The drought has broken for global value investors, but can the recovery continue? This article outlines the scale of the bounce back for value-style stocks and considers whether it is set to run further.

Why value stocks were in the wilderness

A growth stock is a share in a company that is anticipated to grow at a rate significantly above the average growth for the market. A value stock is a company trading at a lower price than justified based on the company's fundamental performance. For many years following the GFC, value underperformed growth.

There main possible explanations for this include:

- Low real interest rates. Low interest rates imply low discount rates for discounted cash flow calculations, artificially inflating longer-dated cash flows which are typically associated with growth stocks.

- Build-up of intangible assets. Using simple valuation metrics tends to ignore the impact of modern intangible assets like research and development (R&D) and brand value, which tend to be associated with tech or consumer discretionary names. Firms that invest heavily in R&D and brand value look expensive when the price is measured against tangibles like book value or total liabilities.

- Low inflation. While global economic growth has been satisfactory, productivity growth has been poor and inflation has been depressed (or at the low end of expectations). This means that nominal interest rates have also remained low.

- Technological shift. The period since the GFC has been dominated by a new paradigm of technological developments, most notably in communications, consumer services and the application of new technology to older problems like transport and power supply. Firms in this space have been much more successful than 'old school' firms – bricks and mortar retail, transport and entertainment have all suffered. These newer firms have often traded on excessively high valuation metrics, making older firms appear cheaper.

A market shift

After languishing for over a decade, global value stocks returned an average 10.3% in the first quarter of 2021, compared to growth stocks at 1.6% (MSCI AC World ex AU Value and Growth, 1 January to 31 March 2021), after a long period of relative underperformance.

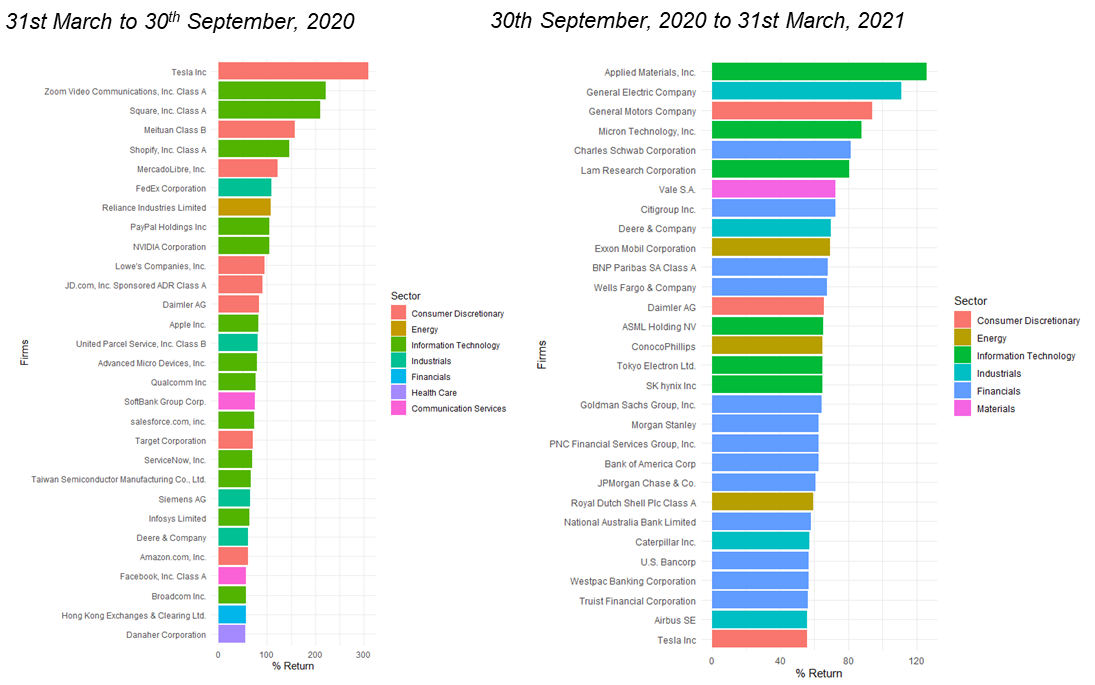

The significant shift in market dynamics can be seen in the rotation of tech and communications names out of the top 20 performers, to be replaced by value-style industrials, energy and financials. For example, between April and September 2020, Tesla, Zoom and PayPal were among the best performers, while from October 2020 to March 2021, brands like General Electric, Citigroup and John Deere saw the strongest gains (see appendix).

