During the COVID-19 pandemic, the Australian major banks (the Majors) significantly increased their loan loss provisions and allowed customers to defer loan repayments, but to date their actual loss experience has been minimal.

The open question is to what extent loan losses will materialise in 2021, as the Government unwinds its economic support measures.

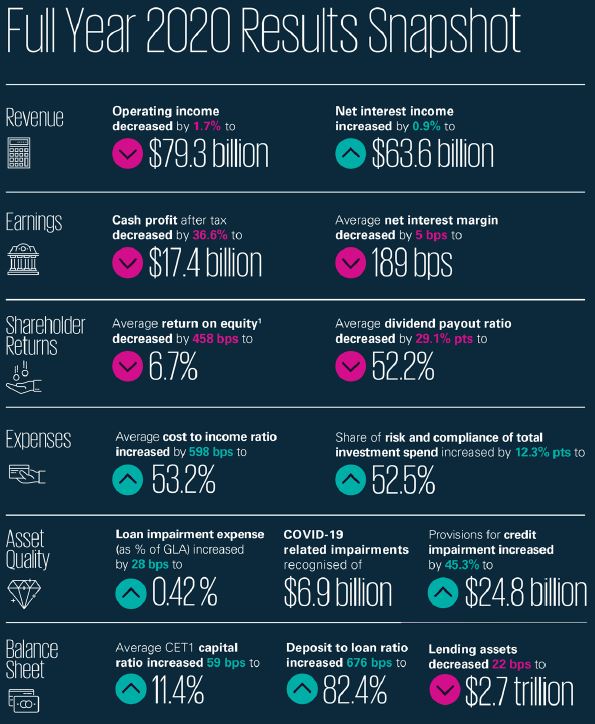

Key highlights

The Majors reported a cash profit after tax from continuing operations of $17.4 billion in FY20, down 36.6% on FY19. The profit fall was a function of a number of factors, including some large, notable items like restructuring costs associated with divestments as well as ongoing regulatory and remediation costs. It was also negatively impacted by rising loan impairment charges and credit provisions, in advance of an expected deterioration in the economy as Government support comes to an end.

The average net interest margin (cash basis) saw continued compression, decreasing 5 basis points compared to FY19. Declining net interest margin (NIM) was driven by repricing of deposits, mortgages and business lending assets amidst RBA rate cuts and increased competition in the market. Excess liquidity from an inflow of deposits also hurt margins. However, the Majors benefited from favourable wholesale funding pricing in the second half of the year.

Cost-to-income ratios have increased from an average 47.2% to 53.2%, in large part driven by rising IT related expenses which included higher costs associated with mobilising their workforces for remote working conditions and higher software amortisation charges. In addition, one of the Majors reported significant items relating to regulatory matters.

Excluding these, average cost to income ratio increased by 177 basis points to 45.2%, with increases reported for each Major.

Aggregated loan impairment expenses increased by 201% to $11.2 billion, coming off a historically low provision base at the end of FY19. This increase reflects the Majors expecting higher loan losses and customer defaults as a result of the pandemic, and continued uncertainty in the economic outlook. As a result, total provisions increased to $24.8 billion, providing a significant buffer for potential future losses.

While the actual loss experience has been modest to date, a big question for FY21 is to what extent loan losses will materialise as the Commonwealth government unwinds its economic support measures.

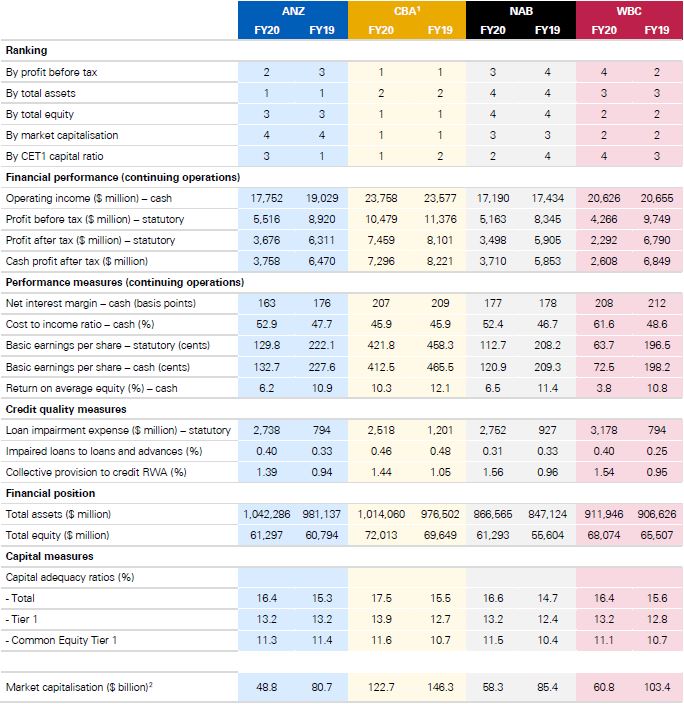

Financial performance and Tier 1 capital

The Majors have maintained a strong Common Equity Tier 1 (CET1) ratio capital position of 11.4%, increasing 59 basis points from FY19. This result has been driven by prudent capital management, and decisions to reduce dividends in line with current APRA guidance, which saw the dividend payout ratio reducing to 52.7% from 81.3%. Westpac and NAB additionally reported a $2.8 billion and $3.5 billion capital raising respectively earlier in the year. While regulators have provided guidance to the banks that in current conditions it would be acceptable to temporarily reduce their capital ratios, it appears that the Majors have preferred the safety of strong balance sheets heading into an uncertain FY21.

