What role should nuclear power play in the energy mix? Answers to this question have differed across countries and over time. Though policies and uptake across the globe remain varied, there's now growing interest in both established and new reactor technologies – even in some countries that have historically been wary.

The rise of power-hungry artificial intelligence (AI) helps explain some of this renewed interest, but there's also broader recognition that greater nuclear energy capacity could help the world to increase power generation while advancing decarbonisation. We offer four insights to help investors navigate the evolving landscape around nuclear energy and explore investment opportunities.

1. Nuclear energy’s global resurgence is boosted by the need to reconcile competing demands for energy security, reliability and decarbonisation

An “age of electricity” is upon us, “fueled by growing industrial production, rising use of air conditioning, accelerating electrification and an expansion of data centers worldwide,” according to the International Energy Agency (IEA). Nuclear energy has emerged as part of the solution to meeting such demand while advancing the energy transition.

A few characteristics excite nuclear energy’s proponents. Nuclear power is low carbon. And it can be produced nearly uninterrupted, providing a steady baseload to complement supply from more variable renewables, such as solar and wind.

Another driver behind nuclear energy’s resurgence was in response to Russia’s invasion of Ukraine in 2022. This prompted top prioritisation of energy independence and security for many countries, particularly in Europe. This includes shifting policy stances on nuclear power, including in countries that had decided to phase out nuclear after a serious nuclear accident in Japan in 2011 reignited fears about safety. Worries about nuclear accidents remain a key reason behind the reluctance to adopt nuclear power in some countries.

Nuclear power produces about 10% of electricity globally, rising to almost 20% in advanced economies. Globally, its share in electricity generation is expected to remain close to 10% through 2050, according to the IEA's "World Energy Outlook" from 2024. The stable headline number may mask the flurry of activities in the industry, including building new plants and managing ageing reactors in advanced economies, home to most of the world’s nuclear fleet.

