“When you act on the emotions of the marketplace, you’re making a big mistake. Stay the course, don’t let these changes in the market, even the big ones, change your mind and never, never, never be in or out of the market. Always be in at a certain level.”

Vanguard founder and former CEO Jack Bogle at CNBC’s ‘Power Lunch’, September 2018.

***

Many investors are their own worst enemies, achieving inferior results versus the funds or indexes they invest in due to the timing of their buying and selling. Even after deciding a level of risk that allows exposure of say 50% of their portfolio to equities, investors panic during market falls and cannot maintain an asset allocation discipline. This article offers techniques to control the natural human urge of flight in the face on danger.

In 2014, leading investment writer and founder of a funds management business, William Bernstein, gave Firstlinks permission to publish a terrific booklet called “If You Can: How Millennials Can Grow Rich Slowly.” He advises young people to take exposure to equity markets because time is on their side. But it comes with a warning:

“Know that from time to time you will lose large amounts of money in the stock market, but these are usually short-term events - the financial equivalent of the snake and the tiger. The real risk you face is that you’ll be flattened by modern life’s financial elephant: the failure to maintain strict long-term discipline in saving and investing.”

The tiger and the snake are Chinese zodiac signs with different perspectives on life and contrasting aspirations, and there is the main behavioural problem. Short-term volatility hits long-term goals, as many older people worry their investments will not have time to recover.

Let’s see if there are ways to invest that might control bad behaviour, but first, what habits are we hoping to fix.

Evidence of poor investor behaviour

Morningstar produces a regular ‘Mind the Gap’ report which compares investor returns with the performance of a range of managed funds and Exchange Traded Funds (ETFs). The latest report published in July 2022 says:

“Our annual study of dollar-weighted returns (also known as investor returns) finds investors earned about 9.3% per year on the average dollar they invested in mutual funds and ETFs over the 10 years ended Dec. 31, 2021. This is about 1.7% less than the total returns their fund investments generated over the same period. This shortfall, or gap, stems from poorly timed purchases and sales of fund shares, which cost investors nearly one sixth the return they would have earned if they had simply bought and held.”

Other research by DALBAR based on 30-year data indicates the average investor in the US S&P500 achieved 7.13% while the index delivered 10.65%.

Locally, the EY Global Wealth Management Research suggests Australians are more inclined than investors in other countries to exit markets when their portfolio declines. The problem is, they may never get back in.

“Australian clients appear more actively aware of declines in their portfolios than those in other markets, with the vast majority (97%) saying they change investment behaviour due to declines in portfolio value, significantly above the global average of 73% ... Continued market stress is amplifying their defensive stance and as well as their appetite for both switching and adding to their portfolio.”

Modifying investor behaviour

Here are five ways to modify behaviour with the aim of improving long-term outcomes. Some people may consider these actions inappropriate, but they should be read in context. They are not suitable for everyone.

Behaviour 1. Panicking when the market falls because of fear it will drop further

Solution 1: Invest in a fund or structure that is time-consuming to exit

In every market on any day, there are reasons to sell. Even in bull markets where stocks run ahead for years, there are down periods where bad news suggests the bear may start clawing at returns. It is in these down periods where damage is done. As writer, hedge fund manager and founder of Gotham Capital, Joel Greenblatt, said:

“Unless you buy a stock at the exact bottom (which is next to impossible), you will be down at some point after you make every investment. Your success entirely depends on how dispassionate you are towards short term stock price fluctuations."

Consider what happens when the market falls 5% or more in a single day, equivalent to today’s S&P/ASX300 level of about 7,250 falling by 310 points. This index is worth $1.6 trillion, and the headlines would scream ‘Market collapse costs Australian investors $80 billion.’ Investors worry that the next day will repeat the fall and they sell to manage their losses.