The focus on balance sheet strength and reduced profitability has continued to impact returns on equity (ROE), which decreased 458 basis points on the prior comparative period to an average of 6.7%. As the Majors continue to focus on supporting customers, investing in the necessary transformation and maintaining strong balance sheets, shareholder value creation will be an important challenge in upcoming years.

The ‘resilience’ in bank balance sheets

Whilst Australia has fared favourably compared to other developed economies, the impacts are still pronounced and are reflected in the Majors’ FY20 results.

The Majors offered temporary loan repayment deferrals to mortgage and SME lending customers, since the onset of COVID-19 in Australia. Large numbers of borrowers, representing significant loan volumes, have taken up these offers. Due to government support measures (especially the JobKeeper and JobSeeker payments), the Majors have seen the number of borrowers on deferral arrangements come down from their initial levels.

Against this trend, provisioning levels have continued to increase as the economic outlook becomes clearer. Loan loss models built upon historical loss experiences have proven inadequate in the face of current levels of uncertainty, resulting in the Majors applying increased judgement in estimating their credit loss provisions (including significant management overlays).

It should be noted the Majors’ loan provisions are still well below those seen in many other countries. There is an expectation that Australia may avoid a loan loss fallout compared to what could be experienced in other countries, given our economic outlook, greater success in managing the spread of the virus and lower risk portfolios which have favoured secured residential lending.

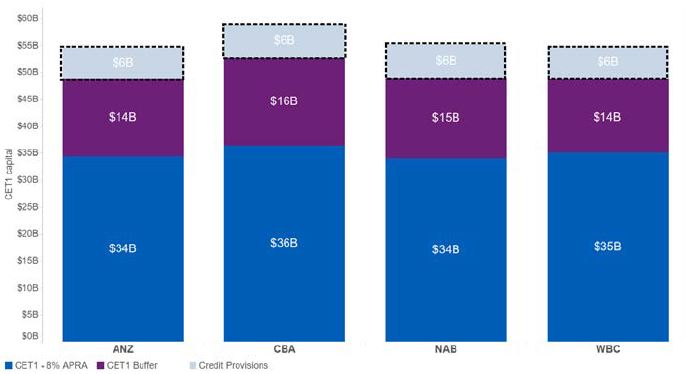

Despite the sharp decline in profitability, the Majors have continued to strengthen their balance sheets and maintain substantial capital buffers to position themselves for any potential future shocks. Capital levels are at record levels and their capital ratios continue to be in excess of APRA’s requirements despite regulatory guidance to temporarily relax ‘unquestionably strong’ targets where needed to continue lending to customers.

Diagram 2: CET1 buffer

Source: KPMG analysis from ANZ, CBA, NAB, WBC annual reports.

Investors have borne the brunt of lower ROEs and the Majors' decisions to reduce payout ratios to below their pre-COVID levels in line with current APRA guidance. It remains to be seen when higher payouts will be restored, as the Majors continue to focus on maintaining financial and operational resilience.

The search for new efficiencies

Aggregated operating income declined 1.7% in FY20 to $79.3 billion, reflecting the slowdown in lending and continued downward pressure on interest margins. At the same time, costs have continued to increase as a result of operational resilience measures, customer remediation expenses and regulatory costs. The outcome is that cost-to-income ratios inclusive of significant items for most Majors have now climbed above 50%.

The Majors are challenged to find earnings growth to aid their recovery. One area where increasing activity has been observed is in partnering with and acquisitions of Fintechs to help them more quickly digitise processes, launch new products and services and build new business models. Recent examples have included the CBA-Klarna and Westpac-Afterpay tie-ups.

Outlook

On a global level, whilst significant uncertainty still exists with key economies where cases of the virus are still prevalent or increasing, financial markets have been able to withstand the initial liquidity challenges of the crisis. In Australia, the Majors have held substantially higher levels of capital and liquid assets compared to prior crises which has positioned them well to absorb significant shocks.

The cash rate and interest rate charged under the Term Funding Facility (TFF) programme is now only 10 basis points (0.10%). This, coupled with the estimated $100 billion quantitative easing programme announced, eases the pathway to recovery with the Majors benefiting from cheap funding sources.

Much of the initial government’s and banks’ response to the crisis has focused on preserving liquidity and their attention is now shifting to the solvency of borrowers as support measures (such as JobKeeper and JobSeeker) and loan repayment deferrals (in some cases extending out to March 2021) come to an end.

It will be important for the Majors to continue monitoring the loan deferral situation and in particular providing support for customers in hardship situations. Whilst a number of these customers may become delinquent at the end of the relief period, the Majors have significant buffers to absorb potential losses.

The following KPMG staff have made a significant contribution to the development of the full report: Danny Pang, Matthew Newell, Jonathan Tan, Hugh McMicking, Sharmani Krishnan, Nadira Dantan, Eileen Li, Shruti Hegde, Tony Kong. A copy of the full report is available here. See the report for full disclaimers. This summary is general information and does not consider the circumstances of any person.