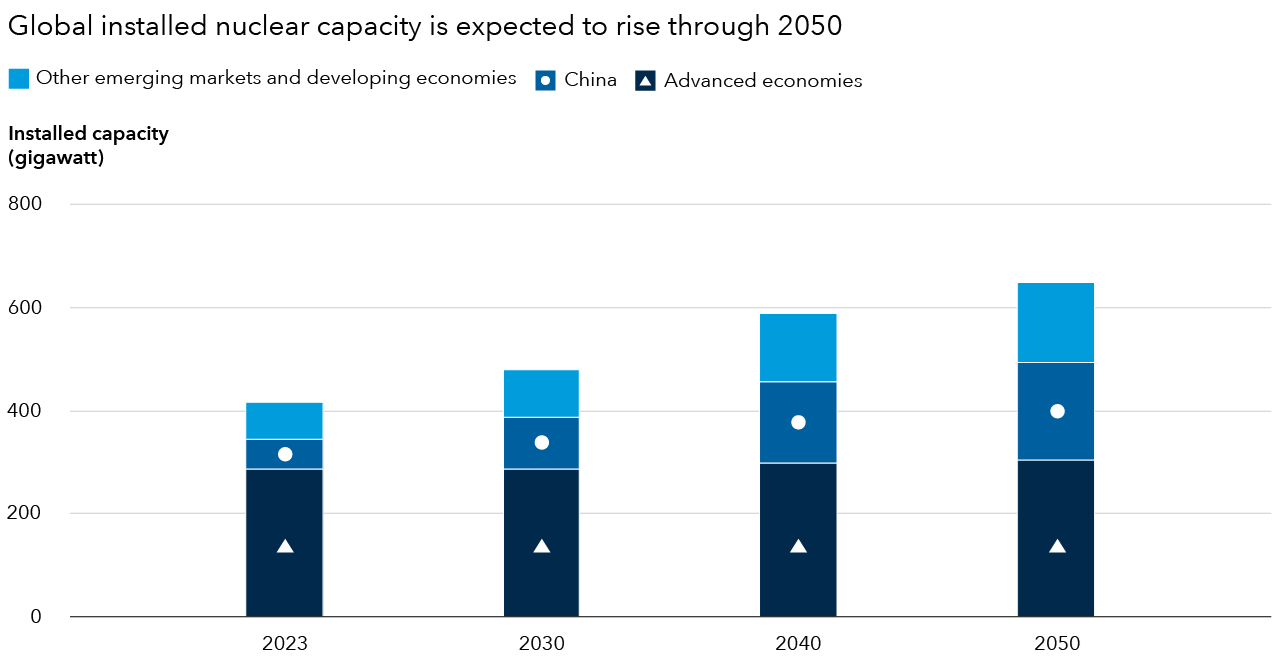

Interest in nuclear power comes from countries along the spectrum. The U.S., France and China – the top three nuclear power producers of the world – all have expansion plans. A number of countries in Southeast Asia and Africa are also exploring developing nuclear power. In the latest sign of a global shift, the World Bank is lifting its decades-long ban on funding nuclear energy, and Asian Development Bank is considering a similar move. Investment in nuclear power globally has already risen by 50% worldwide over the past five years. The IEA has projected that global nuclear power capacity will likely rise through 2050. In recent months there has been a steady stream of news on nuclear-related policy changes and nuclear power deals, often involving tech companies.

“Big tech data centers require uninterrupted power 24 hours per day. Of the main types of fuel that can provide uninterrupted power on demand, only nuclear power generates no carbon dioxide emissions. The more committed a tech company is to achieving a carbon neutrality target, the more likely it is to use nuclear power,” says equity portfolio manager Mark Casey.

Figure 1: The world’s going nuclear

Source: IEA. The Path to a New Era for Nuclear Energy. January 16, 2025. The graphic shows the IEA’s forecast for installed nuclear capacity for 2030, 2040 and 2050 under the Stated Policies Scenario, which takes into consideration existing policies and measures, as well as those under development. 2023 figures are actual. The methodology of IEA’s global energy and climate scenarios can be found on the organisation’s website.

2. Investors should stay focused on reality amid the hype about new nuclear technologies

High costs and long lead times are two key challenges in building nuclear power plants, particularly for established market leaders in recent years. Only a handful of nuclear projects have started construction in Western Europe and North America since 2005, and those being built are significantly over budget and delayed. In the U.S., nuclear power plant Vogtle’s units 3 and 4 took 14 years to build – seven years behind schedule – and cost more than US$30 billion, more than double the initial estimate.

Recently, small modular reactors (SMRs) have been touted as a promising solution. In theory, modules of small reactors can be manufactured in factories and assembled on-site relatively easily – cheaper and faster. Proponents argue that SMR technology's size and design features likely limit the extent of any accidental radiation leaks, while also avoiding the risk of catastrophic meltdown.

SMRs’ appeal also stems from their unique use cases, including repurposing coal power plants and supplying electricity in remote communities. Yet SMR technology is neither a panacea nor a quick fix. In the past, there have been attempts to develop small nuclear reactors, and many such projects suffered from poor economics and technical problems. SMRs also come with specific safety challenges related to novel aspects of proposed designs. More recent SMR projects have also experienced cost overruns and delays.

