Scenario analysis can prepare investors for uncertain times by providing the signals needed when considering a vast number of possible market outcomes after a given period of time. With the global outlook remaining clouded in uncertainty from geopolitics, energy shortages and sticky global inflation, the cards may fall in a number of sequential ways which will have vast implications for skittish asset markets looking to extrapolate those developments, powered by algorithms and momentum-based funds.

Outcomes lie in a few powerful hands

In our recent writings we have touched on the ‘stages of grief’ for investors - who have been forced to accept a world without multiple policy support, as governments and central bankers aim to kill the inflation monster that has fed from the pandemic.

We have also suggested that the US Federal Reserve (as the world’s leading central bank) would not ‘pivot’ its policy easily or quickly as financial market participants return to work after a hot North American and European summer holiday. The global outlook remains highly volatile with several possible pathways for asset markets all having reasonable probabilities.

A few influential folk hold powerful cards to these outcomes (Putin, Xi, OPEC, Biden, Powell) and the sequence with which they may play those hands can have powerful effects against an economic and macro backdrop that will likely continue to slow from increasingly restrictive policy into year end.

Asset allocation based on scenario analysis

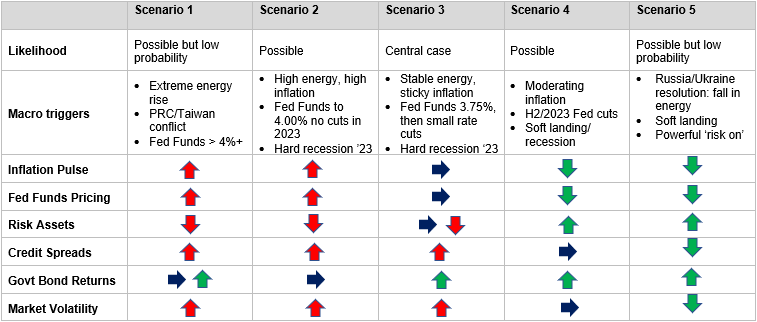

As such, we are thinking about asset allocation as a series of scenarios of differing likelihoods. 2022 is proving to be such a complex year that it is not impossible that the low probability ‘tails’ could happen concurrently, giving the scenario analysis table a third and very complex dimension. That is beyond the scope of this article for now, but let’s consider the world in two dimensions over the five scenarios tabulated below - from our most probable and central case with possible outcomes (both good and bad for assets), and then the extremes, low probability events but high impact contingencies for markets.

Scenario Analysis on a 12-month outlook

Source: Jamieson Coote Bonds

Middle scenario, the central case

Starting with the central scenario most expected by markets, this assumes energy will find a new valuation and trading range, which helps mitigate the inflationary effects as prices remain higher than previous periods, but do not continue increasing (inflation is a rate of change concept). Goods inflation moderates as supply chains continue to heal – this is already occurring across the global economy – however the services side of inflation remains sticky from an inflation perspective which frustrates the year-on-year inflation readings from moderating faster.

Things like ‘rent’ often have a mechanical legal contract component driven by previous higher headline inflation readings which become somewhat self-reinforcing, making it imperative that central bankers kill inflation quickly by destroying demand in the economy via higher interest rates.

This outcome is currently priced by markets, which expects inflation to moderate, the US Federal Reserve to continue hiking rates towards the 3.75% area before delivering mild support with some rate cuts in 2023.

We expect most assets to be range-bound in this scenario, with a drift towards more ‘risk-off’ pricing as the economic picture continues to weaken from previous policy adjustment that is yet to hit the economy due to its lagged effect (rate hikes usually take 6-12 months to appear in economic data). In this scenario, we assume most assets are already well priced, inflation stays well above mandate but does decline, the US Federal Reserve continues hiking but at a slower pace, equities, credit spreads and bond yields reflect higher risk premiums and volatility remains higher than historical settings.

Scenarios 2 and 4, the possibles

On either side of this central scenario are ‘possible’ outcomes, one that is better for asset prices and one not as supportive.

This hinges around energy pricing and its feedback into inflation outcomes and hence the amount of additional tightening required to moderate demand to bring the economy into balance. If we have additional exogenous shock events that drives energy prices higher (for example, Putin cuts off Russian gas in the European winter or OPEC heavily restricts oil flows) then the impact on inflation will force central banks to raise interest rates higher into restrictive territory, crushing asset values in the process and obliterating demand causing a violent recession.

If central banks stay the course as inflation fighters, it would be unpleasant for bonds as short-dated bonds continue to move to higher yields (lower prices). However, we would assume that long-dated yields become stubborn and bond total returns might hold up quite well relative to other asset classes, as a lot of this has already been priced for bond markets, helped by the current 3.60% yield to maturity across the index of Australian Government bond assets.

It would be terrible for credit spreads, as corporates already facing weaker demand will be forced to refinance outstanding debt obligations at far higher yields (cost) and in a market of weak confidence, not all lower rated corporates will be able to complete such a refinancing. We would expect heightened credit defaults, which in turn would drag on the equity complex. As we know, bonds would lead this process initially, but as we saw earlier this year, when other markets play catch up it can be quite violent.

Conversely, without an exogenous shock to energy, the mirror image could be expected. Lower energy prices as supply comes online, lowering demand from already active monetary tightening helping a faster moderation in inflation allowing central bankers to pause and do ‘less’ which would be supportive for all asset classes.

In this instance, we would expect Government Bonds to be the lowest returning, whilst corporate credit and equities would benefit from less restrictive policy settings and volatility might moderate under lower default assumptions than previously feared.

Scenarios 1 and 5, the extremes

At the extremes of our scenario analysis, we envisage low probability but highly impactful possibilities.

First, a resolution to the conflict between Russia and the Ukraine would generate a powerful bullish move for assets, in expectation of lower volatility, plentiful supply of energy, lower inflation etc. In this instance, full blown risk allocation would be the preferred outcome. Growth equities and crypto assets would be expected to slingshot higher. Credit would also enjoy this environment with expected spread tightening and bonds would also perform, although would be mild in comparison to other expected asset returns.

Second, on the other tail extreme, we assume a geopolitical flash point between the US and China in the Taiwanese Strait. This would likely deliver panic and a strong ‘flight to quality’ response from markets which is usually highly supportive of Government Bonds (particularly United States Treasury Bonds) and volatility. Sadly, all other asset classes would be expected to perform poorly if we had to endure the scary prospect or world war. We don’t believe this is likely, but the probability is not zero.

Government Bond capacity to play anchor role

With much uncertainty ahead, diversified portfolio allocations seem to navigate a host of possible scenarios. With the restoration of yield in Government Bonds markets, they will continue to play an anchor role through these uncertainties ahead and an important role in four of our five scenarios.

Charlie Jamieson is Executive Director and Chief Investment Officer of Jamieson Coote Bonds (JCB). This article contains general information only and does not consider the circumstances of any investor.

JCB is an investment manager partner of Channel Capital, a sponsor of Firstlinks. For more articles and papers from Channel Capital and partners, click here.