Over 400 readers completed the short survey on expectations for market returns in this new financial year, and the results suggest optimism for overall share market performance.

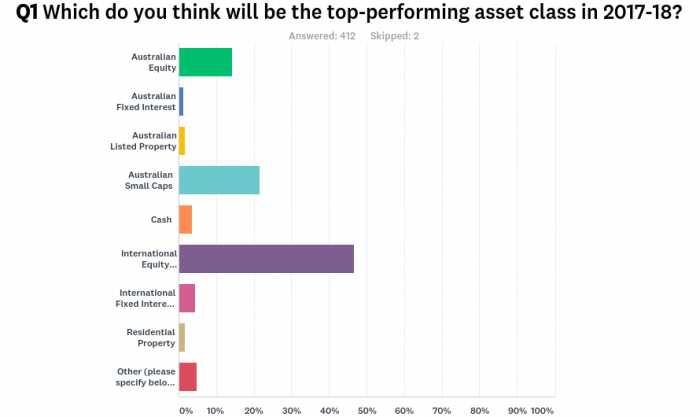

Winner of the expected best-performer category

Unhedged international equities (46% of votes)

Equities received strong support, with unhedged global shares (46%), Australian small caps (22%) and Australian equities (15%) adding up to 83% of votes. There was little support for fixed interest, and with cash at only 4% of votes, few investors see a market rout.

Particularly notable is that international equities have come first in four of the previous five financial years, so there’s either little support for ‘reverting to the mean’, or people are extrapolating from recent performance. How much does the concentration in Australia’s market among banks, miners and retailers play a role?

Only 2% expect residential property to be the best, but as in all years, that’s where most of the investment dollars will go.

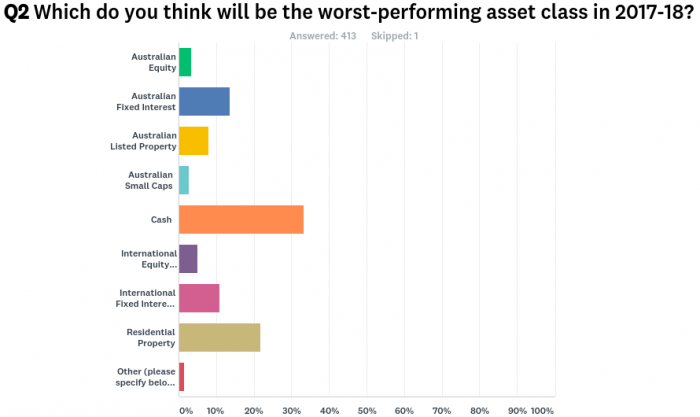

Winner (or loser) of the expected worst-performer category

Cash (33% of votes)

Expectations for the worst performer were somewhat more balanced, with cash and fixed interest adding up to 57% of nominations. Taking a look at the Morningstar numbers for each financial year since 1998, cash has only come bottom twice. There are usually one or two other asset classes that put in a bad year and underperform the defensive characteristics of cash. Last year, cash outperformed listed property and fixed interest.

A healthy 22% expect residential property to perform worst, which is a decent vote for the market finally losing its head of steam (in Sydney and Melbourne, at least).

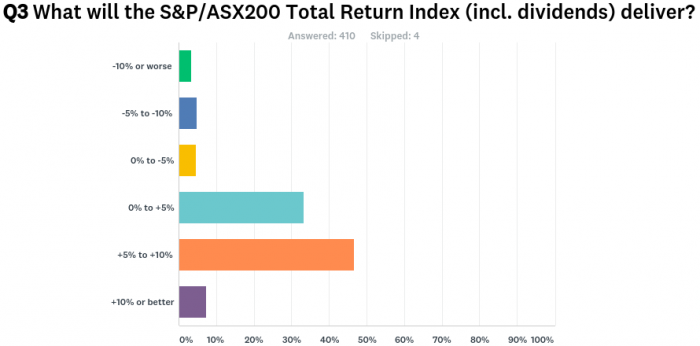

Most nominated range for S&P/ASX200 Total Return Index

+5% to +10% (47% of votes)

A strong 87% of votes placed the Australian index in the range of 0% to 10%, with most above +5%. Given the US market is at all-time highs and Australian and global valuations look stretched, and with US rates rising, this is an optimistic note for steady performance. There was stronger support for +10% and better (7.5%) than a bad result of -10% or worse (only 3%).

We will report on the results of these predictions at the end of 2017/2018.