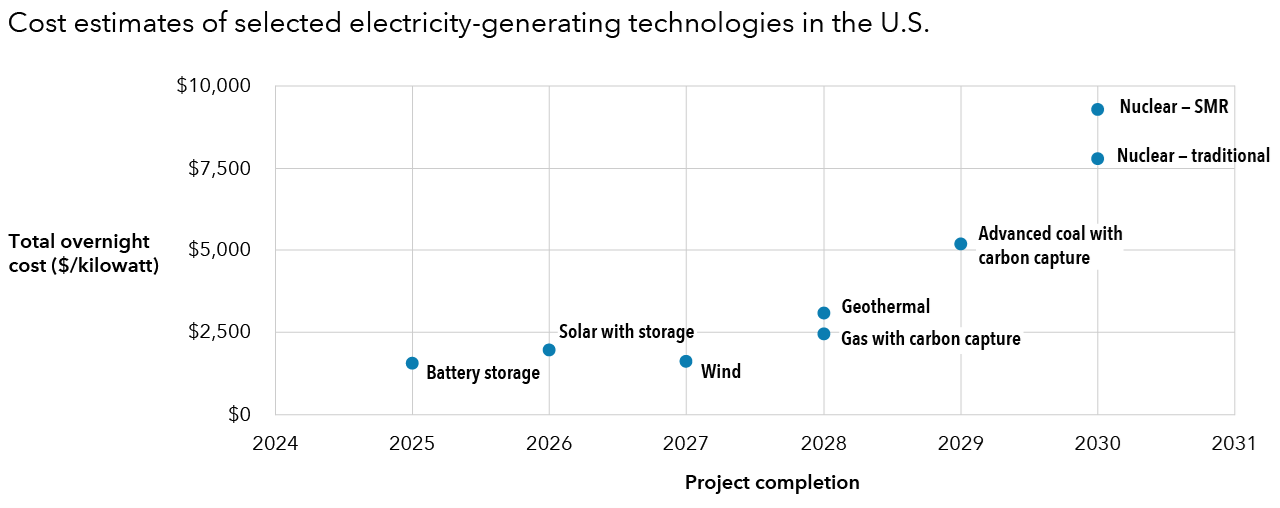

A new generation of small reactors may well be part of the advanced nuclear technology suite, but commercial viability remains years – if not decades – away. The U.S. Energy Information Administration expects the first SMR to be available in 2030, with an estimated total overnight cost (total construction cost excluding interest expenses during plant construction and development) exceeding $9,000 per kilowatt – higher than most new electricity-generating technology.

Figure 2: SMRs are being hyped, but they are no bargain

Source: U.S. Department of Energy “Assumptions to the Annual Energy Outlook 2025: Electricity Market Module.” April 2025. “Nuclear – traditional” refers to light water nuclear reactors, the most common type of reactors. “Nuclear – SMR” refers to nuclear small modular reactor. “Advanced coal with carbon capture” refers to ultra-supercritical coal (a combustion technology using higher pressure and temperature to achieve higher efficiency) with 30% carbon capture and sequestration (CCS). “Gas with carbon capture” refers to combined-cycle gas with 95% CCS. Costs were estimated based on information about similar facilities recently built or under development in the U.S. and abroad.

Nuclear fusion, a process where two light atomic nuclei combine to form a single heavier one while releasing a massive amount of energy, is another nascent nuclear power technology. It is different from nuclear fission, where the nucleus of an atom splits and releases energy, which is used to generate electricity in today’s nuclear power plants. Fusion is even further away from commercialisation than SMR, but commercial interest is emerging, as evidenced by Google’s recent agreement to purchase power from a planned fusion plant in the 2030s.

3. We expect sustained policy support to provide a structural tailwind

In addition to high costs and long lead time, worries about nuclear safety are also a key reason behind some countries’ anti-nuclear stance or decisions to exit nuclear. In a sign of broadening interest in nuclear energy, some of these countries appear to be reconsidering – or at least discussing – these policies.