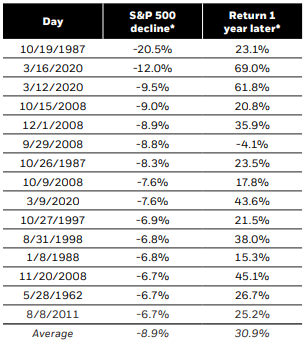

Here is a chart published by BlackRock in 2022 using Morningstar data showing the largest one-day losses in the S&P500 since 1950 and the return one year later. In almost every case, the investor who reacted missed an excellent recovery.

It is usually argued that liquidity is good because it gives flexibility to respond to market changes and personal needs for cash. The development of listed funds such as ETFs is a welcome alternative to the tiresome paperwork still required to invest in some unlisted managed funds. Application forms for SMSFs requiring certified copies of the trust deed and identification documents for trustee company directors can be cumbersome and time-consuming.

But it can work to the benefit of investors if exiting a fund at least forces some paperwork in contacting the fund administrator, rather than jumping to an online broker account and exiting in a instance.

A recent example was the immediate collapse of prices on a wide range of capital instruments when Credit Suisse defaulted on its hybrid bonds. Similar bonds fell heavily for a few days while investors sorted out whether other central bank had forced their banks to include clauses where shareholders ranked ahead of noteholders. When the expected hierarchy of repayment was confirmed, the market recovered well but anyone in a listed note fund who sold quickly missed the bounce.

Some funds may prevent a panic sale by:

- Requiring a completed redemption form to be mailed to an administrator.

- Allowing redemptions only at the end of the month with five days’ notice.

- Closure to new investors so existing investors know if they exit, they will not be allowed back in.

Behaviour 2: Judging your own results against others

Solution 2: Tread your own path as only you know your needs, worries and risk appetite

Investing is like posting on Instagram. People only tell their followers about the good times. The photos from the holiday ignore the hours stuck in airports, dragging heavy bags around looking for a hotel and the daily search for a decent place to eat. Online, it’s all smiles and fun. The investing equivalent is buying Apple or Tesla or Afterpay in the early days, loading up on equities at the bottom of the pandemic, selling before the GFC hit or exiting fixed rate bonds before the rate rises of 2022. The disappearing small tech company is forgotten, while the insider tip from a mate rarely works out.

It's better to decide on your own plan, what works for you and avoid comparisons.

Guy Spier is a fund manager and author of ‘The Education of a Value Investor’, but this is not a typical ‘how to’ book. It’s more about his personal investing journey to learn what works for him, including moving away from the noise of Wall Street to a quiet village outside Zurich. He says:

“Following my move to Zurich, I focused energy on this task of creating the ideal environment in which to invest – one in which I’d be able to act slightly more rationally. The goal isn’t to be smarter. It’s to construct an environment in which my brain is not subjected to quite such an extreme barrage of distraction and disturbing forces that can exacerbate my irrationality. I hope that I can do it justice here because it’s radically improved my approach to investing, while also bringing a happier and calmer life … The constant barrage of bad news could easily have exacerbated my irrational tendencies, when what I needed most was to screen out the noise and focus on the long-term health of my portfolio.”

He has developed what he calls his Personal Scorecard.

“You should judge yourself by your own personal standards and proactively work towards self-improvement rather than indulging in comparisons with the standards and accomplishments set by other investors … Investing has a way of exposing our psychological fault lines. However, you have to live your own life rather than follow the dictum put forth by famous names.”

Behaviour 3: Worrying about running out of money

Solution 3: Allocate to cash and high-quality bonds to cover several years of income needs

Faced with the current greater uncertainty than in the halcyon decade leading up to 2020, Australians are now increasingly protecting their wealth at the expense of returns. The recent EY research says:

“According to the survey, over the past two years there has been a shift in the leading financial goals of Australian investors, with protecting wealth against losses and inflation now the top priority (58% in 2023 compared to 38% in 2021). Ensuring adequate income has dropped from the number one position in 2021 (64%) to fourth spot this year (27%), behind growing investment returns (46%) and wealth transition (28%).”

