Investing in the pandemic era has raised a whole new set of challenges, but in some ways, the fundamentals haven’t changed. Corporate earnings still matter. In fact, they might just matter more than ever. The bull market may be long in the tooth and overdue for a correction, but there’s a reason the pandemic shouldn’t bring it down.

The outlook for global equity markets in a new year

There’s a three-part framework I like to use and that is: pandemic, economy, markets. The pandemic will be with us for a while, but it will have a diminishing impact on the economy over time. And the health of the economy matters a lot to the bond market, but less so to the equity markets. The stock market is driven by the earnings of the companies that are listed, and many companies have done well even during the COVID period. So we should see the pandemic having less impact on the economy, the economy continuing to expand and companies well positioned to thrive.

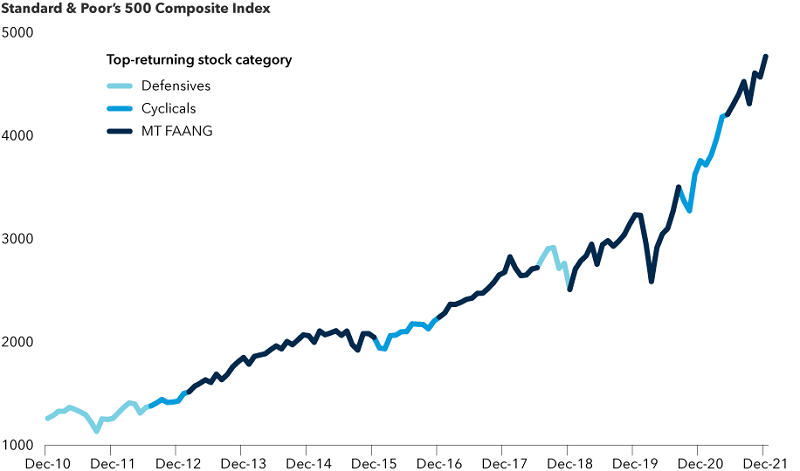

After the COVID correction in the first quarter of 2020, stocks not only bounced back, they continued the extension of what we now realize is a decade-long bull market. It's been led by the same group of U.S. tech-related stocks that we used to call the FAANGs — Facebook (now Meta), Amazon, Apple, Netflix and Google (now Alphabet). That long-term trend is still in place. COVID interrupted the climb, but it didn’t change the fundamental direction of the markets.

Pandemic-era rally is a continuation of a long bull market

Sources: Capital Group, FactSet, MSCI, Standard & Poor’s. As of 31/12/21. MT FAANG represents the collective price performance of shares of Microsoft, Tesla, Meta (Facebook), Amazon, Apple, Netflix and Alphabet (Google).

Over this 10-year period, we’ve definitely seen some excesses building up, and it’s usually these excesses that need to be cleaned out by a correction. That doesn’t mean it’s going to happen right away but, at some point a stabilization in prices, if not a full correction, would probably be a good thing at this point in the cycle. We may be seeing that needed correction starting already this year.

Growth in the world’s major economies

I’m expecting solid economic growth in the U.S. and Europe. It may be slower in China, but economies are not necessarily the best indicators of stock market levels. Equity markets will do well depending on the performance of the underlying companies.

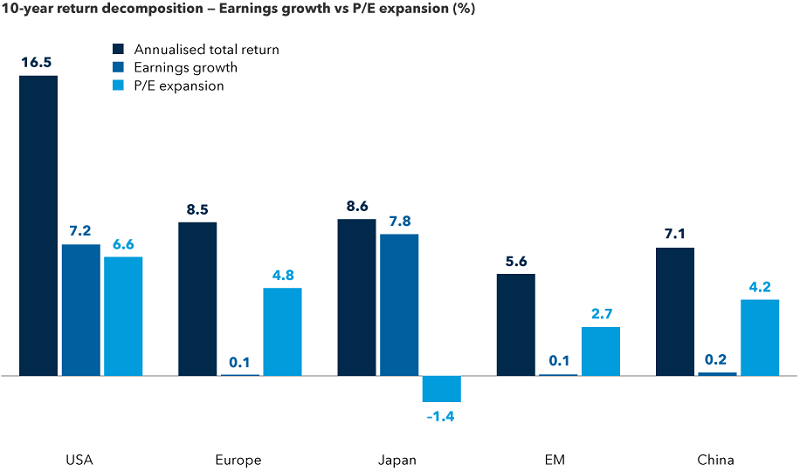

Let’s take a look at the U.S. stock market, which has been compounding at more than 16% a year over the past 10 years. That’s a remarkable number. Many people think it’s because of the stimulus that has come into the market, so most of it has been due to multiple expansion. But that's only half the reason. The compound average growth rate of U.S. corporate earnings has been over 7% a year. So that means about half the growth is driven by earnings and the other half is driven by investors valuing those earnings more highly.

This chart (shown below) makes a powerful statement about what's happened over the past decade in the U.S. compared to other major equity markets.

Strong earnings and P/E growth push U.S. markets higher

Sources: FactSet, MSCI. "Earnings growth" represents the annualised 10-year growth in earnings per share. "P/E expansion" represents the annualised 10-year change in trailing price-to-earnings ratios. Returns include dividends and are net of withholding taxes. All figures reflect USD. As of 31/12/21.

Other markets have been growing at only about half the pace of the U.S. Europe had almost no earnings growth at all. Japan hasn't had any valuation expansion, but it’s had decent earnings growth. So those two markets have been compounding around 8% a year. Emerging markets are even lower, and a big piece of that is China.

When we look at growth around the world, most of it is finding its way to the bottom line in the U.S., which is why this market has outpaced others over the past decade. While we are seeing some excesses, what's happening in the U.S. is unique and keeps us focused on opportunities in this market.

The risks that could bring this long bull market to an end

In investing, you don't have to figure out what's going to start the fire, you just need to know the brush is dry. When you think about how the markets are currently structured, how far they've gone up and where multiples are, you just have less room for mistakes.

Some of the excesses today aren’t necessarily in listed securities, but in the private equity markets and so-called PIPE (private investment in public equity) deals. That's where I’m seeing things that worry me, and that's why I am in no way sending a panic signal about the public equity markets. As we’ve just demonstrated, U.S. stocks are driven as much by earnings expansion as P/E expansion, and that's healthier than I think most people realize.

The pockets of growth and innovation

We’ve already discussed the FAANGs and I think Tesla has also joined that group. These are companies which have wide moats. They’re making a lot of money and not just in their core business areas. Some have two or three other strong pillars of growth. And while people may argue that valuations are stretched, they are less stretched than they were a few years ago because the underlying earnings are so powerful.

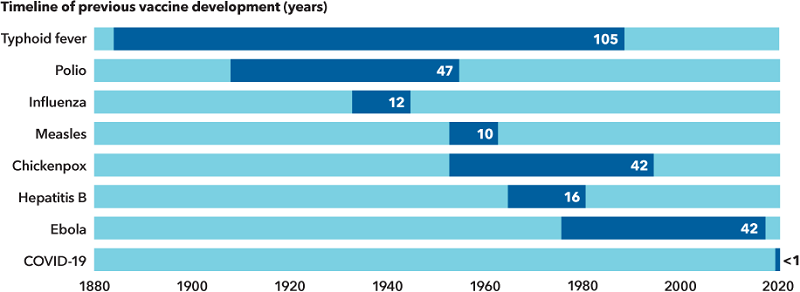

I am also excited about advancements in the health care industry. Most of the COVID vaccines have resulted from the mRNA technology delivery system developed about 20 years ago, and it’s finally finding its way into common drugs. This structure will be used to develop multiple new treatments and even cures for deadly diseases. It’s going to change our lives, so I’m interested in a number of companies in that space.

COVID-19 vaccines were developed at breakneck speed

Sources: Capital Group, NIAID, Our World in Data. Date ranges represent the approximate time between the year the pathogenic agent was first linked to the disease and the year that its vaccine became licensed in the United States.

Also, don’t count out Europe and some of the emerging markets. They've learned from the U.S. and China, and they are creating their own centres of excellence, especially in the technology sector. I see this in Canada as well. There are many companies such as Shopify building their own innovative platforms. They have great products that they are bringing to market in the digital and meta worlds.

Positioning our portfolios for the year ahead

As long-term investors, we have an average holding period of about eight years, so we try to build all-weather portfolios. We have this incredible bull market in the U.S. and I don’t want to count it out, so my view is: I'm buying the raincoat, but I'm not putting it on yet. I just want to have that raincoat nearby. And with low interest rates, cash isn't as attractive an asset class to use on the defensive side.

I’m looking more toward durable companies with strong operating positions, often dividend payers. Because of the duration of the bull market and current valuations, I am cautious and shifting where I can to strong cash-flow generating companies. But when our analysts find amazing new companies doing innovative things, I can often be convinced to hold a few in my portfolio. That's why I describe it as all-weather. It's structured with a nice safe core, but I try not to miss some of these opportunities, particularly in the digital space.

What’s your perspective on Environmental, Social and Governance (ESG) issues?

Source: Capital Group.

ESG is everywhere, and it's only going to get more important. We have made a commitment to fully integrate ESG principles into our investment process. So every security now goes through an ESG filter. We know it's going to be driving prices and outcomes.

We have a role as bottom-up fundamental investors who are out there every day talking to companies. Companies want to do the right thing. They want better governance. They want to treat their workforce better. They want to have minimal climate impact. And they are looking to us for guidance on those issues.

ESG concepts are global and cut across all asset classes

In addition, it’s important to give asset managers the flexibility to evaluate companies from an ESG perspective, rather than simply banishing some companies from a portfolio. Don't think of ESG as just an exclusion process. Think of it as identifying companies that are doing the right thing and also supporting companies in transition.

I understand there is some trepidation about how ESG concepts will be implemented in our industry. People are worried about new government regulations, additional rules or expanded disclosure requirements. But I would say: Get over it. This is important. There's a lot to learn, but I would go into it with a sense of optimism and enthusiasm.

Parting thoughts

First, remember that even though the pandemic isn’t fading, it shouldn’t scare you. It will have less impact over time.

Second, we're in the 11th year of an extended bull market and near the end of the cycle. Some type of correction is likely, but it’s not time to panic. What's happening underneath is solid, healthy and underpinned by strong earnings growth. For all the worries about rising inflation and broken supply chains, we’re seeing lots of opportunities in individual companies and securities throughout the world. We found ourselves in a very tough situation but we got creative and figured out a way to get through it.

Bottom line: Stay invested. Don’t try to time the market.

Rob Lovelace is Vice Chairman and President of The Capital Group Companies, Inc., Chief Executive Officer of Capital Research and Management Company, and an Equity Portfolio Manager. Capital Group Australia is a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.