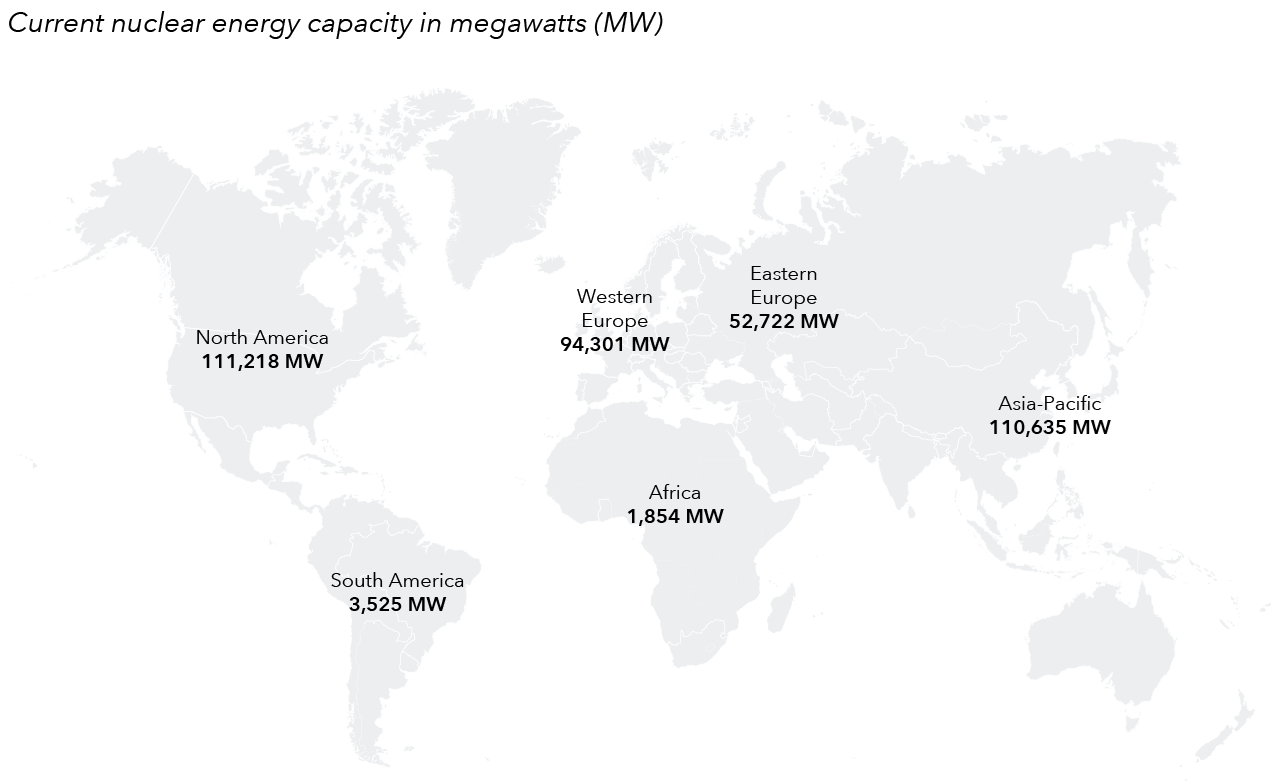

For example, Germany has closed all its nuclear power plants after deciding to exit nuclear in 2011, but has recently dropped its opposition to nuclear power. Denmark is considering lifting a 40-year nuclear ban, and Spain’s major blackout in April has rekindled a debate over the country’s plan to exit nuclear energy. Meanwhile, countries such as Egypt and Bangladesh are developing their first nuclear power plants. Others with established nuclear fleets are expanding capacity, often with SMRs included in the plan.

For countries to successfully introduce or expand their nuclear power capacity, policies that help tackle high costs and long lead time will be key. The IEA observed that standardising reactors’ designs and developing a strong supply chain and skilled workforces have helped China’s recent success in rapidly expanding its nuclear fleet and achieving an average of five years in completing projects. Today, among the 62 reactors under construction, 29 are in China, which is expected to overtake the U.S. as the world’s top nuclear power producer by 2030.

Although policy support in developed countries is unlikely to match China’s strong state involvement in nuclear development, a lot can still be achieved. Long-term energy and industrial policies can encourage standardisation of reactor designs and nurture a strong supply chain, government support in the form of loan guarantees or risk-sharing mechanisms could also help mitigate risks and attract financing.

In the shorter term, extending the life of existing reactors where feasible remains the most economical way to maintain a stable nuclear fleet that contributes to a secure and affordable supply of electricity, according to the IEA.

Lifetime extensions are not, however, without controversies. There are concerns about deteriorating reliability of components, impact from climate change, and that an emphasis on nuclear energy could sideline development of renewables. Nevertheless, 13 countries have decided to extend lifetimes of a total of 64 reactors, which account for about 15% of current global nuclear fleet capacity.

Prolong and proliferate

Figure 3: Nuclear energy capacity set to grow worldwide

Number of countries pursuing strategies to support nuclear energy

Source: International Energy Agency (IEA). The Path to a New Era for Nuclear Energy. January 2025. International Atomic Energy Agency (IAEA) Power Reactor Information System. The map shows current nuclear energy capacity in each region, based on data from the IAEA. The table shows the number of countries planning or considering any of the three strategies related to nuclear power in each region, based on policy decision summaries from the IEA report.

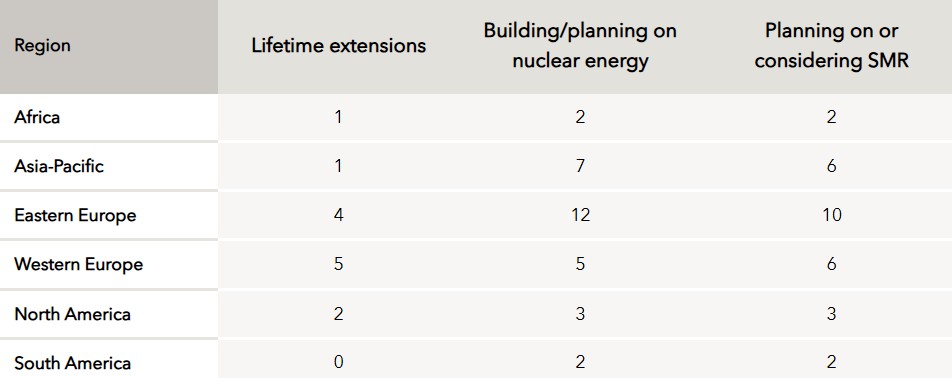

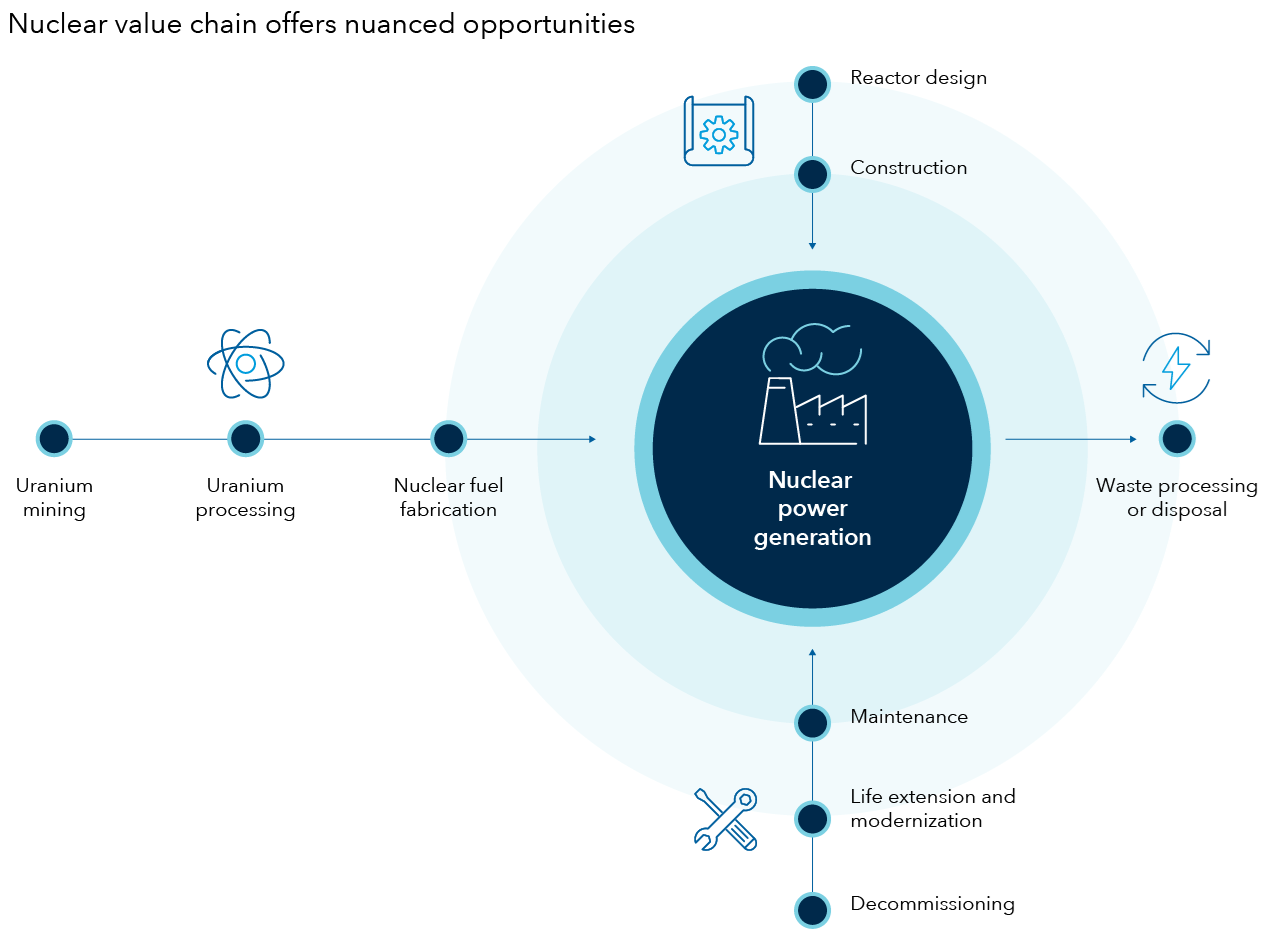

4. Traditional nuclear power’s value chain is offering some compelling opportunities

Some U.S. nuclear power producers have been primary beneficiaries of a wave of power purchase deals with major technology companies. Opportunities to capture the growing interest in nuclear. energy can be found up and down the value chain, including uranium miners, component manufacturers, specialty engineering and service providers.

Take uranium mining. Expansion of nuclear power capacity will require more uranium, just as a uranium shortage looms large after a decade-long bear market. “I believe this uranium bull market has more room to run, as primary supply is fragile and having difficulty ramping up, secondary supply is dwindling, and demand is increasing,” says equity investment analyst Aditya Bapna. “Given the complexity and long lead time of developing uranium mines, uranium miners that are low-cost, have strong balance sheets and are located in geographies with lower geopolitical risks are potentially more attractive, in my view.”

Industrial companies with growing exposure to nuclear energy may be worthy of investors’ attention too. A large U.S. machinery manufacturer recently purchased a producer of sensors for aerospace and nuclear industries. “The market will love the added aerospace and nuclear exposure, as they are probably the two best end markets one could have in industrials over the next decade,” says equity investment analyst Nate Burggraf.

Figure 4: For investors considering nuclear energy, generation is not the whole story

This illustration shows key links on the nuclear power value chain.

The bottom line

Global nuclear power output is expected to hit an all-time high in 2025, and more than 40 countries now have plans to expand nuclear power use. Even in countries that have historically avoided nuclear, such as Australia, the debate over its role in the energy mix has been reignited.

Nuclear power has experienced boom-and-bust cycles before, but this time may be different, as it is marked by increasing investment interest from the private sector, especially in new technologies such as SMRs.

Investors could find opportunities along the value chain, including mining companies, utilities and specialised engineering and services companies. They should also keep tabs on development elsewhere in the electricity system. Power grids need to accommodate rising electricity demand and growing supply from renewables and other sources. Grid modernisation and expansion are, in our view, a related growth area that investors should also keep a close eye on.

Jayme Colosimo is an investment director for Capital Strategy Research and ESG, Donovan Escalante is an ESG senior manager, and Belinda Ga is an ESG investment director at Capital Group, a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.