In dozens of meetings over the past four years, I’ve learnt a lot about how family offices and institutional asset allocators (that is, groups that aggregate funds and make investment decisions on behalf of individual clients) think when picking external fund managers. While no two asset allocators are the same and certainly no two family offices are alike, there are often similarities. After the small talk, the first questions from the potential investors are a good marker of how they think.

The common and hidden questions

The first questions from family offices are typically ‘what are your returns?’ and ‘what are your fees?’ The hidden question is ‘do you make money for your clients or just for yourself?’ Family offices are looking for managers who have a track record of meaningfully outperforming their benchmark and charge competitive fees. If you don’t have these, you aren’t going to be part of their asset mix and you may as well leave at that point.

The first questions at meetings with institutional asset allocators are different. The most common questions are ‘what are your funds under management?’, ‘how many clients do you have?’ and ‘what systems do you use?’ Here the hidden question is ‘if you underperform will our peers underperform as well?’ The most important filters for many institutions are what their peers are doing and their career risk, not the product itself. There’s often a checklist of unspoken milestones that fund managers need to meet before asset allocators will consider investing with them.

Checklists are a good thing. I use them when making investment decisions to see if I’ve covered the key risks. Having a checklist and using it when making decisions relating to fund managers is a good thing too – it’s something investors in Bernie Madoff’s Ponzi scheme undoubtedly wish they’d used. The key questions to ask about fund manager checklists are; ‘why are things on the checklist?’ and ‘what is the outcome on returns and fees as a result of using the checklist?’ If using the checklist means you end up investing with managers that deliver low returns and charge high fees, you are buying the packaging, not the product.

Emerging managers often disqualified

In the US, it is common for pension funds to run publicly advertised tenders to select asset managers. This is great for competition, with the benefits flowing through to asset allocators and their beneficiaries. Tenders allow for asset allocators to specify what they want including milestones. Asset allocators often specify that proposed fees will have a substantial weight in determining fund manager selection. This helps drive down the fees, albeit at the risk of discouraging some high return/high fee funds from tendering.

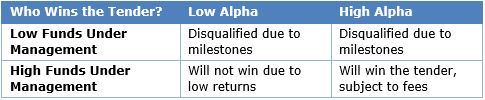

However, the required milestones may disqualify a substantial number of high return/low fee fund managers. This often comes by specifying a high threshold for minimum funds under management or a minimum number of other pension funds that are already clients. The two diagrams below help explain the issue. Firstly, here’s the outcome of the tender for fund managers based on their funds under management and ability to generate alpha.

Managers with both high funds under management and high alpha generation (excess returns) will win the tender. If the focus is solely on fees, an index fund is likely to win. Emerging managers will either not submit or will be disqualified due to the required milestones.

Good managers closed to new investments

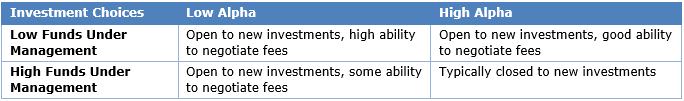

The next matrix shows the reality of the funds management industry when it comes to negotiating fees and terms.

The bottom right hand corner is where everybody wants to invest. As a result, managers that have both high funds under management and high alpha are typically closed to new investments and in some cases may be giving capital back to their investors. Existing investors who ask for lower fees are likely to be reminded of the waiting list or to have their capital returned.

For fund managers that have both high funds under management and high alpha and that continue to accept new investments, their returns will suffer. Eventually, they will migrate to the low alpha column as their size will impede their ability to take advantage of market mispricings. Asset allocators with high milestone thresholds are essentially limiting themselves to these fund managers. This means consigning themselves and their beneficiaries to managers with lower returns and medium-to-high fees, or to index funds.

Early-stage investing

This is where family offices and non-traditional asset allocators can outperform traditional asset allocators. By looking for managers with high alpha but low funds under management they can achieve high returns with reduced fees. The more enterprising investors will also look for seed opportunities, where a share of the equity or a royalty stream of the fund manager is granted in return for allocating a game-changing mandate to an emerging manager. Early-stage investing also gives investors priority access to the fund manager when their funds are large enough that closing the fund or returning some of the invested capital is required.

Conclusion

The different approach to investing by family offices and institutional asset allocators can be categorised as focussing on the product or the packaging. By focussing on the product, family offices and non-traditional asset allocators look for emerging managers that can deliver high returns as well as lower fees. By focussing on the packaging, traditional institutional asset allocators are often limited to investing with lower return, higher fee managers or with index funds.

Jonathan Rochford is Portfolio Manager at Narrow Road Capital. Comments and criticisms are welcome and can be sent to [email protected]. This article has been prepared for educational purposes and is not a substitute for tailored financial advice. Narrow Road Capital advises on and invests in a wide range of securities.