I love an election, particularly a federal one. It’s the quintessential characteristic of democracy in action (assuming no undue influence from foreign governments). Any election is about comparing opposing parties’ policies. So let’s compare Labor's proposals to the current super rules, not only as input to our voting decisions, but as a good reminder on ways to put more into superannuation.

CONTRIBUTIONS

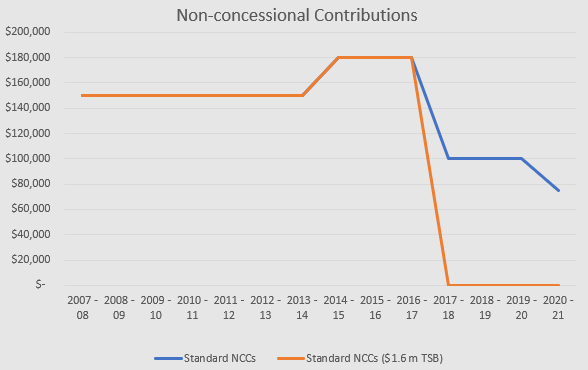

Non-concessional contributions cap

Current law

You can make 'after tax' or non-concessional contributions (NCC) of up to $100,000 if you qualify and have a total superannuation balance (TSB) of less than $1.6 million at the prior 30 June.

If you are under 65, it is possible to access the ‘bring-forward’ rule and make NCCs of up to $300,000 over a fixed three-year period, provided your TSB is no more than $1.4 million at the prior 30 June. If your TSB is between $1.4 and $1.5 million you can make NCCs of up to $200,000 over a two-year fixed period and if your TSB is between $1.5 and $1.6 million, your NCC is limited to the standard annual limit of $100,000.

Labor policy

The standard annual NCC cap of $100,000 will be reduced to $75,000. The ‘bring-forward’ rule will then change to allow a one-off (after-tax) contribution of $225,000 for an individual, or up to $450,000 for a couple to a maximum of $225,000 each.

The cut in the cap reduces the ability to make a ‘one-off’ contribution to super, which can come from the proceeds of selling investments, an inheritance, a redundancy payment or some other means.

Assuming Labor wins on 18 May, it will be a further step down in the ability to put money into superannuation.

Concessional contribution cap

Current law

The 'before tax' or concessional cap (CC) for the 2018/19 financial year is $25,000 for an individual. There is no higher cap for older Australians. The cap is indexed and increased in amounts of $2,500. The cap will not increase for the 2019/20 financial year.

Labor policy

Labor has not announced any changes to the concessional cap, however, it has announced changes to the catch-up concessional cap rules, refer below.

Tax deductions for personal superannuation contributions

Current law

You can claim a tax deduction for personal superannuation contributions providing you have notified the fund of your intention and the fund has acknowledged your notice in writing. The maximum amount for personal superannuation contributions, including any employer or salary sacrifice contributions, is $25,000 without incurring a tax penalty.

For example, if your salary for the financial year is $100,000, your employer would be required to make a 9.5% super guarantee contribution of $9,500, allowing you to make a personal tax-deductible contribution of up to $15,500 ($25,000 – $9,500).

Labor policy

Tax deductions for personal superannuation contributions will be more restricted and is likely to revert to the previous rules. However, more detail of the announcement is required to work out who may be affected. The previous rules allowed a deduction for personal contributions if less than 10% of your total adjusted taxable income came from employment sources.

Catch-up concessional contributions

Current law

You may be eligible to claim personal ‘catch-up’ CCs if you meet certain conditions. Whilst the measure started in the current 2018/19 financial year, the first year that a person can apply any ‘catch up’ amount is the 2019/20 financial year.

The ‘catch up’ contribution is the difference between CCs you make plus those that are made for you and your annual CCs cap of $25,000. You can carry forward the shortfall for up to five years and can claim a personal tax deduction up to the catch-up amount if your TSB as at 30 June in the previous financial year is below $500,000.

As an example, if you earnt $100,000 for the 2018/19 financial year and your employer contributed the compulsory super guarantee contribution of $9,500 (9.5% of $100,000) you would have an unused catch-up CC of $15,500 ($25,000 - $9,500) which you can carry forward for the next five years.

Assuming your TSB at 30 June 2019 was less than $500,000, your CC cap for 2019/20 would be $40,500 (i.e. the standard $25,000 concessional contributions cap for the income year plus the carried forward amount of $15,500 from the previous income year).

Labor policy

Catch up contributions will be abolished as they are considered to provide an unfair advantage to upper income earners.