Chart 1: MSCI ACWI Total Returns by Company

Source: MSCI – April 2021

However, the recovery is starting from a low base.

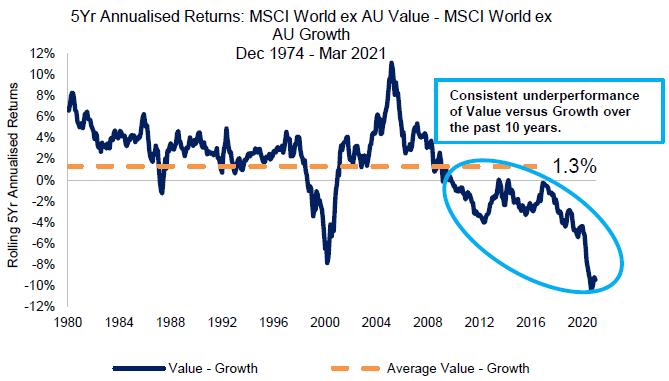

Over the past 40 years, value and growth styles of investing have competed for dominance, and in the last decade, growth has convincingly won. While the recent rebound is welcome, it has hardly made a dent in terms of recovery, as Chart 2 shows.

Chart 2: Value vs Growth Returns

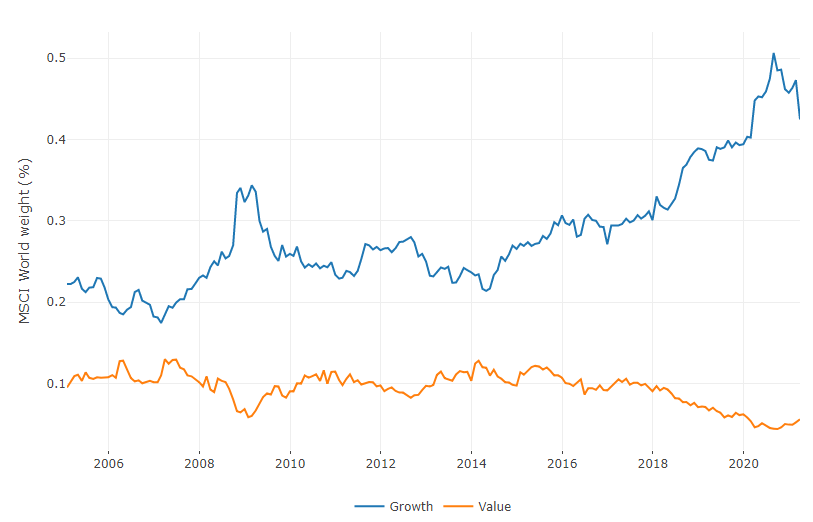

Our research also illustrates how the gap between value and growth stocks has increased in recent years. Since 2014, growth names have more than doubled as a proportion of the benchmark weight, while value names have approximately halved.

Chart 3: Growth and Value companies as a percentage of MSCI World

Source: Realindex, Factset, MSCI. Data as at 31 March 2021.

