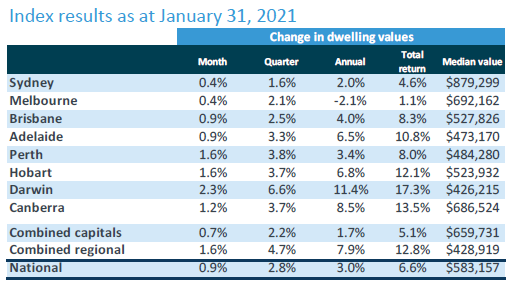

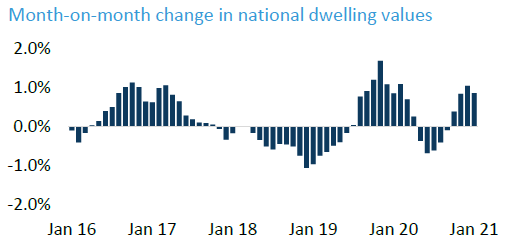

Housing values continued to rise through the first month of 2021 with CoreLogic’s national home value index up 0.9% over the month. The January movement takes Australian home values to a fresh record high. Housing values have surpassed pre-COVID levels by 1.0%, and the index is 0.7% higher than the previous September 2017 peak.

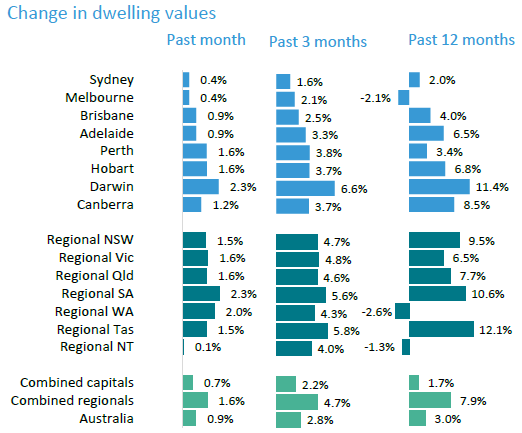

Every capital city and broad rest-of-state region recorded a rise in housing values over the month, ranging from a 2.3% surge across Darwin to a relatively mild 0.4% rise in Sydney and Melbourne.

Regional doing well

Continuing a trend that became evident early in the pandemic, regional housing values rose at more than twice the pace of the capital city markets. CoreLogic’s combined regionals index was up 1.6% over the month, while capital city values were 0.7% higher. Since the onset of COVID-19 in March last year, regional housing values have surged 6.5% higher while capital city housing values are down -0.2% over the same time frame.

The largest states are seeing regional home values rising at more than three times the pace of their capital city counterparts. Home values across Regional Victoria and Regional New South Wales rose 1.6% and 1.5% respectively in January compared with a 0.4% increase in home values across Melbourne and Sydney.

According to CoreLogic’s research director, Tim Lawless, the divergence between metro and regional housing demand in New South Wales and Victoria is more substantial than in other states.

“Internal migration data shows more people are leaving Sydney and Melbourne for regional areas, resulting in a transition of activity from the metro regions to the outer fringe and regional markets. This demographic trend is further compounded by the demand shock of stalled overseas migration. As Melbourne and Sydney historically receive the vast majority of overseas migrants, these metro areas have been the hardest hit by this demand shock.”

“Better housing affordability, an opportunity for a lifestyle upgrade and lower density housing options are other factors that might be contributing to this trend, along with the new found popularity of remote working arrangements.”

Houses over units

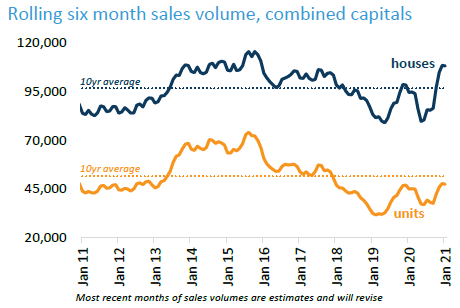

Another broad trend that is becoming increasingly evident is the outperformance of houses over units. At a national level, house values have risen by 3.5% over the past six months while unit values are unchanged. More recently, the past three months has seen every capital city record a stronger result for houses over units. Mr Lawless said:

“Demand for units has diminished through COVID-19 amidst record low levels of investor participation and changing living preferences. At the same time supply levels are heightened in some precincts. While demand and supply remain imbalanced we are likely to see units continue to underperform relative to detached housing markets.”

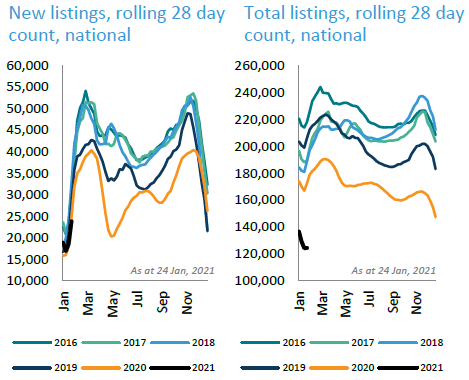

The rise in housing values is occurring against a backdrop of low advertised supply and rising buyer activity. Inventory levels started 2021 in a tight position. The number of fresh listings added to the market nationally over the four weeks ending January 24th was 3.3% lower than the same period a year ago and 13.3% below the five-year average.

Melbourne and Perth were the only capital city markets to buck the trend, with new listings 20.8% higher than a year ago in Melbourne and 2.2% higher across Perth. “Melbourne vendors may still be playing catch-up from the earlier lockdown period, while in Perth vendors seem to be relishing the best selling conditions seen in many years,” Mr Lawless said.

