Fear of missing out (FOMO) may have some investors piling back into share markets. But if this bear market cycle plays out like those that have come before, long term investors can afford to wait, and patience is likely to be rewarded.

How bulls and bears behave

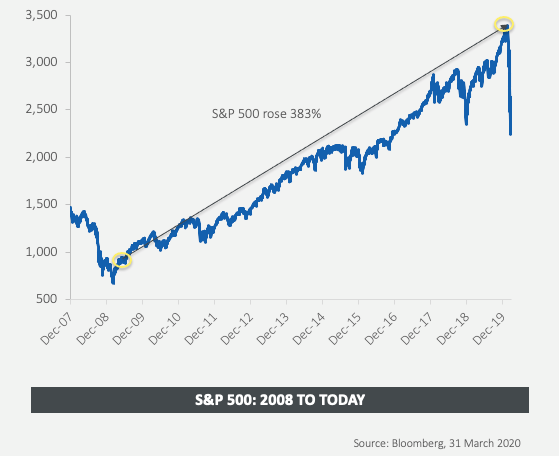

History shows that when bull markets start, they generally last a long time, much longer than the bear market that preceded them. As the chart below shows, even if investors bought into the last bear market three months after it bottomed, there were still handsome returns to be made over the decade that followed.

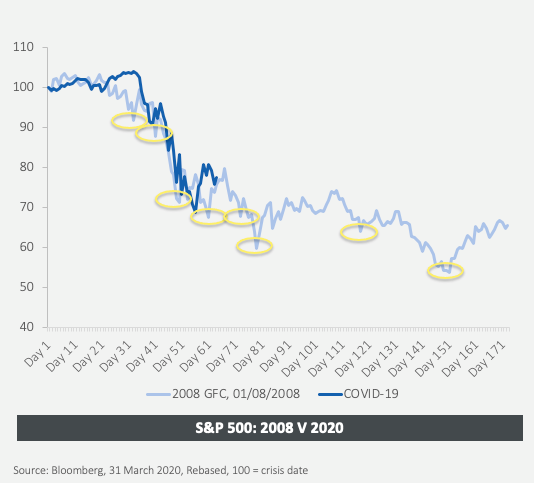

We have recently moved out of bear market territory, but it is early days yet. The chart below shows the S&P500 during the Covid-19 crisis overlayed with the GFC and gives an indication of how this could play out.

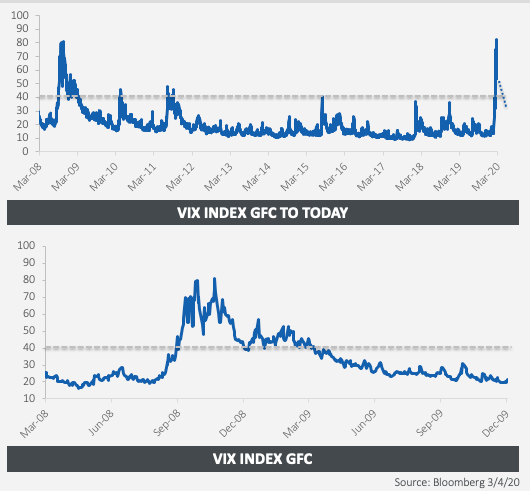

Volatility in bear markets bounces along the bottom – up and down from day-to-day - and we can expect volatility to continue for a while.

That said, there is a lot of opportunity to buy, and our portfolio is doing so – having gone from 20% to 60% invested. But we are prudent about being fully invested too soon, because bear markets generally drag on for a while.

The trick is to not give in to FOMO and to be patient, because the bull market will come back and ultimately there will be good times ahead again.

So when to return to markets?

There are many market timing indicators worth keeping track of, and we follow the VIX closely. A good time to go fully invested is generally when volatility passes. The VIX has been as high as 80 in this crisis and it has only been at 80 once before in my lifetime, which was during the GFC. Then, it took seven to eight months to fall back below 40, as the chart below shows.

Our view is to wait until volatility subsides, which means potentially giving up a bit of relative return in the short term. For absolute returns over the longer term, ultimately the next bull market will be like those that have come before and will be long and fruitful.

Where would we invest when the time is right? The bottom line is that earnings growth drives stock prices. We are focusing on companies that will be better off on the other side of this crisis. Some of them may take a hit this year, but we want to focus on those that will be better off over the next three to five years.

The three largest sectors we are exposed to are digital enterprise, e-commerce and digital payments.

We are particularly bullish on the digital enterprise sector. We were already positioned strongly in Microsoft, along with some other cloud and software companies, before these latest events. And if anything, the current crisis will only accelerate the move to cloud-based systems. Microsoft Teams is being used around the world, and most children are moving to online learning. This shift to the cloud and to software will accelerate.

E-commerce is another sector we like, for the same reasons. We’ve always followed the trend towards e-commence and if anything, this crisis means the shift will happen even faster than predicted. From that point of view, Amazon and Alibaba are two names that we like.

And while the digital payments sector will take a hit this year, because commerce is slower, ultimately the shift to digital will accelerate. We are positive on PayPal in this space.

Other sectors we like include digital advertising. While Google and Facebook will be impacted this year, we expect it to outperform over the long run.

In the same vein, healthcare companies and diagnostics are also well placed.

While value investors may find good opportunities in sectors such as energy, tourism and leisure and media companies, there will are also tough times ahead for financials, restaurants and franchise operations as well as automotive industries. Unfortunately, these are the ones to suffer most in this crisis because these are the sectors exposed to consumers and small-medium sized businesses.

There is no doubt that there are still tough times ahead for markets and economies, and there will be no avoiding a downturn. But history has shown that investors can afford to miss the absolute bottom of the market, and still make good market gains.

The bull market will return and when it does, it will last for a long time.

Nick Griffin is a Founding Partner and the Chief Investment Officer of Munro Partners. The information included in this article is provided for informational purposes only. Munro Partners do not represent that this information is accurate and complete, and it should not be relied upon as such. Any opinions expressed in this material reflect our judgment at this date, are subject to change and should not be relied upon as the basis of your investment decisions.