Back to author William Bernstein, quoted in My Money Journey, explaining how he invests now he has reached the age of 75.

“I often tell people that, when you’ve won the game, stop playing with the money you really need. Perhaps all would be fine if I kept 100% in stocks. But I’m now in my 70s and more interested in financial survival, which is why today I keep at least 20 years of living expenses in bonds and cash investments. That won’t make me rich. Instead, I’ve done something more important: minimized my odds of dying poor.”

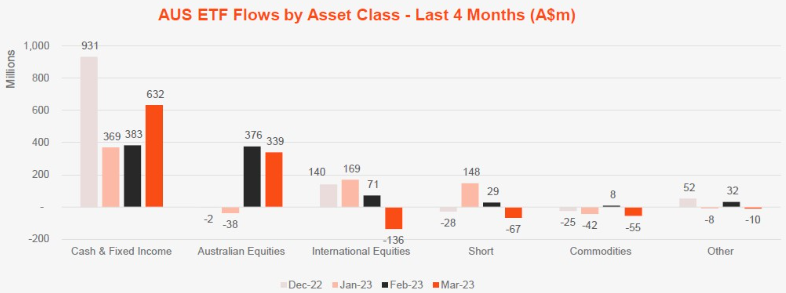

Flows into Australian cash and bond ETFs in 2023 are larger than into any other asset class, as this chart from BetaShares shows.

The most popular method of protecting capital in Australia is to place money on deposit with banks, especially given the government guarantee on deposits of $250,000 and less. Listed high-quality alternatives in floating rate bonds with no duration risk include the VanEck Australian Floating Rate ETF (ASX:FLOT) or BetaShares Australian Bank Senior Floating Rate ETF (ASX:QPON), while better returns with a little more risk come from subordinated bonds such as VanEck’s Subordinated Bonds (ASX:SUBD). Cash ETFs offer rates similar to term deposits. An Australian bond fund such as Vanguard's Australian Fixed Interest ETF (ASX:VAF) offers high credit quality but duration risk exposure.

Behaviour 4: Hating management fees and tax surprises

Solution 4. Find funds which are free to invest in and avoid trusts

It is not best practice to base investment decisions only on a fee or tax impact, as there is little point in saving fees or tax in a poorly-performing fund. But many investors dislike paying 1.5% annually plus a performance fee to a fund manager, and as the EY research indicates, plenty of investors focus on tax treatment.

“Meanwhile, reducing taxes has almost doubled as a goal among Australian respondents in the past two years (23% in 2023 compared to 12% in 2021) although it still remains well below the 2019 survey result of 63%.”

There are many funds in Australia where investing is almost free, and recent competition in the ETF market has driven management costs even lower. Some unlisted funds are free of base management fees where the manager is paid only on performance. Here are a few examples:

- Many ETFs in Australia cost only a few basis points, or less than 0.1%, which is effectively free. The cheapest at 0.03% a year is the Vanguard US Total Market Shares Index (ASX:VTS). In Australian equities, three cheap funds are iShares Core S&P/ASX 200 (ASX:IOZ) costing 0.05%, the Vanguard Australian Shares Index (ASX:VAS) at 0.1% a year while the cheapest Aussie is BetaShares Australia 200 ETF (ASX:A200) at 0.04%. Smart beta is offered by VanEck such as global shares (ASX:QUAL) at a 0.4% fee. In other sectors, recent launches include iShares Core FTSE Global Infrastructure (AUD Hedged) (ASX:GLIN) and iShares Core FTSE Global Property ex Australia (AUD Hedged) (ASX:GLPR) priced at only 0.2%, highly competitive for these thematics

- Managed funds can also be highly competitive, such as Solaris offering a Core Australian Equity fund with a management fee of zero and relying on a 30% performance fee over its benchmark. Tony Hansen's EGP Capital is another fund which is performance fee only, and many platforms offer low cost index options.

