We have been living through an extraordinary period of economic stability, characterised by low but stable global growth and fueled by central bank largesse, persistently low or even negative interest rates and a seemingly insatiable appetite for risk assets. Given this extended period of economic expansion, and multi-year strong credit performance, the question arises as to where we are in the credit cycle and whether current valuations warrant further outperformance.

The credit cycle: a primer

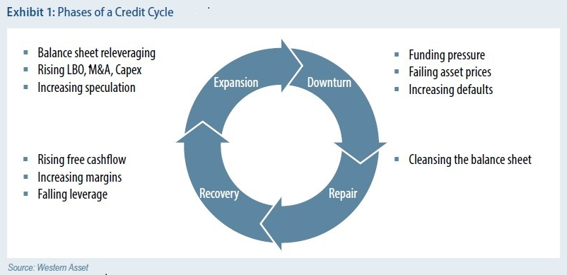

Credit cycles are generally considered to have four distinct phases: expansion, downturn, repair and recovery (Exhibit 1). All credit cycles ultimately end in a downturn. While this outcome is inevitable, the timing of transition from expansion to downturn is not and the turning points are never easy to predict. Credit cycles do not die of old age. They do, however, tend to follow the direction of the broad economy and are typically presaged by a turn in economic conditions, tightening lending standards and heightened funding costs. As the availability of capital falls, and the cost of servicing debt increases, defaults rise as companies that had over-levered in the good times struggle to meet financial obligations under the weight of excessive debt loads and falling revenues.

The Australian economy continues to defy gravity

Australian economic conditions remain conducive to a continuation of the current credit cycle. GDP growth currently sits at 3.1%, with the Reserve Bank of Australia (RBA) forecasting growth of 3% and 3.25% for 2018 and 2019, respectively. Growth remains well balanced and supportive for domestic companies. Business conditions remain robust. Unemployment is stable and sits at 5.6% with ample spare capacity, and inflation remains below the RBA’s target band of 2-3%.

If there is a downside to this picture, it is clearly the consumer. Household debt-to-income has risen exponentially, wages have stalled (recording a cumulative growth rate of 0.2% in real terms since 2012) and savings rates continue to fall. Key risks remain in the housing market, with the rise in investor and interest-only loans.

The active use of macro-prudential regulations by the Australian Prudential Regulation Authority (APRA) has been successful in reducing the risks of the housing sector overheating albeit risks still remain. The RBA is cognisant that households remain susceptible to any significant upward shifts in monetary policy and has subsequently been reluctant to raise the cash rate above the low of 1.5% set in August 2016. We do not see any obvious driver for this policy setting to change in 2018.

Australian corporates remain in good health

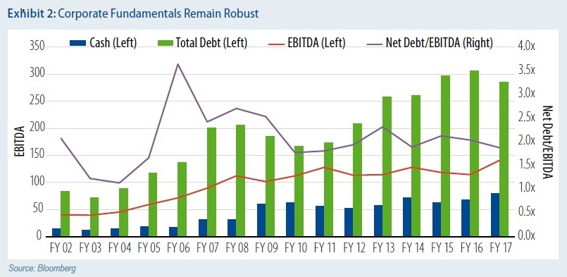

Corporate Australia is coming from a position of relative strength. The latest corporate earnings season has shown a continuation of this trend with improved revenue, stronger earnings and a slightly more optimistic outlook. Gearing ratios generally remain towards the lower end of target ranges (or below) and debt coverage ratios remain healthy (see Exhibit 2, based on ASX 100 companies (ex-financials), equally weighted). To date, corporate treasurers have tended to be well behaved, with returns to shareholders via dividends and buybacks being largely credit neutral.

A deeper look into the balance sheets of many Australian corporates highlights that their treasurers have become more prudent in the management of their debt profile post-GFC. An historical reliance on short-term bank funding has given way to more balanced approach, with treasurers actively smoothing out and extending their debt profile and increasing their use of debt capital markets.

A deepening domestic bond market now provides companies with the opportunity to raise debt funding out to 10 years (up from five years pre-GFC). Australian corporates are now in a stronger position to deal with potential reductions in capital availability from any one source.

