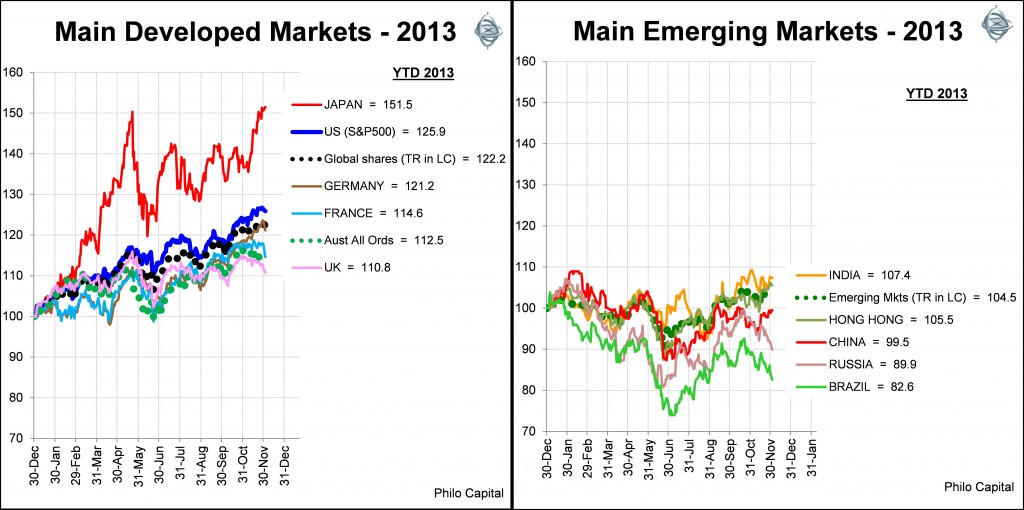

As we near the end of 2013, it looks like this year has been a repeat of 2012 for shares in the major developed world stock markets - high returns plus super-low volatility.

Stock markets in the US, Europe and Japan have done very well again this year despite their moribund economies being on life support in intensive care, their crippling government debt levels, high unemployment, aging populations, soaring pension costs, and debilitating political wrangles.

At the bottom of the pack once again for stock market returns were the BRIC markets, despite their much healthier fiscal, monetary, current account positions, more favourable demographics and lower unemployment levels.

The US stock market and deficit/debt crises

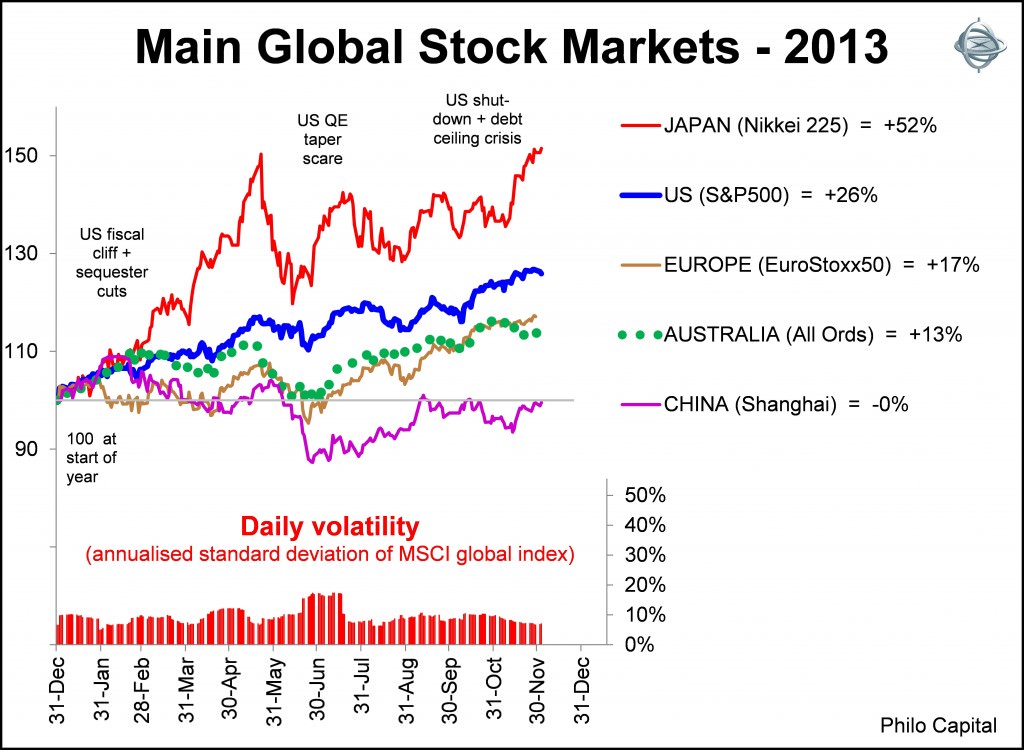

The US market in particular has had a remarkably smooth upward run this year, cruising right through the fiscal cliff, the sequester cuts, the QE taper scare, the government shut down, the debt-ceiling crisis, plus the worsening acrimony and dysfunction in Washington.

We have been over-weight global shares in portfolios (nearly half of which is US shares) since early 2012, and our confidence in the US was underpinned by a great deal of detailed fact-based research we did over the past 12 months into the US debt situation going right back to Abe Lincoln. This work was summarised in a number of Cuffelinks articles.

Far from being the end of the world, as predicted by many, our research showed that prior US Treasury defaults and government shutdowns actually provided catalysts for positive change and rising share prices.

Low volatility as well!

Volatility on global stock markets has also been incredibly low again this year, on any measure. The chart below shows the annualised standard deviation (the most common measure of price volatility) for the global index during the year. It has averaged an amazingly low 9% (compared to a long term average in the mid-teens), and has been below 10% for 74% of the year.

This has been even more calm than the super-calm 2012 (12% volatility) and 2011 (15%) which was more in line with long term average volatility levels.

In spite all of this we still see almost daily media headlines bemoaning these ‘volatile times’ in this low return world. All this scare-mongering helps sell newspapers, and it gives all those reporters on the 24/7 financial news channels something to babble to each other about.

As I said at the end of 2012, if this is the so-called new-new normal, high volatility, low return world, then let’s have more of it.

The missing link has been the money printing on an unprecedented, global scale. The uninformed chatter in the media is that as QE is withdrawn, as it inevitably must be, rising bond yields will be bad for share prices. Last year we also undertook extensive research into every bond yield spike since the Second World War to show that rising bond yields in the current conditions should actually be good for share prices. This has indeed been the case since bond yields started to rise in July 2012. Future Cuffelinks articles will summarise this work.

In summary, 2013 has been yet another reminder for investors to ignore the media hype and focus instead on the facts.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director and adviser to Third Link Growth Fund.