Over the past couple of weeks I have been bombarded by calls and emails about Bitcoin. The usual stuff, such as, “The price just has doubled! Should I buy some?” My response is the same as always, “Of course not! You want buy something before it doubles, not after! Anyway, are you an investor or a gambler?”

It reminded me of the last time people got themselves into a frenzy about Bitcoin when the price shot up rapidly in December 2013, before collapsing. And the time before that when it shot up in March-April 2013 before collapsing.

On those prior occasions, the outcome was the same. Late-comers to the party jumped on the bandwagon too late and suffered big losses when the bubble burst. They got despondent, licked their wounds, admitted defeat and sold out, only to kick themselves when they missed out on the next bubble!

The pattern of behaviour is the same in every bubble, whether it is Bitcoin, shares, flats off the plan, tulips or even garlic (yes, there was a garlic price bubble in China recently!).

It’s hard-wired into human nature, the fundamental tendency to get sucked into buying frenzies in the hope of making a quick buck. To follow the crowd and panic buy at the top of booms, then to panic sell in the busts that follow.

But Bitcoin is interesting for other reasons. It is an alternate form of currency that has been around since only 2009. It has many advantages over paper money. Supply is limited, you bypass the banks, it is global, and transactions are anonymous (hence it is the currency of choice for drug dealers and cyber ransom attacks like the ‘WannaCry’ virus last month). Many thousands of retailers are now accepting Bitcoin as a form of payment and the trend is accelerating.

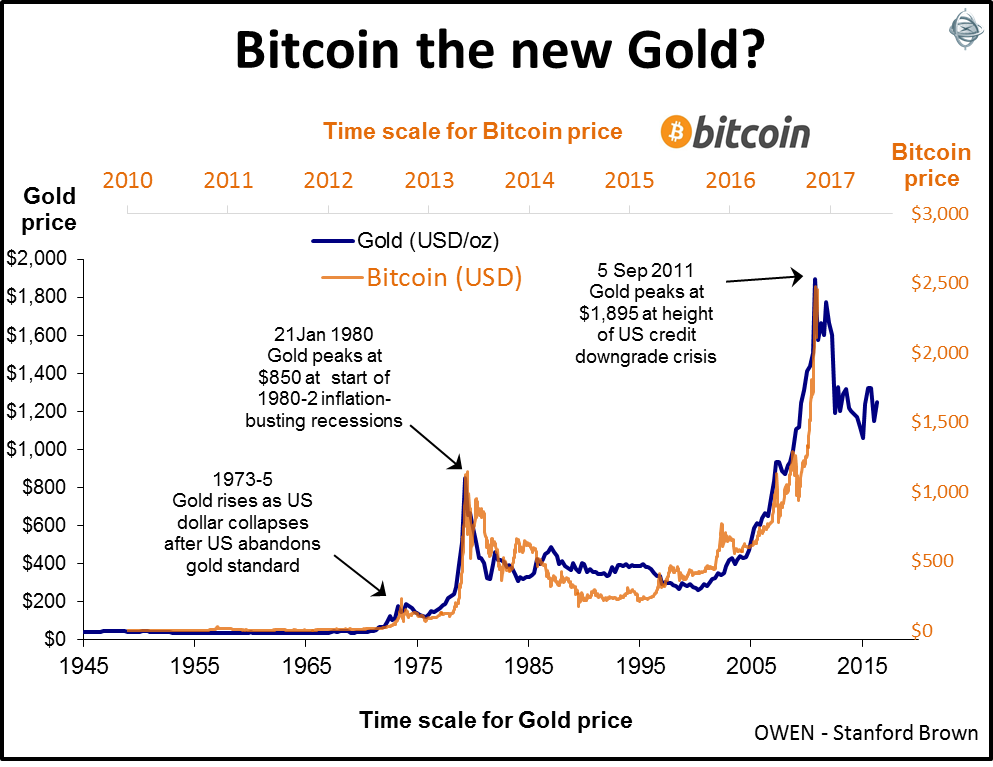

So is Bitcoin the new gold? It certainly behaves like gold in its tendency to suffer price bubbles and busts. When I looked at the price chart for Bitcoin I said to myself, “Hang on a minute, I’ve seen that chart before!” Sure enough it is the same as the gold price chart, only the time scales are different.

Here are the price charts for Bitcoin and gold. For gold (black line) the time scale is from 1945 to now, but for Bitcoin (orange line) the time scale from 2009 (when Bitcoin was born) to now.

The price bubbles and busts are almost identical. This is not to suggest that the pattern will continue of course. But it does show that, like gold and just about everything else, Bitcoin is subject to wild price bubbles and busts. You can lose a lot of money if you follow the crowd and get caught up in panic buying at the top and panic selling at the bottom.

Ashley Owen is Chief Investment Officer at privately-owned advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.