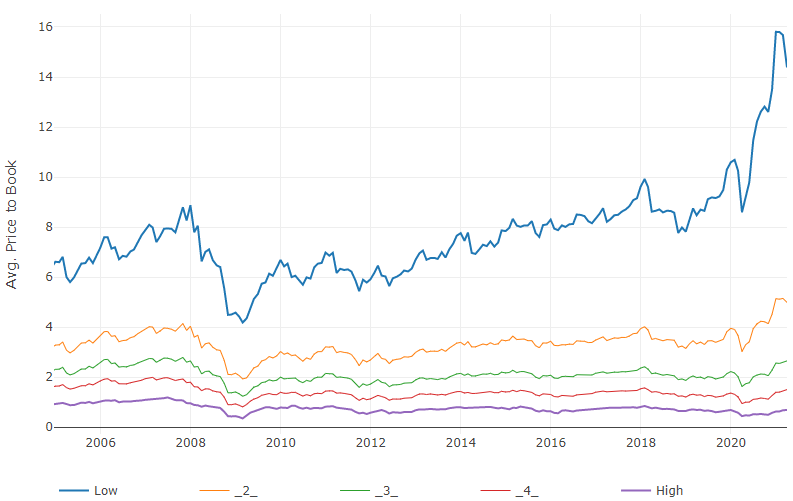

Chart 4 outlines the average price-to-book ratio of all stocks in the MSCI World, sorted into quintiles (by price to book). For example, the blue line shows the average price-to-book of the 20% most expensive names in the universe. This shows that the spread in valuations has been caused by the expensive names becoming more expensive, not the cheap names getting cheaper.

Chart 4: MSCI World Growth and Value price-to-book by quintile

Source: Realindex, Factset, MSCI. Data as at 31 March 2021.

Another insight from this data is that despite the recent rebound in value, the spread is still large, and the most expensive names are still very expensive in historical terms. As such, the rebound has merely ‘scratched the surface’, making it more likely that further gains for value are possible.

If we see the runaway performance of growth as an unsustainable trend that has run its course, then we are more likely to see the value rebound as a trend that is here to stay.

The inflation factor

The inflation and interest rate environment could also influence the performance of value stocks. With bond yields indicating that inflation is picking up globally, and that real interest rates may follow, these types of stocks are set to benefit.

That’s because they are known to be ‘short duration’ in nature – their cash flows are near term. Growth stocks, on the other hand, are known to be long duration. In a world of low interest rates, long dated cash flows are inflated, which will inflate the value of growth stocks when compared to value stocks.

However, when interest rates rise, growth stocks’ valuations will decrease much more quickly, for the same reason. It then follows that an increase in inflation and interest rates will hit long duration names harder. In other words, value will outperform - and this is indeed what we have seen recently.

Analysts betting on value

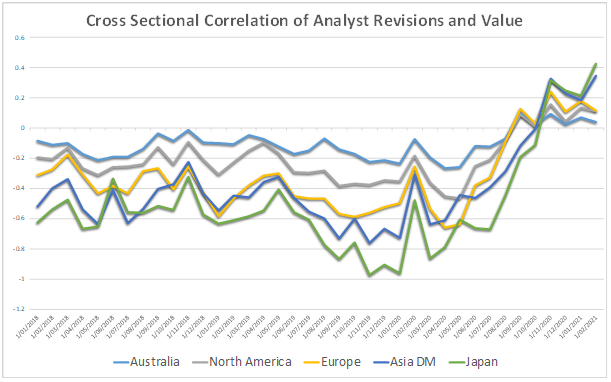

We also looked at the sentiment among sell-side analysts to infer whether the value rebound is set to continue. The chart below plots the correlation of analyst revisions with our composite value factor since the start of 2018. Until the second half of 2020, analyst revisions were negatively correlated with value – that is, growth stocks were being upgraded, or value stocks were being downgraded, or both.

Chart 5: Correlation of Analyst Revisions

Source: Realindex and Factset, April 2021

However, beginning in August 2020, a distinct change has been observed. We now see analysts moving away from the growth-upgrade/value-downgrade cycle, to the opposite – upgrading value stocks and/or downgrading growth stocks. The analyst community is a strong predictor of future market leadership, and this shows that the shift toward value is well underway.

A positive outlook

Overall, our analysis concludes that the signs are good for a continued value revival, as there is a lot of room for value stock prices to catch up. Inflation and interest rates may be ticking up, which normally creates positive conditions for value stocks. And finally, it appears that the ‘smart money’ is on value, with the analyst community looking more favourably on them. We think the signs are good for value investors.

David Walsh is Head of Investments at Realindex Investments, a wholly owned investment management subsidiary of First Sentier Investors, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from First Sentier Investors, please click here.