Although fresh stock being added to the market is close to the same levels a year ago, total advertised inventory started the year around record lows. Nationally, total listing numbers, which include new listings plus re-listed properties, were 27.8% lower than this time last year, tracking 29.3% below the five-year average. Melbourne was the only city to record total listing numbers that were higher than last year, up 7.7%.

Another factor impacting available housing supply has been a strong rate of absorption from rising home buyer activity, especially in the detached housing space. CoreLogic estimates the number of national home sales over the past three months was 23.9% higher than the equivalent three-month period from a year ago. The volume of regional home sales was estimated to be 26.8% higher than a year ago while capital city sales were up 22.1%.

On the latest estimates, the volume of capital city house sales were 11.8% above the decade average over the past six months while the volume of capital city unit sales were rising but remained 8.1% below the decade average. Advertised supply levels are low while demand is strong.

New listings and buyer numbers growing

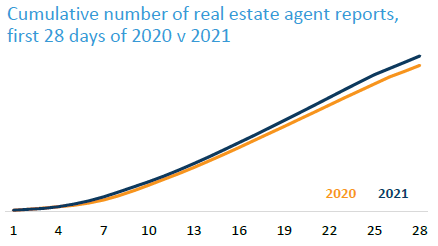

Some early indicators suggest that new listing numbers are set to outpace levels from a year ago. Real estate agent activity across CoreLogic’s RP Data platform is up 6.5% over the first 28 days of January compared with the same period in 2020.

However buying activity is also ramping up, with the number of mortgage related valuations already 27% higher than a year ago across CoreLogic’s Valex valuation platform. “At the moment, despite our expectation of a lift in new listing numbers, buyer demand is still outpacing new stock additions. If this trend persists, the rapid rate of absorption is likely to keep overall stock levels low resulting in further upwards pressure on housing prices,” said Mr Lawless.

Recovery in apartment rents, especially Perth and Darwin

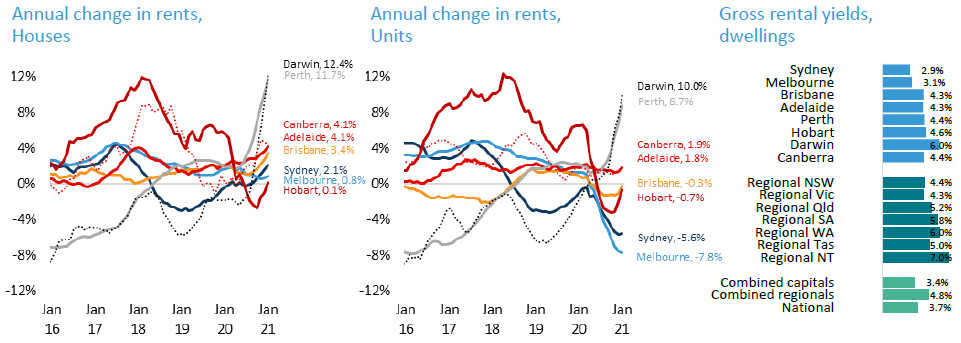

The rental market dynamic has changed substantially through COVID but there are some early signs that weakness across the unit sector is starting to level out, if not turn around.

Rental demand has transitioned towards detached and lower density housing markets since the pandemic, partly reflecting the disruption to rental demand from overseas migration, but also the stress of changed working conditions, caused by COVID restrictions, in industry sectors that are traditionally more aligned with rental demand. Additionally, with more people working from home, demand for larger housing options has lifted.

Unit rents in Melbourne and Sydney are down 7.8% and 5.6% respectively over the past year, but in some positive news for landlords, the rate of decline is easing across these markets; in fact Sydney unit rents posted the first month-on-month rise in January (+0.8%) since March last year and Melbourne unit rents held firm over the month.

Part time job numbers have now fully recovered back to pre-COVID levels and more businesses are embarking on a return to work program which could be helping to support renewed demand towards inner city rental accommodation. Additionally, with rental rates now lower for inner city units, improved rental affordability could be attracting more people back to inner city renting.

Geographically, Perth and Darwin stand out with the largest rental increases. The annual lift in house rents is well into double digit territory while unit rents are also posting strong gains. The strong rental conditions in these regions comes after a long run of falling rents and low levels of investment activity. The result is extremely tight rental supply at a time of rising demand, while affordability is relatively healthy due to the sustained fall in rents between 2013 and 2018. Despite the substantial lift in Perth and Darwin rents over the past year, the median rental rate in Perth is still $90/week lower than the 2013 peak, and Darwin rents remain $145/week below their previous record high in 2014.

Summary of the good start to 2021

Overall, the January results from CoreLogic show the housing market has started the year on a firm footing, setting the scene for further price rises throughout the year.

Low interest rates have been a key factor in supporting the housing market recovery. Mortgage rates are likely to remain at record lows for the foreseeable future, with little chance interest rates could rise this year. This is because inflation and unemployment are still a long way from reaching the RBA’s objectives of full employment and returning the annual inflation rate to the target range of between 2 and 3%.

New headwinds for the housing market could be seen in the form of tighter lending policies, however a trigger for another round of macroprudential intervention is not apparent. A rise in lending activity regarded as ‘riskier’, such as higher proportions of interest only lending, loans with high debt or loan value to income ratios and loans to borrowers with small deposits, could be the catalyst for a tightening in credit rules.

The most significant risk to housing markets remains further outbreaks of the virus. The recent series of outbreaks, and subsequent border closures and restrictions through late December and January, had an immediate negative impact on consumer sentiment.

Tim Lawless is Executive, Research Director Asia Pacific at CoreLogic. Read or download the full report here. This article is general information and does not consider the circumstances of any investor.