Technical tailwinds continue to support spreads

Global quantitative easing, changing demographics and excessively loose monetary policy have driven an insatiable appetite for risk assets as investors hunt for yield globally. While the process of normalisation has begun, it will be gradual, and we expect high demand for income-producing assets to continue.

Additionally, corporate issuance is likely to fall for the remainder of 2018 and into 2019. Refinancing requirements for 2018 is expected to be the lowest in Australian credit markets since 2013, with only a slight pickup in 2019. Additionally, modest growth CAPEX requirements and to date, limited debt funded corporate actions, should also act to curb any significant supply of corporate issuance into the domestic market place.

Australian valuations

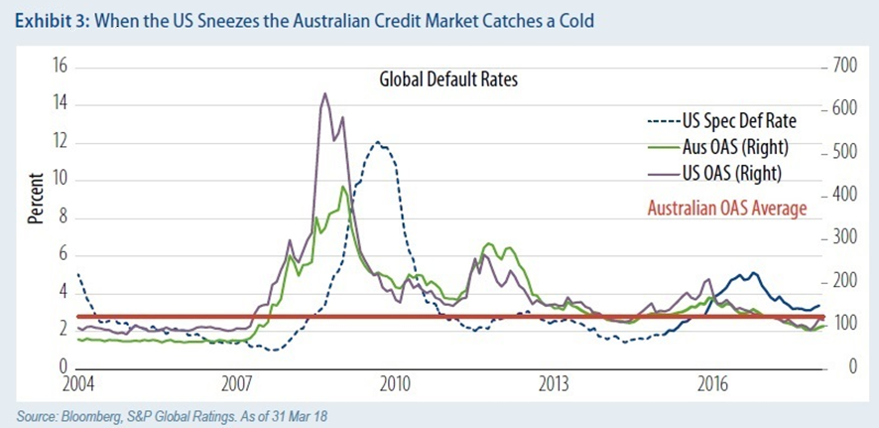

Domestic credit spreads tend to display lower volatility than global peers due to Australia being a strong investment-grade market with a much shorter duration than global markets. It remains the case, however, that regardless of the domestic economic outcomes and the relative strength of corporate Australia, the performance of our credit market is largely dictated by movements in offshore, and in particular US, markets. Historically, there has been a strong correlation between US speculative grade default rates and AUD corporate spreads (Exhibit 3). This relationship is no more evident than during the GFC, when Australian spreads widened significantly, in spite of there being neither a domestic economic recession nor a subprime housing sector. Domestic credit markets remain global by nature. Approximately 50% of the value of the Australian corporate bond market is issued by global companies. Additionally, Australian institutions derive much of their funding from offshore markets, particularly the major banks.

Where to from here?

Absent any exogenous shocks to the system, we do not see an imminent threat to the current credit cycle, either globally or domestically, for the remainder of this year.

Australian spreads have come in a long way since the GFC and are now sitting slightly below long-term averages. While we believe that we are being adequately compensated for default risk at these levels, there is limited upside from taking on too much risk. The cycle is in its later stages, and we feel that domestic credit spreads will be largely range-bound for the remainder of this year. Global bouts of volatility will remain a key driver of domestic spreads.

We continue to stay invested in credit, but prefer to focus on those sectors that offer stability of cashflows, in particular infrastructure, utilities and property. While the banking sector clearly has its problems, globally banks remain on sound footing and we are happy to accumulate as valuation opportunities arise.

Investing in shorter-dated credit will act to minimise any volatility that may occur as the market slowly moves towards the turning point in the cycle. In this environment, bottom-up analysis is key. Avoiding companies that have exposure to more cyclical parts of the economy (i.e., exposure to retail in an environment of a stressed consumer) will serve portfolios well. This focus on the fundamentals will also continue to drive our tactical positioning across portfolios as we look for opportunities to invest in primary issuance that offer excess premiums and also take advantage of any short-term technical volatility that may result in mispriced investment opportunities in the secondary market.

Damon Shinnick is Portfolio Manager / Senior Research Analyst, Fixed Income and Credit at Western Asset Management, a Legg Mason affiliate. This material is issued by Legg Mason Asset Management Australia Limited. This article is for information purposes only and reflects the current opinions of Western Asset Management. It has been prepared without taking into account the objectives, financial situation or needs of any individual.

Legg Mason is a sponsor of Cuffelinks. For more articles and papers from Legg Mason please click here.