Almost every fridge in Australia contains some form of dairy product, and dairy is one of Australia’s top agricultural industries. Yet few investors have direct exposure to dairy farms, even while dairy farms offer a ‘real asset’ alternative with low correlation to other investments.

Dairy was worth $6.2 billion in 2024, according to the ABS, placing it as Australia’s third largest agricultural commodity behind only beef and wheat.

Sure, investors can get some exposure to dairy by investing in listed product manufacturers. But dairy farms provide an opportunity to invest right at the source, via an unlisted, less volatile alternative for investors, which includes potential for capital appreciation of the underlying farmland.

Dairy also brings greater consistency of income. Many agricultural businesses farming grain, horticulture or livestock often only have one crop/offspring/produce for sale yearly, which can be impacted by weather events such as hail, floods or commodity price movements. In contrast, dairy cows are milked every day, with a committed minimum annual milk price that provides more control over performance, and lower impact from isolated weather events.

While milk sales are hugely important, dairy farms behave similarly to other traditional commercial property investments, such as retail or industrial property, as an investment. Except rather than derive cashflow from rents, owned and operated dairy farms receive cashflow from dairy production, with potential for unrealised capital growth from the farmland itself.

Historically, capital growth for dairy farmland has proven significant.

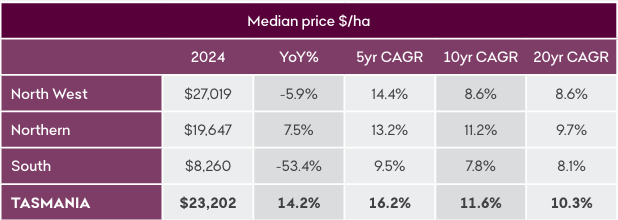

For example, Tasmanian dairy farmland, some of the best available (and most expensive) in the country, has grown by an average annual rate of 10.3% over the last 20 years, according to the Bendigo Bank Farmland Values Report for 2025.

Source: Bendigo Bank Farmland Values Report 2025

The report shows another great dairy region, Southwest Victoria, has seen farmland appreciate by an average annual rate of 9.6% over the last 20 years, making farmland in these areas one of the top performing asset classes over the last 20 years.

It’s worth noting reported farmland values can fluctuate year-to-year, as average prices are often influenced by relatively few sales. A long-term view provides a clearer picture, and with an appropriate gearing level these returns can be amplified.

As with other commercial property, there is a high barrier to entry, and compiling your own portfolio of dairy farms is a stretch for all but the wealthiest investors. The starting cost for buying a farm directly would be $5 million or above, plus costs for livestock and equipment. Hence diversification into dairy or agriculture is out of reach for most investors.

Investors can access dairy assets via Dairy Trusts, similar to how investors access industrial or retail properties which would otherwise be out of reach.

Dairy consumption shows resilience to cost-of-living pressures

A lift in domestic dairy consumption combined with a decline in dairy production is creating favourable fundamentals supporting Australian dairy.

The bad old days of the supermarket milk price wars are behind us, and it’s hard to see another price war starting up since the landmark Dairy Code of Conduct was introduced on 1 January 2020.

The Code is a significant policy which governs how processors deal with farmers and is enforced by the ACCC. All dairy trade must now comply with the Code.

It has brought greater clarity including a minimum milk price, which is determined each year in June. Importantly, there is no maximum milk price for the year. Once the floor price is set, the dairy price can move higher: processors increased the farmgate milk price during the 2024-25 and 2025-26 seasons, following positive industry momentum.

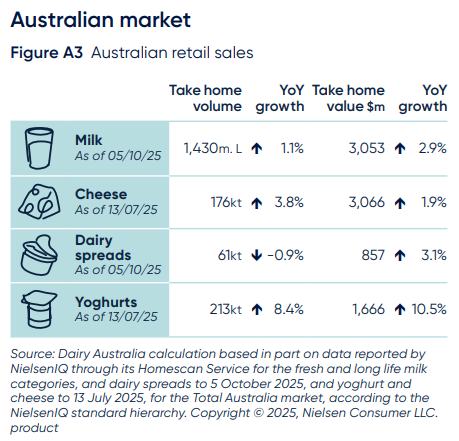

Recent trends show consumer resilience has defied cost-of-living pressures. Dairy Australia’s Situation and Outlook report for Year-end 2025 showed strong growth in sales value across all four dairy products (milk, cheese, yoghurt, and butter) over the last year:

Source: Dairy Australia Situation and Outlook Report Year-end 2025

Seeing an uptick in dairy consumption, at a time when many households have been cash-strapped, shows underlying resilience in the dairy market.

Meanwhile, Rabobank’s Global Dairy Quarterly, released September 2025, said a marginal fall in Australian milk production has influenced higher farmgate milk prices, with prices already around 10% higher than last year’s closing dairy price.

If we consider the big picture, there has been a long-term fall in the local dairy supply: over a 20-year period, Australia’s national milk production fell from approximately 11 billion litres to 8 billion litres. Australia now needs approximately 70% of its national milk production to satisfy domestic consumption.

Global demand and tariffs

Demand for dairy products continues to grow globally. The International Dairy Federation projects a potential shortfall in global dairy production of 30 million tonnes by 2030 based on current consumption trends.

Rabobank has also confirmed a 12% uplift in the value of Australian dairy exports in the last 12-months.

President Trump’s trade tariffs are not expected to have a material impact on Australian dairy, and its possible retaliatory tariffs on US dairy from Australia’s key export partners (e.g. China) would be positive for local producers.

The US announced a 10% tariff on Australian Dairy commencing April 2025, but this should have little material impact given the US market accounts for just 0.6% of Australia's total dairy exports, and it ranks as our 20th largest export destination.

China is a more significant market for Australian dairy producers: Australia exported 185,466 tonnes of dairy products to Greater China in 2024 and there are currently no tariffs from China on Australian dairy.

Location, optimisation key for mitigating risks

Any agricultural product may experience seasonal fluctuations due to weather conditions, and dairy is not immune. Location is hugely important, and Australia’s most valuable and productive dairy land is in high rainfall areas.

But sometimes even these areas experience unusual weather conditions, and two of Australia’s most dependable, high-rainfall dairy areas in southwest Victoria and northwest Tasmania experienced record dry conditions during 2024 and early 2025.

While we can’t control the weather, dairy farmers have some control over how they manage their resources. Farms with the ability to irrigate can mitigate the worst effects of dry periods. But good management and decision making to drive performance is most important.

An ‘own and operate’ structure, whereby one entity owns and manages the dairy farms, creates various efficiencies. It is more appealing as an investment by combining returns from both operational performance and the underlying capital growth of the farmland, something not achieved through investing in listed downstream dairy processors.

Dairy farms which control these common risks are set up to produce competitive returns over the longer term, adding something different to investor portfolios.

While dairy may face short-term challenges from time-to-time, over the longer term several fundamentals suggest this is an alternative investment to watch.

Harrison Stewart is a Senior Investment Analyst, Alternative Investments at Prime Value Asset Management, which offers a Dairy Trust fund.