On the tax side, a major headache often arises from trust structures used by managed funds and ETFs but not by Listed Investment Companies. The problem for a unit trust is that each year, all income received (including realised capital gains) is divided among unit holders based on how many units they hold at the time of a distribution. Unit holders must include their share of this income (which may comprise dividends, interest, capital gains and franking (imputation) credits) in their own tax return in the year it was earned.

An investment in June that receives a distribution in July may be converting capital to taxable income. For example, if someone invests on 25 June when the unit price is say $1.00 and then a 10 cent per unit distribution is made on 30 June, the unit price will fall to 90 cents (assuming no market movement) at the beginning of July. The 10 cents will be taxable income in the hands of the unit holder. The tax shock can be intense.

LICs are companies where the boards can decide whether to pay a dividend, which allows a dividend reserve to build up and smooth payments when returns may not be as good.

Behaviour 5: Losing patience with a fund manager or a share price

Solution 5: Ignore the market value of your portfolio until the end of the year

Warren Buffett says if you don’t feel comfortable holding a stock for 10 years, you shouldn’t hold it for 10 minutes. Although a long-term investment thesis remains in place, investors lose patience. Buffett famously said, “Our favourite holding period is forever”, and he demonstrates this with Apple, Coca-Cola, Heinz and American Express.

I recently invested with a fund which opened to new applications only briefly and then closed again. The fund manager required me to vouch that I would be a long-term investor, although the fund is open-ended. The fund has excellent historical performance, and while this may not be repeated, I doubt I will exit this fund for at least 10 years. In fact, although they will issue a monthly report, there is no intra-month reporting and I would prefer not to know how it is going for many years.

Here are some strategies to consider:

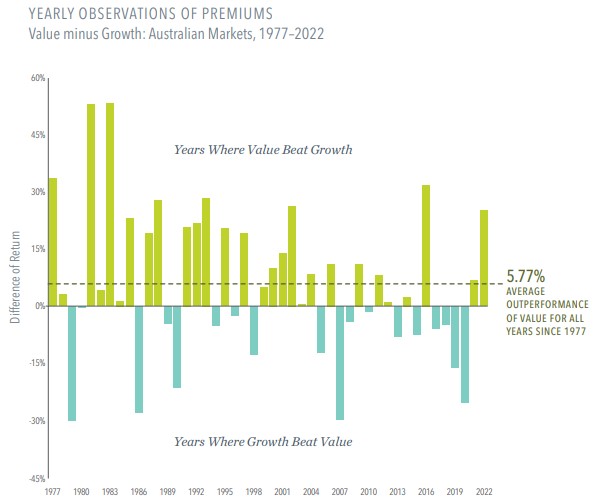

- Placing funds with an active manager is a long-term decision, say 8-10 years. Their investment style may go out of favour for years, but you can be sure just when you give up on them, they will turn the corner. For example, over the very long term, ‘value’ investing has outperformed ‘growth’, but in most of the last 10 years, growth has outperformed value. Is now the time to get out? This chart from Dimensional shows value or growth can dominate for years before underperforming.

- Open another account with your broker, or another account with a different broker, and put the shares you expect to hold for a long term in there, and don’t look at it. Sure, you will know if CBA shares are at $100 or $80, but at least the losses will not stare you in the face each day.

- When considering the purchase of a stock, buy half your initial plan. If the stock rises, you can take satisfaction that you invested at a good time. If it falls, you have a cheaper entry price. If you’re not a trader, then selling for a loss a few weeks after buying is an admission that the first purchase was a mistake.

It’s what works for you

Volatility is the price investors pay for the attractive long-term return from equity markets, but jumping in and out is usually counterproductive. There is nothing wrong with a conservative allocation in a diversified portfolio if protecting capital gives comfort. Know in advance how you will react and manage your behaviour in times of heightened market volatility.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any person. Disclosure: Graham personally holds some of the investments mentioned in this article.