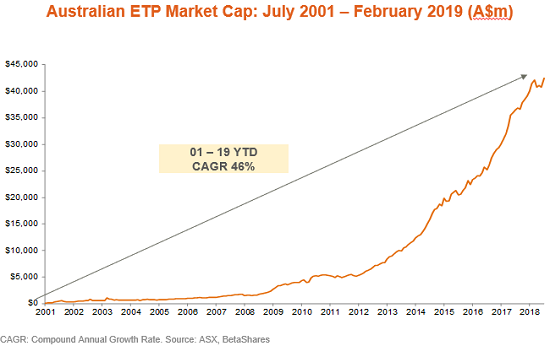

The 10th annual BetaShares/Investment Trends ETF Report provides a snapshot of the key statistics and drivers in the Australian Exchange Traded Fund (ETF) industry, from the perspective of self-directed investors, SMSFs and financial advisers. The latest report shows a record numbers of investors have entered the Australian ETF market, with some changing characteristics.

Key findings of the report

The insights collected from this round of research are based on responses from around 8,000 investors and 800 advisers:

- The number of ETF investors in Australia grew by 22% in the 12 months to October 2018, reaching a record high of 385,000.

- The number of investors holding ETFs through an SMSF rose to 120,000 from 105,000 the previous year, an increase of 14%. Diversification and access to overseas markets are the main drivers for this market.

- Growth in non-SMSF investors was even stronger, with an increase of more than 24% from 213,000 investors in 2017 to 265,000 in 2018.

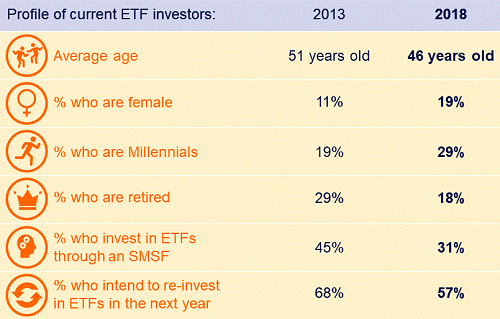

- With increasing mainstream take-up of ETFs, the average age of ETF investors has fallen. 29% of ETF investors are millennials, up from 19% in 2013.

- The use of ETFs by financial advisers continues to grow, with more than half of all advisers (53%) now recommending ETFs (up from 45% in 2017).

SMSF usage remains strong, and non-SMSF take-up is growing even faster

SMSF ETF investors as a percentage of the total ETF market declined from 33% in 2017 to 31% in 2018, reflecting a surge in the number of self-directed investors who are utilising ETFs outside of SMSFs (up by 52,000 from 2017).

Diversification remains the primary driving factor for SMSFs, with 77% of SMSF investors citing this as a reason for using ETFs, followed by access to overseas markets (65%) and low cost (53%).

The average ETF investor is getting younger

The average age of an ETF investor is 46 years old, down from 51 years old in 2013. About 29% of ETF investors are millennials, compared with 19% five years ago. This trend towards younger investors will be a big part of the ETF growth story in the future.

Source: BetaShares/Investment Trends ETF Report, 2019

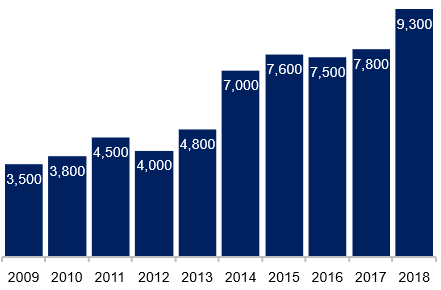

Use of ETFs by financial advisers continues to rise

Financial advisers are adopting ETFs in increasing numbers, with more than half of all advisers (53%) now recommend ETFs, and a further 16% intending to use ETFs within the next year.

Number of financial advisers using ETFs in Australia

Source: BetaShares/Investment Trends ETF Report, 2019

51% of financial advisers agreed that the use of ETFs has been of financial benefit to their clients, while 45% said that using ETFs had enabled them to service more clients. However, there is scope for more growth through advice as only 21% of investors say a financial adviser was involved in their most recent decision to invest in ETFs.

We believe that the Royal Commission could have a positive impact on the ETF industry, with financial advisers likely to favour lower cost, transparent products.

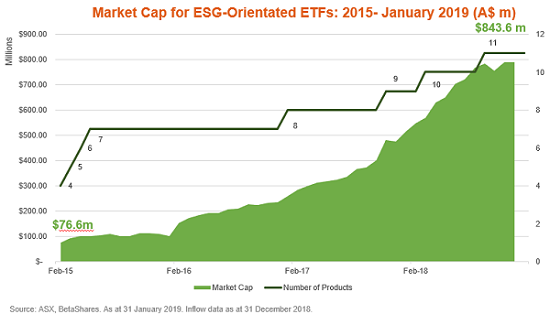

Increased interest in responsible investing

The latest study found an increased focus on responsible investing by ETF investors. The market cap of ESG-oriented ETFs grew by a factor of 10 over the last four years, from $77 million in 2015 to $844 million in 2018. One in three ETF investors has already applied the concept of ESG in their investing over the last 12 months, while 25% of financial advisers have expressed interest in more education on socially responsible investing. Our two 'Sustainability Leaders' ETFs, ASX codes ETHI and FAIR, received over $250 million of inflows over the course of 2018.

Source: BetaShares/Investment Trends ETF Report, 2019

Outlook for the sector

The Report projects a record 437,000 Australians will be invested in ETFs by September 2019, and we project the Australian ETF industry could end 2019 with $50 to $55 billion in funds under management.

More than half of all ETF investors rate their understanding of ETFs as average or lower, suggesting efforts to improve investor knowledge may prove rewarding and increase both new and existing investors’ participation.

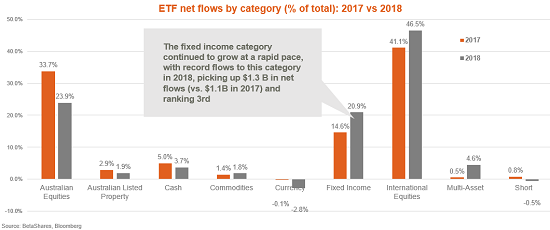

Two other major trends are worth noting. First, we are seeing an increased adoption of ETF model portfolios, where advisers or ETF providers pre-mix a selection of ETFs in an asset allocation model. Furthermore, while Australian equities remain important, they have been overtaken by global equity ETFs, and a big growth in non-equity ETFs, especially fixed income.

Ilan Israelstam is Head of Strategy at BetaShares, a sponsor of Cuffelinks. A summary copy of the Report can be accessed here. This article is for general information purposes only and does not address the needs of any individual.

For more articles and papers from BetaShares, please click here.