“That which has been is that which will be, and that which has been done is that which will be done. So there is nothing new under the sun.” Ecclesiastes 1:9.

The events overtaking Argentina and Turkey in recent months are textbook cases of an emerging market crisis. Both countries have racked up substantial amounts of foreign currency debt despite having limited foreign currency reserves, have high rates of inflation and are running budget deficits. Their situations are the same as Brazil in 2015, the Asian financial crisis of the late 1990s and the Latin American crisis of the early 1980s. This article reviews the build-up, the breakdown, the responses and who else is at risk.

The build-up

Any review of emerging market crises has to begin with the lenders not the borrowers. There will always be countries, companies and consumers that want to borrow excessively and live it up, but they can only do so if there is a willing lender. This time around, ample liquidity from central bank quantitative easing and yield chasing fuelled by supressed interest rates kick started a global borrowing binge. There’s evidence of this right across developed and emerging market debt, as well as in government, corporate, consumer and financial sector debt.

Now that the US is normalising its monetary policy (quantitative tightening and raising interest rates) and Europe is reducing its quantitative easing, global liquidity is reducing and yield chasing has pulled back slightly. Emerging market debt, European high yield debt and Chinese shadow banking are the first sectors to show this turnaround.

Turkey’s pathway to problems was fairly traditional. It had the largest foreign currency debt to GDP ratio amongst emerging countries and a high rate of credit growth, leaving it poorly placed if lenders wanted out. The failed coup in 2016 strengthened the political hand of its president and allowed him to proceed with popular but damaging economic policies. The threat of trade sanctions from the US further spooked investors and accelerated the downward trend.

Argentina’s pathway was less traditional yet still exhibited many of the same risk factors. It defaulted on its debts in 2001 and sought help from the IMF. It cleared the IMF loans in 2006. It undertook a series of debt restructurings in 2005 and 2010, but a small group of holdout creditors remained. The unresolved debt blocked Argentina from returning to international lending markets until a settlement was reached in 2016. The next 18 months saw Argentina make up for lost time with a series of jumbo bond issues, including US$2.75 billion of 100-year bonds. The buyers of this bond were comfortable lending for 100 years to a country that has defaulted eight times in the previous 200 years. Madness.

The breakdown

Argentina’s currency has been progressively devaluing over time as is expected for a country with very high levels of inflation. However, this accelerated in May 2018 as it became clear that a recession is likely this year. The exchange rate jumped from 20.5 Peso to the US dollar to just over 30 in three months. A recent bond sale failed to achieve the targeted volume, a far cry from the heavily oversubscribed bond issues of 2016 and 2017.

Turkey has seen the Lira jump from 3.5 to the US Dollar a year ago to as high as 7 this month. The 10-year bond yield is now over 21% with inflation running at 16%. Standard and Poor’s downgraded Turkey’s credit rating to B+ this month and is forecasting a recession next year.

The responses

Argentina is following the textbook solution of getting help from the IMF. In return for the US$50 billion standby facility, Argentina is tasked with implementing a range of measures to balance its budget, reduce inflation and clearly delineate the government (fiscal policy) from the central bank (monetary policy). This has included pushing the key central bank rate to 45%, a level that should hammer down inflation and stabilise the currency but with the side effect of a recession or substantially reduced GDP growth.

Turkey is trying to avoid an IMF bailout. The country’s strongman president wants to continue to run budget deficits and is in no mood to accept IMF spending restrictions. The central bank rate has been increased from 8% to 17.75%, but the threat that the president will intervene and push rates down has spooked investors. Qatar has agreed to provide US$15 billion of support which has led to a small turnaround in the Lira. However, without vital economic reforms it’s likely to be a temporary respite to Turkey’s troubles. In recent years Venezuela and Zimbabwe both refused to seek IMF assistance with their economies failing spectacularly.

Who else is at risk?

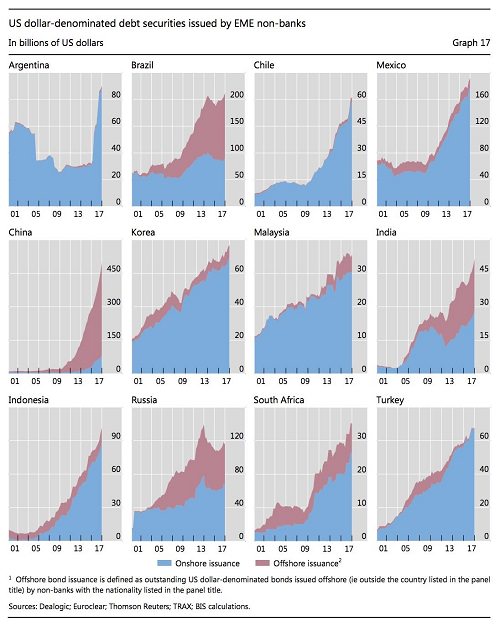

At a simple level, Pakistan and South Africa appear to be the other emerging markets most at risk. However, as the table below from a Bank for International Settlements report shows many emerging market countries have had material increases in their use of US dollar debt in the last five years. The report also found more than half of the international lending to emerging Asian economies was “hot money” with maturities of less than one year.

Click to enlarge

Pakistan’s foreign currency reserves have dwindled at the same time as its budget deficits have lifted government debt levels. South Africa stands out for its profoundly negative current account balance and consistently increasing government debt to GDP ratio. Ongoing corruption, plans to nationalise the central bank, and the wider emerging market sell-off are scaring off lenders and pushing bond yields higher. At a wider level, while Greece and Italy are generally considered developed economies, their falling GDP per capita levels and weak institutions could push them back into emerging market classification. Greece’s GDP per capita is already well below South Korea and Taiwan, who are generally categorised as emerging markets. Both Italy and Greece have large amounts of debt in a currency they don’t control, very large debt to GDP ratios, weak banks burdened by problem loans and governments that are resistant to economic reforms. Neither has any plan to reduce to their debt levels, other than giving their lenders a haircut.

Jonathan Rochford, CFA, is Portfolio Manager for Narrow Road Capital. This article is for educational purposes only and is in no way meant to be a substitute for professional and tailored financial advice.