Normally when I write articles, I try to minimise the technical jargon. However, this article is about the new tax on superannuation contributions, commonly referred to as the ‘Division 293 tax’, and I encourage you to use the same terminology.

At a recent meeting of SMSF professionals, there were many reports that clients were complaining about this law after receiving a ‘surprise’ tax assessment from the Australian Taxation Office (ATO) requesting payment due in 21 days. Before I explain all the nuts and bolts of this law, let me explain its purpose.

What is a Division 293 tax?

Division 293 tax is an additional 15% tax imposed on relevant concessionally taxed superannuation contributions (referred to as low tax contributions) made to superannuation funds (including SMSFs) by individuals whose income exceeds $300,000.

It has been easy to forget this law. It was originally announced in the 2012 Federal Budget as a “Reduction of the higher tax concession for contributions of very high income earners” and at the time wasn’t actually referred to as the ‘Division 293 tax’. The law did not pass until 28 June 2013 and while the commencement date was backdated to 1 July 2012, assessments only started being issued from January 2014.

The purpose of the law

The average income earner’s marginal income tax rate is 32.5% (excluding the Medicare Levy). Superannuation contributions made for the benefit of the individual are taxed at 15%, effectively giving them a 17.5% tax concession. By contrast, very high income earners pay 45% tax on income over $180,000, effectively giving them a 30% tax concession. Division 293 tax applies an additional 15% tax to certain concessional contributions effectively diluting the 30% concession to 15%, in line with the concessions received by average income earners.

Income and contributions included in the $300,000 threshold

An individual will be liable to pay Division 293 tax if the sum of their income plus their low tax contributions exceeds $300,000. The ATO will use the following information from income tax returns:

- taxable income (assessable income less deductions)

- total reportable fringe benefits amounts

- net financial investment loss

- net rental property loss

- amounts on which family trust distribution tax has been paid

- superannuation lump sum taxed elements with a zero tax rate (because it falls within the low rate cap amount).

These elements are added together (except the superannuation lump sum amount, which is subtracted) to give the income amount.

To calculate an individual’s low taxcontributions, the ATO will use the following information:

- employer contributed amounts

- other family and friend contributions

- assessable foreign fund amounts

- assessable amounts transferred from reserves

- notional employer contributions, known as defined benefit contributions, when the fund is a defined benefit superannuation fund.

The above contributions are concessionally taxed within a superannuation fund. For Division 293 tax purposes they are known as low tax contributed amounts, and are equal to the low tax contributed amount minus excess concessional contributions. Therefore, low tax contributions do not include non-concessional contributions and concessional contributions that are subject to excess concessional contributions tax.

Division 293 tax of 15% will be charged on an individual’s concessional contributions above the $300,000 threshold (up to the concessional contribution caps). There are special rules for members of defined benefit superannuation funds, constitutionally protected state higher level office holders, certain Commonwealth justices and temporary residents who departed Australia.

Division 293 tax calculation and assessment

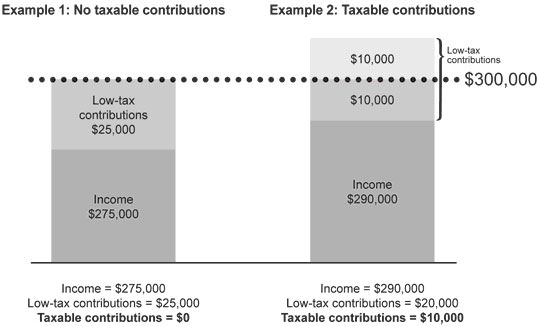

To calculate the Division 293 tax liability, the ATO will:

- Add the individual’s income and low tax contributions.

- Compare the amount from step 1 to the $300,000 threshold to identify any excess above the threshold.

- Compare the low tax contribution amount and the amount from step 2. Take the lesser of the two amounts, which then become the taxable contributions.

- Apply a 15% tax rate to the taxable contributions.

The following graphic, taken from the ATO’s website, illustrates how the calculation works. In example 2, the amount of Division 293 tax payable would be $1,500 ($10,000 x 15%).

The Division 293 tax notice of assessment will state the total earnings for tax purposes, the taxable contributions and the amount of Division 293 tax that is due and payable by a set date which is generally 21 days after the ATO’s notice of assessment was issued.

Individuals are responsible for paying their Division 293 tax. The following payment options are available:

- pay the assessed tax out of their own monies

- pay the assessed tax and then seek reimbursement from their fund, or

- pass on the notice of assessment to their fund using a release authority to have their fund pay the tax on their behalf.

Using a release authority

Individuals can send a release authority to their superannuation fund or SMSF to have the money released. They can choose to have the entire amount or a partial amount released from one fund, or partial amounts released from a number of funds. To do the latter, photocopies can be made and presented to each superannuation fund, as long as there is an original signature on each photocopy and the total amount noted for release does not exceed the amount of the Division 293 tax. Released amounts can be paid to either the individual or directly to the ATO.

General Interest Charge (GIC)

Regardless of how one chooses to pay the tax, if the whole amount is not paid by the due date (21 days after the notice is issued), a general interest charge will start to accrue.

The ATO acknowledges that where a release authority is used, there may be timing issues as superannuation funds are allowed 30 days to process authorities. In these circumstances, the ATO will take this into account when considering applications for remission of GIC accrued during the superannuation fund’s processing period.

Monica Rule worked for the ATO for 28 years and is a specialist SMSF adviser. Monica is running SMSF seminars at the Perth Convention and Exhibition Centre on 7 May 2014.