Division 293 high-income super contribution threshold

Current law

If your adjusted taxable income exceeds $250,000, you are required to pay an addition 15% tax on CCs up to the standard cap amount of $25,000, which means a total tax rate of 30% after the 15% contributions tax deducted by your super fund.

As an example, if you had an adjusted taxable income of $275,000 and your employer contributes $25,000 to your super fund, you would end up with an additional tax bill of $3,750 ($25,000 x 15%). However, if your adjusted taxable income was $260,000 and CCs of $25,000 were made to your fund, then only $10,000 would be taxed at the additional 15% ($1,500).

Labor policy

The high-income superannuation contribution threshold will be reduced to $200,000.

SUPERANNUATION GUARANTEE

$450 superannuation guarantee threshold to be phased out

Current law

Super guarantee is not payable by an employer for employees who earn up to $450 in a calendar month.

Labor policy

The $450 monthly threshold is to be progressively reduced in increments of up to $100 each financial year between 2020 and 2024. The intention of this change is to benefit low income earners, casual employees and those in part-time employment.

Superannuation guarantee (SG) to be paid on the government’s paid parental leave

Current law

Superannuation guarantee contributions are not required to be paid by your employer if you are receiving paid parental leave.

Labor policy

Superannuation guarantee contributions will be paid on amounts you receive under the federal government’s paid parental leave scheme. At present, $719.35 is paid weekly for 18 weeks if you are female and meet a work test and earn less than $150,000 per year. The amount paid for the super guarantee will be 9.5% of $719.35 ($68.34 weekly to a maximum of $1,230.08 over 18 weeks).

LIMITED RECOURSE BORROWING

Direct borrowing by superannuation funds and limited recourse borrowing

Current law

Your SMSF can borrow to invest as long as the loan arrangement and the asset being acquired satisfy strict rules.

Labor policy

Limited recourse borrowings will cease, however, those in place prior to the law changes will be grandfathered.

FUNDS CLAIMING EXEMPT CURRENT PENSION INCOME

Restriction on amount of fund income that can be claimed as exempt current pension income (ECPI)

Current law

From 1 July 2017 a transfer balance cap (TBC) of $1.6 million was introduced on the amount that can be transferred to a ‘retirement phase income stream’. This cap effectively restricts the amount of ECPI that a fund can claim.

Labor policy

Prior to the introduction of the TBC, Labor announced a policy to limit the amount of ECPI that a fund could claim to $75,000 per member. It is unclear whether Labor still intends to introduce this policy now that the TBC has been introduced.

OTHER DIFFERENCES THAT AFFECT SUPER

Here is a brief summary of three other differences to complete the picture.

1. Dividend imputation

Current law

Individuals and superannuation funds are entitled to a refund of franking credits, if the franking credits plus any PAYG tax paid by the individual or fund exceeds their tax liability.

Labor policy

Refunds of excess franking credits that exceed tax liabilities will cease for some taxpayers. Generally, the policy will apply to most individuals, SMSFs and some larger superannuation funds. As part of Labor’s ‘pensioner guarantee’, SMSFs which had at least one member who was a welfare recipient on 28 March 2018 are exempt from this policy.

2. CGT discount

Current law

A discount of 50% applies to capital gains made on CGT assets held by an individual for at least 12 months. A one-third discount applies to capital gains made on CGT assets held by a superannuation fund for at least 12 months.

Labor policy

It is proposed that the 50% discount that applies to capital gains made by individuals on CGT assets held for at least 12 months is halved to 25% for CGT assets acquired from 1 January 2020. There will be no change to the one-third discount that applies to superannuation funds.

3. Taxing discretionary trust income

Current law

Distributions from discretionary (family) trusts are taxed depending on the personal tax rate of the beneficiary.

Labor policy

Labor intends to introduce a minimum tax rate of 30% to discretionary trust distributions aimed at reducing tax minimisation and artificial income splitting. This should not affect SMSFs, as trust distributions received are generally from unit (fixed) trusts, not discretionary trusts. Current law treats distributions from a discretionary trust to an SMSF as non-arm’s length income, taxing the distribution at the relevant top marginal tax rate.

We await the outcome of the May 18 federal election to see which party will form government. Regardless of the election outcome, there will still be the issue of the make-up of the senate, which determines, in most cases, the successful or otherwise passage of legislation.

Mark Ellem is Executive Manager, SMSF Technical Services at SuperConcepts, a sponsor of Cuffelinks and a leading provider of innovative SMSF services, training, and administration. This article is general information only and does not consider the circumstances of any individual.

For more articles and papers from SuperConcepts, please click here.