Part 1 of this storycontained a brief outline of government debt – both domestic and foreign - and various ways in which governments can avoid repaying their debts in full, through default, restructure and/or inflation. We also looked at the level of Australian government debt compared to the current government debt crisis, and how it compares to Australia’s debt level today.

In Part 2,we looked at how Australia’s big default and debt restructure occurred, which bond holders were rescued, and which were forced to take a ‘haircut’ on their interest and principal repayments.

Here, in Part 3, here we look what it meant to bond investors, including the returns achieved by bond investors before, during and after the debt default and restructure. We will focus on returns to local investors on domestic Australian debt since they were the ones directly affected.

We see that money was made for bond holders, and even those who hung on and were hit with the ‘haircut’ restructure.

Returns were good for patient investors

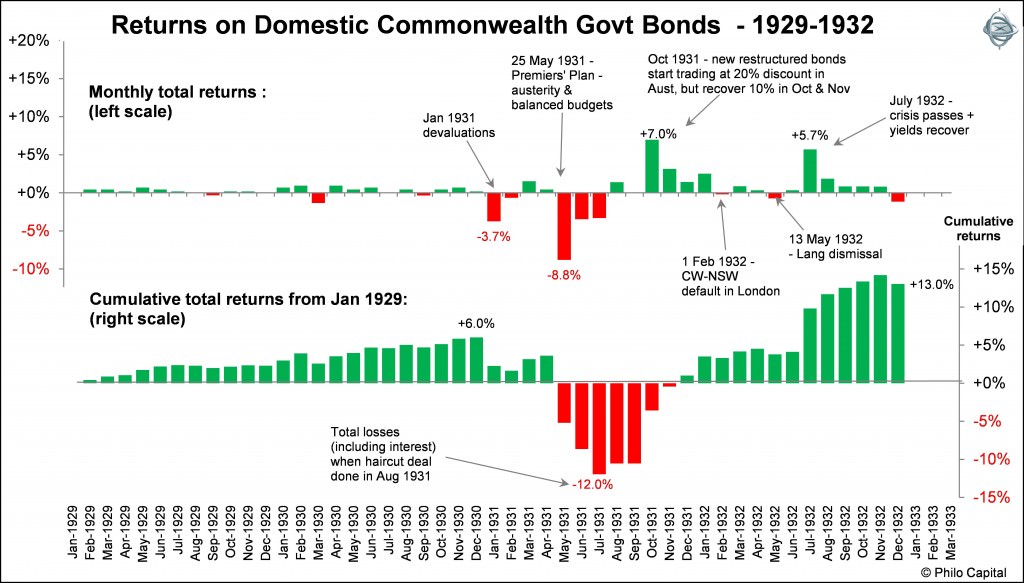

The first chart shows monthly returns (top section) and cumulative returns (lower section) on domestic long term Commonwealth bonds from the start of 1929 to December 1932.

Bonds returned 13% in total over the four years, made up of 19.3% from total interest payments minus a 6.3% capital loss.

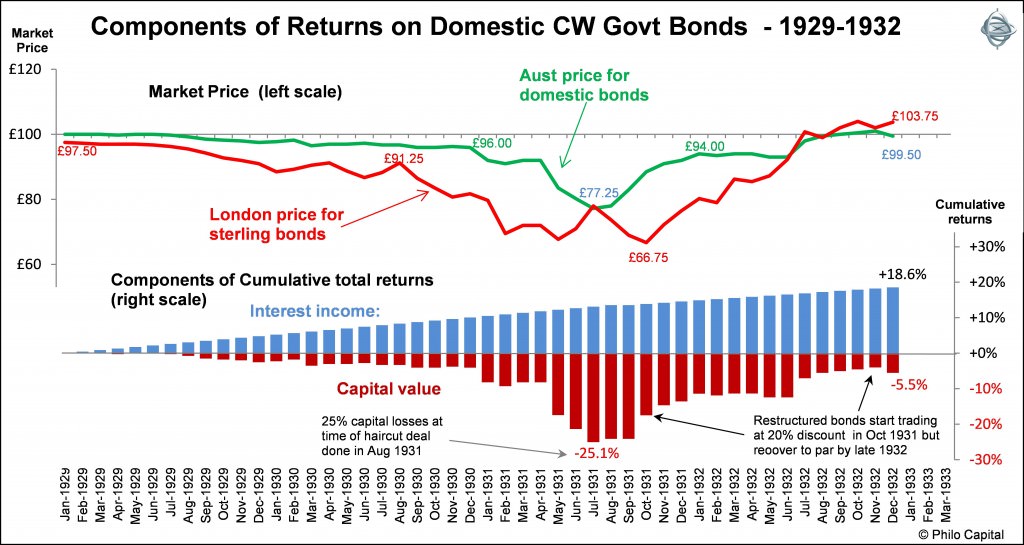

The next chart shows prices for long term bonds in both markets: domestic bonds in the Australian market (green line) and foreign bonds in the London market (red line). The lower section shows cumulative returns from interest on domestic bonds (blue bars) and cumulative capital value (red bars).

Patient investors who held onto their bonds, took the haircut deal, bought new replacement bonds, and then held them until the end of 1932, would have achieved total returns (i.e. interest plus capital gains/losses) of 13%.

A 13% total return over a 4 year holding period doesn’t sound very good, but after inflation (or deflation actually) it amounted to a healthy 30% real return because consumer prices had fallen by 17% over the period, and wages had fallen by around 10%. In terms of the real spending power of investors’ money after inflation, the 30% return over 4 years equated to 6.8% per year compound return after inflation. Not a bad return for patient investors, even after the default and restructure in 1931-1932.

A major contributor to the good returns was the fact that the new replacement bonds did not sell for par at auctions. They were sold at significant discounts to par because investors were still nervous about the government’s ability to service even the new lower interest payments. These discount purchase prices contributed to good returns as market prices quickly rose back up near par during 1932 as confidence returned and yields declined from crisis levels.

Winners and losers

On the other hand, investors who bought domestic 10 year bonds in December 1930 when yields were an attractive 6.4%, and then sold out in the panic in July 1931 when and the government was talking about default and bond prices had crashed 20% from £96 to £77, with yields soaring to nearly 13%, would have lost 18% on their investment.

Likening this to the current European debt crisis, investors who lend money to Greece at 100 cents in the dollar before the crisis (mainly European banks) and then panic sold in early 2012 at less than 20 cents in the dollar before the restructure was announced, would have lost 80% of their money. These were permanent losses. The big winners in Greek debt were the numerous hedge funds that bought up Greek bonds from the panic sellers at prices as low as 15 cents in the dollar in early 2012, and then doubled their money when the old bonds were exchanged for new bonds an average of around 33 cents.

There are winners and losers in all markets. Even when governments default on their debts there is money to be made by investors who resist the temptation to panic sell in a crisis (and also resist the temptation to panic buy in a boom for that matter).

In Part 4 we will look at the returns from the broad stock market versus the government bond market during the crisis. We see how the impact of the Greece-like default and restructure of government bonds affected bond returns, compared to the impact of the 1929 crash had on share returns.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund.