“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us ...”

- Charles Dickens, A Tale of Two Cities, 1859

The best thing about a mobile phone is that people can contact you at any time.

The worst thing about a mobile phone is that people can contact you at any time.

The best thing about Listed Investment Companies is that they trade at a discount to NTA.

The worst thing about Listed Investment Companies is that they trade at a discount to NTA.

Wait a minute! Is this the age of foolishness or the age or wisdom? Surely for LICs, it can’t be both.

Well, that’s what we were led to believe at the LIC session at the Morningstar Investor Conference last week by two leaders in the sector. Who was stretching incredulity, to use Dickens’ word?

The worst of times

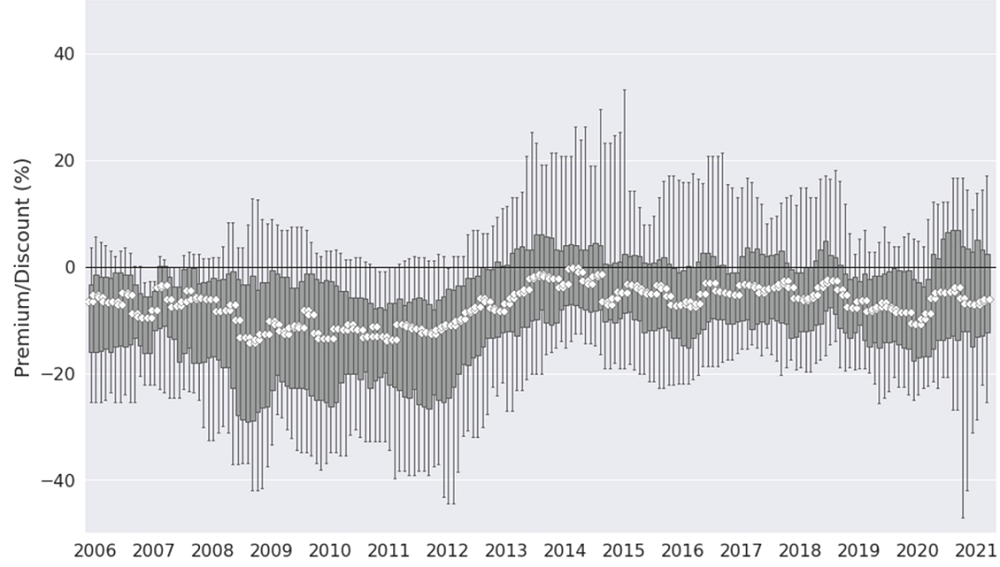

At the Conference, Michael Malseed of Morningstar showed the following chart of premiums and discounts for all Australian equity LICs back to 2006. The horizontal line in the middle is parity to the value of Net Tangible Assets (NTA) and the white dots show the median valuation. The discount is persistent but varies over time. The bars show the range of discounts and premiums across all LICs (longer bars are the 5th to the 95th percentile, fatter bars are the middle 50%).

It highlights the main problem. Some LICs have so little investor support that they can sell for discounts of 40% or more. It’s a disaster for an investor who supported the manager in the initial offer and now wants to sell, regardless of how the fund manager has performed.

Median and range of LIC share price premium/discount (in percentage terms) to NTA, across Australian equities LICs—2006-21

Source: Morningstar Direct. Data as of 31/10/2021.

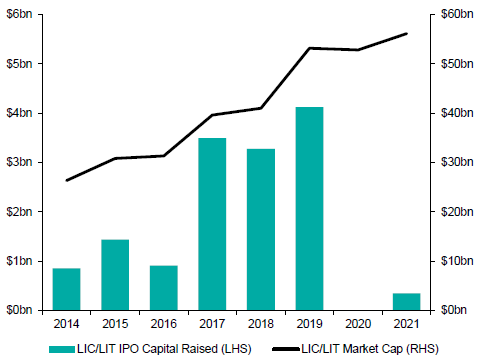

The prevalence of discounts is one reason why new LICs have become almost non-existent following the ban on stamping fees paid by issuers to brokers and advisers. Firstlinks has already covered this subject in detail, here and here. The ban effectively closed the IPO market in 2020. The main new transaction in 2021 was WAM Strategic Value (ASX:WAR) raising $225 million on the back of Geoff Wilson’s strong direct-to-investor marketing with $125 million an entitlement allocation to existing shareholders. It invests in discounted LICs.

Source: Bell Potter

Here are the LIC holdings of WAR picked up at decent discounts to NTA, including some of the most respected and highest-profile fund managers in Australia. It's not a good look for these managers. WAR itself is trading at a discount (end January NTA $1.26, share price $1.17). Anyone for a discount on a discount?

Attempts to remove the discount

Faced with persistent and embarrassing discounts, some fund managers have abandoned the LIC structure. Ellerston Global converted to an unlisted fund, Monash to an active ETF, Templeton Global Growth merged with Wilson Global and Antipodes converted to an ETMF.

Antipodes should have possessed the right ingredients for a listed vehicle to trade well. It was established by Jacob Mitchell in 2015 after 14 years at Platinum Asset Management and the team manages a healthy $8 billion. Yet after the first couple of years, its LIC could not remove the persistent discount, as high as 20%, even after buying back 13% of the company’s shares.

Antipodes is part of the Pinnacle Investment Management group of boutiques, and at the Morningstar Conference, Chris Meyer, Director of Listed Investments at Pinnacle, said (edited transcript):

“Our journey with LICs started about five years ago with some strategies in global equities and Australian equities. One of the great things about listed funds, LICs included, is that you can click to buy them in an online broking account through your broker and it's very easy, whereas unlisted managed funds are quite cumbersome.

So we had demand from our client base to have a listed fund capability. We've since moved a little bit more into using the LIC structure to provide access for our clients to asset classes that they can't ordinarily access through unlisted managed funds or ETFs, such as private assets.

I think the Achilles heel for the sector, and we've had this for as long as it's been around, we definitely pick up some frustration amongst our shareholder base of our LICs and the advice market that they are frustrated with LICs. No one likes it when the share price and the NTA dislocates, particularly those that bought at IPO. And I do think we need to solve for that. I think we are on a journey to solve that, we are getting much better.”

Pinnacle and Antipodes was willing to swap the guaranteed, committed capital of a LIC to an alternative where the money can be withdrawn by the investor to address this investor frustration. Malseed continued:

MM: Chris, I want to ask about your experience over 2021 of this consolidation phase with the Antipodes LIC. There were a number of options on the table to address the discount and you decided to give shareholders the opportunity to invest in the QMF (Quoted Managed Fund), AGX1. Can you talk about the pros and cons of what options there were on the table?

CM: It comes back to discounts. There's a significant part of LIC discounts that are cyclical, because it depends on investor sentiment, it depends on investment performance, those things which ebb and flow in the history of the LIC industry.

But there was also a potential that there is a different fund structure now which competes with LICs, which is the open-ended listed fund called the ETF. And I think it remains to be seen which of those two will win out. In the case of Antipodes, it was a five-year old company, for the first two years, it went gangbusters, great performance, traded at a premium, last three years traded at a discount particularly because it's a value manager and the markets weren't in its favour. It was underperforming the market. It was a big reason why the discount had widened up.

We tried everything, we did the ASX’s biggest buyback, we put in a big effort on marketing and communication. But at the end of the day, we took the decision that we needed to do something in the best interest of shareholders. And we felt like giving them something that trades at its NTA and remove this perennial discount to NTA. And that's why we made the decision to move to an ETF.

Magellan obviously led the charge there in the beginning of last year with their High Conviction Fund, and we saw that as a pretty elegant solution. Antipodes already had an ETF and so now you can buy the same strategy from the same manager but you just no longer have the vagaries of premiums and discounts. The opportunity to buy at a discount is removed but it can also be a source of frustration and we were worried that our shareholder base was getting increasingly frustrated and we needed to solve for it."

The best of times

Geoff Wilson of Wilson Asset Management (WAM) is the King of LICs. His empire of eight LICs across global equities, domestic equities and alternatives is capitalised at over $3 billion. The retail subscriber base for the WAM weekly newsletter is over 70,000. Wilson loves the discounts, such as saying: “As an investor, getting the opportunity to buy $1 of assets at 80¢ is exciting.”

Here’s what Wilson said at the Morningstar conference:

“To me the discounts are great, that's nearly the Holy Grail. And the great thing about your chart is it showed how there are big variants, big discounts but also big premiums. You look at the leaders, AFIC and Argo. Look at AFIC at the moment. It's trading at 18% plus premium. So there are some great opportunities.

I think what a lot of people forget is for Listed Investment Companies, there’s four things you've got to do.

One is you've got to perform for the investors.

Second, you need a growing stream of fully franked dividends because a lot of the marginal buyers are the self-managed super funds, trying to get this consistent dividend flow.

The third thing is what every listed company has to do and it's treat shareholders with respect.

And the fourth thing is … and this is what a lot of the newer investment companies don't necessarily get initially … is you've got to have a really detailed shareholder engagement communication and marketing strategy. And that is costly.

So a lot of the rationalisation that has occurred in the industry recently is where unfortunately, the manager just hasn't got that last bit right.”

Wilson again promoted the merit of the discounts when Malseed asked about developments in 2022 and if the discounts had 'quietened down'. Wilson said:

“Look, there's some great value. You look at the two VGI LICs, now they're trading at 18% and 13% discounts, and since the Regal announcement, they've narrowed. And the Magellan LIC, we were buying it a little while ago at an 18% discount and I think it's only about a 13% discount at the moment. So you're getting a high quality manager cheaply.

On Chris's point, I take my hat off to the Pinnacle guys in terms of how they operated with Antipodes. If I was in that position, I probably would have left it in the structure. We had the same situation with WAM Research, traded at a big discount that actually took us seven years to get to NTA. The tough thing is when it takes that long you usually tighten up your shareholder base and that's where we've got the problem on the other side, we're at a 40% premium which is as ridiculous as the 30% discount that it used to be at.

But it does give you a great opportunity. There will always be Listed Investment Companies trading at premiums and there will always be Listed Investment Companies trading at discounts, and the logic of WAM Strategic Value was to take advantage of buying those discounts.”

New funding rolls on

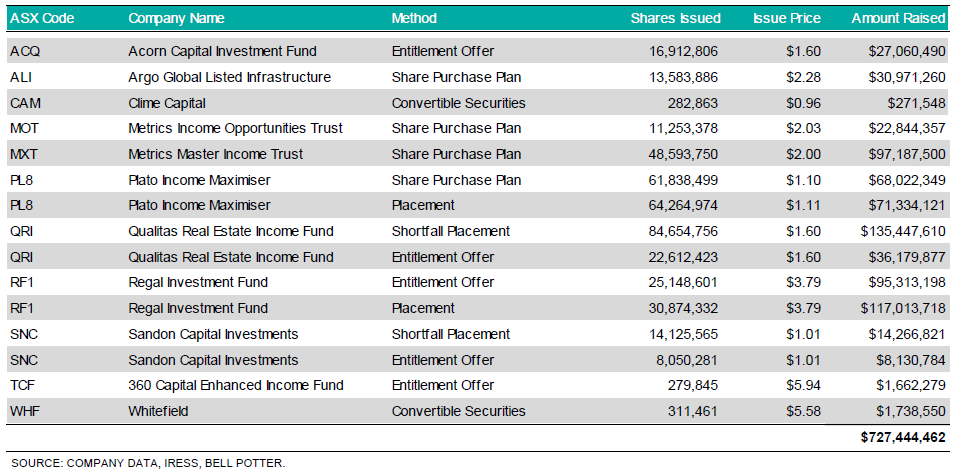

As there are few new IPOs of LICs, does that mean the sector is effectively dead, except for market variations on existing LICs? No, far from it. As the table below shows, existing LICs and Listed Investment Trusts (LITs) continue to raise money from existing and in some cases, new investors. There may be a question whether some of these transactions disadvantage investors who do not participate by issuing shares at a discount to NTA, but the same can be said of share placements to favoured investors by any company. This ability to build the investor base is one reason many managers will persist with LICs, and over $700 million raised in a quarter is impressive.

Share purchase plans, placements and entitlements, December quarter 2021

Coming back to Pinnacle, the above table shows why they support the LIC structure for the right asset or fund manager. Plato and Metrics are Pinnacle boutiques, and they have both written articles (here and here) in Firstlinks explaining why the LIC structure suits them. Here’s Malseed and Meyer again:

MM: In terms of Pinnacle's outlook for LICs and other listed structures, what's the pipeline for new launches and in what sort of areas?

CM: Pinnacle is very committed to the LIC sector. We think the future is pretty bright. It wouldn't appear obvious right now, because there hasn't been that much (IPO) capital raised in the last couple of years. But a couple of things. The discounts have tightened a lot, so that problem is not solved but it's way better than it was. Capital is starting to flow again. With existing LICs, the strong will get stronger. Geoff’s stable is a good example of that. We've got Metrics, a repeat capital raiser because it's in high demand. But my personal view is that future IPOs will be more in private assets. Investors want it and need it. When you look at a typical retail investor’s portfolio, full of stocks and bonds, not much in infrastructure, real property, private equity, those sort of asset classes.

The LIC structure is perfect for those asset classes because it's closed-end. You've got an illiquid asset class in private assets. You can't have daily redemptions. You can't put it in an ETF. You can't put it in an unlisted managed fund. A LIC is perfect for it. And the LIC structure provides the investor with liquidity. So you get this Holy Grail of the reason why the structure makes sense. We've seen this in the UK where about 40% of LIC assets are in those private asset classes, real estate, private equity, credit. Here, it's about 10% in Australia and I think that pendulum is going to shift."

A bad investor experience cannot be a Holy Grail

So that's two Holy Grails. Wilson thinks it’s the discount, Meyer thinks it’s the investor liquidity in an illiquid asset class.

I’m with Meyer. Many investors are tired of the inability to exit from their LICs or LITs at the value of the assets. When liquidity was most wanted during the March 2020 COVID-19 sell off, discounts widened significantly. With buying interest in a closed-end fund relying on finding bids in the market, prices collapsed more than the fall in the market.

My own experiences over the years is that LIC discounts can move out and remain persistently wide for years. If something happens at the manager, such as a change in personnel or an unwelcome portfolio change, some LICs are so poorly supported that investors are forced to hang on or liquidate at a 20%+ discount. More of the small LICs should be consolidated into a structure offering better liquidity. To Wilson’s credit, he has been vacuuming up LICs and merging them into his larger funds.

What Wilson should acknowledge is that it can hardly be a Holy Grail when an investor loses 20% versus the underlying asset performance as a reward for supporting the manager in an IPO. That investor’s bad experience means they will not come back for more LICs and it’s not an endorsement of a structure when the end-investor circumstance is poor, as Meyer experienced with Antipodes, Simon Shields with Monash and Ashok Jacob at Ellerston.

The final line of Dickens’ A Tale of Two Cities is said by a man before he is executed at the guillotine:

"It is a far, far better thing that I do, than I have ever done, it is a far, far better rest that I go to than I have ever known."

It would be a far, far better thing if discounted LICs with ineffective or insufficient marketing resources or poor investment performance would guillotine themselves and either convert to an unlisted fund or merge with a larger fund and put their investors out of their misery.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.