Many writers of opinion pieces have discussed what tapering of the Federal Reserve’s (Fed) Quantitative Easing (QE) might mean for investment markets. This article looks at the more basic questions: what is ‘QE’ and what does ‘tapering’ mean?

QE is not ‘printing money’. They are close cousins, so don’t hang, draw and quarter anyone for confusing them, but they are different in some important ways. Printing money happens when governments run deficits and central banks simply create the cash that governments spend in excess of revenues without the need to issue government bonds. This is also called ‘monetising the deficit’. Central banks are not currently doing this. QE is in fact independent of the budget deficit and in theory could be undertaken even if the budget was in surplus.

However, the context in which QE has been implemented is a budget deficit. This is how it works.

The budget deficit is funded by the sale of bonds to the market. Money is thus taken out of the economy as the private sector pays for these bonds. However, central banks put money back in, by purchasing long dated assets from the market. These assets include, but aren’t limited to, government bonds. For example, the Fed in the US has also bought residential mortgage-backed securities, while the Bank of England bought some corporate bonds.

This is where the Q part of QE comes in. The instrument of the policy is to buy a pre-announced quantity of assets. Currently the Fed is targeting US$85 billion per month. The target quantity of assets is bought at the market price. By standing as a large source of demand, the intention is to increase the price (reduce the yield) of these assets compared to what it would otherwise have been, but with QE a specific yield is not set by the central bank.

Signs of success

The evidence suggests that central banks have been successful in this goal. Dr Min Zhu, the Deputy Managing Director of the International Monetary Fund, said in a speech at the Australian Business Economists conference held on 21 November that the impact in the US has been a 1% reduction in long bond yields. He put the impact in the UK at 0.5%.

Therefore, QE changes the composition of private sector assets. Banks hold less in bonds and more cash. Unless the private sector actually boosts its borrowing or spending by putting the cash to work, the funds invested by the central bank will just sit in bank reserves. The increased money supply doesn’t automatically mean that there is more lending in the economy. This is one of the reasons the Fed included mortgage-backed securities in its QE program, as that provided a more direct policy support to the beleaguered housing sector in the US. However, overall it is up to the private sector to decide how QE transmits to the broader economy.

Although QE is called ‘unconventional’ monetary policy, buying bonds from the market is not unusual at all. The main difference from what central banks do when they are easing policy in normal times is simply that they have a quantity target rather than a yield target.

In normal times, central banks go to the markets to buy short term securities in order to drive the cash rate lower. This is the conduct of open market operations. When the cash rate approaches zero, as it has in most Western economies, this cannot reduce money market rates any further. However, by QE, central banks try to reduce yields across the maturity spectrum. Lower long term yields are an incentive to the private sector to borrow more or to invest in riskier assets.

The intention of easy monetary policy, whether conventional or not, is to create stronger economic growth without generating excessive inflation. There is always a debate about whether policy is being run ‘too easy’, but the underlying growth rate of many economies – the US, UK, Japan and others – has been so weak, and the risk of inflation so low, that their central banks have chosen to provide additional support beyond zero cash rates.

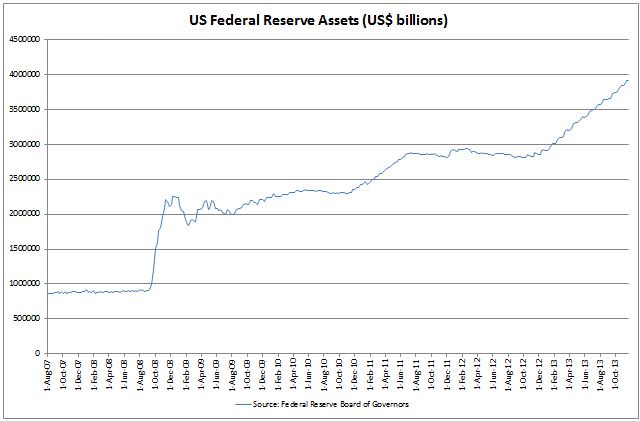

The other difference from open market operations is that QE results in an increase in the central bank’s balance sheet. The assets of the Fed have increased dramatically since the commencement of QE, as the following chart shows:

The first surge was in late 2008 when they purchased mortgage-backed securities. For a brief time in mid-2010 QE was stopped, but when the economic data continued to be weak the Fed announced in August 2010 that it would buy US$600 billion of Treasury bonds by June 2011. This second round became known as QE2.

Continued economic underperformance led to a step-up in the programme, this time leaving its size open-ended. QE3 was initially US$40 billion of securities per month, and then was increased to the current US$85 billion in December 2012.

Unwinding QE

At some point, when economic recovery is more self-sustaining, QE will need to be wound back. What will that involve?

Step 1 is tapering. This is simply a reduction in the quantity of assets that are purchased. The Fed believes, rightly in my view, that tapering is not the adoption of tight policy. It is reducing the amount of stimulus, but even a reduced program of QE is still providing liquidity to the private sector. The Fed has indicated that its judgment about how rapidly to taper the programme will depend on the performance of the economy.

Step 2 is a decision about what to do with the enlarged balance sheet once purchases cease. Will they simply let bonds run off and allow the balance sheet to return to a more normal size gradually? Or will they actively sell bonds out of their portfolio to reduce the balance sheet more quickly? Either way, it will take a long time before the Fed’s assets returns to ‘normal’. Dr Zhu from the IMF suggested a timeframe of at least 10 years.

Many analysts fear that the unwinding process will be disruptive. Some use emotive imagery, likening financial markets to a drug addict dependant on QE, and the unwinding process to the pains that an addict experiences when they start to kick their habit.

While that sort of language is over the top, there is no doubt that past episodes in which easy monetary policy has been turned around have seen higher bond yields and weaker equity markets. It’s understandable that many forecasters see markets behaving the same way when QE ends.

However, when forming your own view on the outlook for market, I hope you’ll keep in mind that QE is really only a form of easy monetary policy. A lot of the hyped-up commentaries you see around the place seem to suggest it is a dark art that has introduced all sorts of abnormalities into the world economy and that it can only end in tears. I hope that this article has put QE into a more sober perspective.

Warren Bird was Co-Head of Global Fixed Interest and Credit at Colonial First State Global Asset Management until February 2013. His roles now include consulting, serving as an External Member of the GESB Board Investment Committee and writing on fixed interest, including for KangaNews.