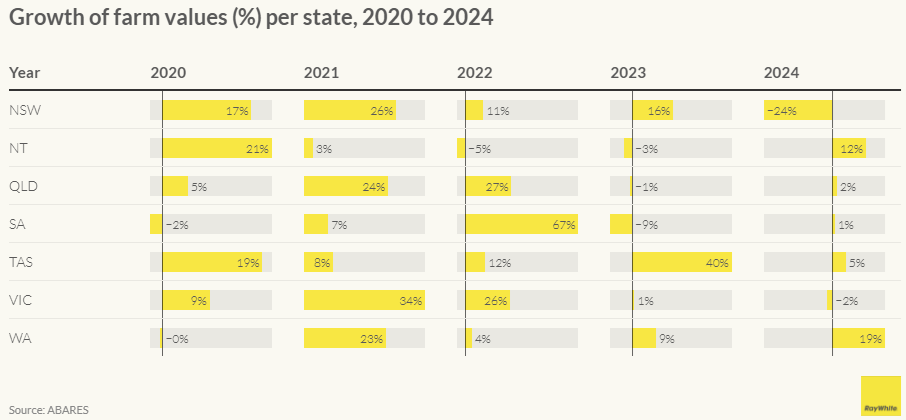

States chart dramatically different paths

While national figures show flattening, state-level data reveals the Australian agricultural land market is fracturing along regional lines. Western Australia bucked the national trend with robust 18.7% growth in 2024, while New South Wales experienced a sharp 24.4% correction that wiped out much of its recent gains.

While house prices have stalled in Tasmania, the same cannot be said for agricultural land. Tasmania continues to command Australia's highest rural land prices at over $18,000 per hectare. The Northern Territory, by contrast, remains Australia's most affordable rural real estate at just over $5,000 per hectare, though even it managed 11.9% growth in 2024.

These divergent paths suggest local factors - from mining activity to lifestyle migration patterns - now matter more than broad national agricultural trends. Australian farmland prices are no longer moving in a unified manner, instead shifting according to local market conditions.

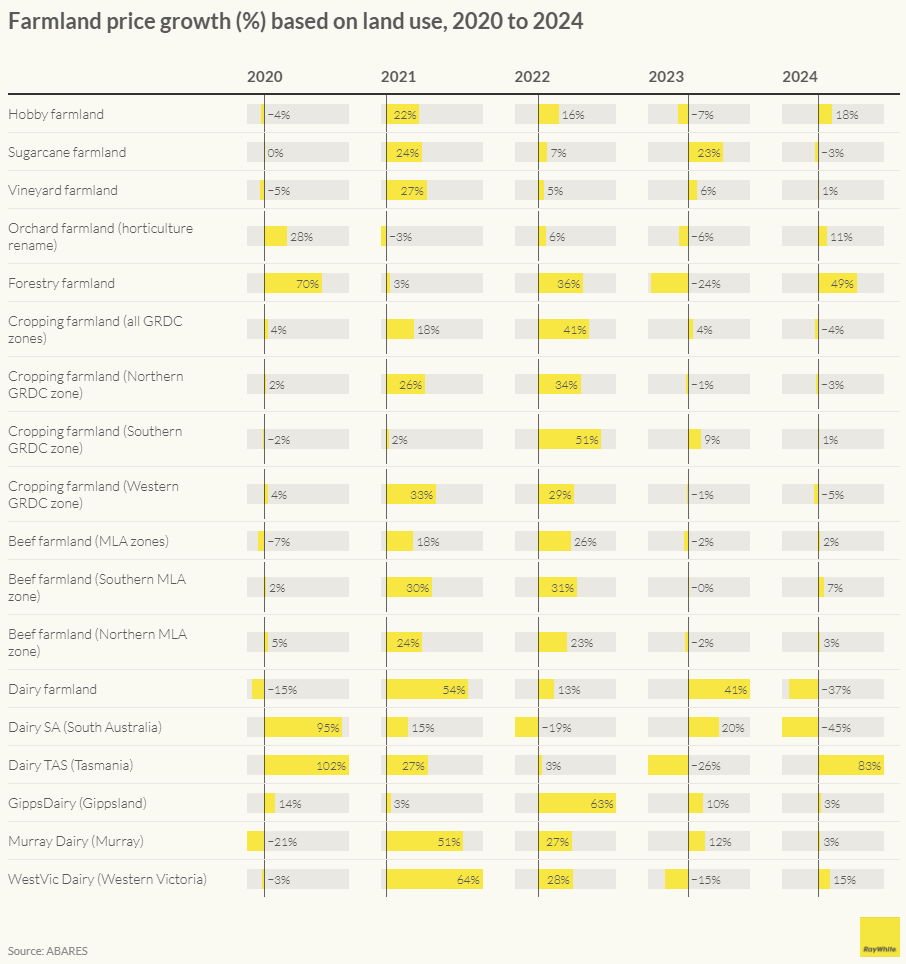

Land use tells the real story

Perhaps the most revealing insights come from examining different agricultural land uses, where 2024 delivered some genuinely surprising outcomes. Dairy farming, traditionally one of Australia's most stable rural sectors, experienced extreme volatility with growth rates ranging from plus 83% in Tasmania to minus 45% in South Australia. The decline in South Australia is being driven by drought conditions in this state. The result in Tasmania is more surprising as this state is also experiencing drought however it may reflect fewer transactions, and perhaps slightly better weather conditions.

Forestry emerged as 2024's standout performer with 48.6% growth, reflecting increasing investor interest in carbon farming. Meanwhile, traditional cropping land declined 3.8% nationally, suggesting the sector may be entering a more challenging phase after years of exceptional returns.

The hobby farming sector continues to command extraordinary premiums, with prices exceeding $229,000 per hectare – a reflection of ongoing lifestyle migration trends and the premium city residents will pay for rural amenity.

What happens next?

Australian agriculture is undergoing structural change. Carbon farming, for example, is creating new sources of land value. In addition, the uniform national growth story that characterised the pandemic period appears to have ended, replaced by a more complex landscape where local fundamentals drive outcomes. For now, it appears to be at an inflection point. Prices may have stopped rising rapidly, but the lack of transaction activity means fewer options for buyers. This holding pattern is likely to continue for a while longer however ongoing interest rate cuts are likely to create more opportunities for both buyers and sellers.

The timing of this shift will largely depend on how aggressively the Reserve Bank cuts rates and how quickly agricultural commodity prices respond to global economic conditions. Ongoing geopolitical tensions and supply disruptions globally continue to support agricultural commodity prices, which should underpin farmland values even as transaction volumes remain subdued. If rates fall meaningfully over the coming months, we could see transaction volumes recover well before prices resume their upward trajectory.

Nerida Conisbee is Chief Economist at Ray White.