We recently launched the first edition of the quarterly BetaShares Global ETF Review to analyse key trends and developments in the industry outside Australia. Looking at more mature ETF markets globally gives insights into the potential future for the Australian market. The global review complements our monthly Australian-focused publication on the local ETF industry.

The full report is available for download, but I’ve captured key highlights below.

Index strategies dominate investor preferences

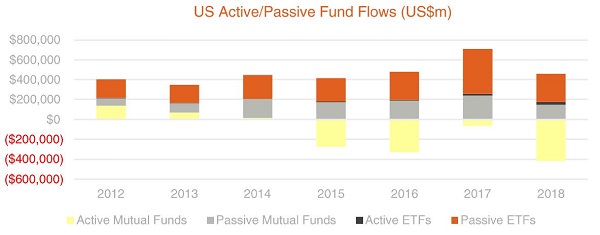

The global ETF industry ended 2018 at US$4.8 trillion in assets under management (AuM), posting a robust annual growth rate of 20% since 2005. The strength of ETFs can be largely explained by the growing preference for passive strategies, which still dominate the global ETF space. More broadly, unlisted funds (known as ‘mutual funds’ in the US) are also evidencing a tilt towards passive strategies. In the US in 2018, passive funds (including traditional unlisted mutual funds and passive ETFs) attracted net inflows of US$431 billion. In comparison, active mutual funds in the US reported net outflows of US$418 billion, the highest level of annual outflows for this category on record.

The chart below illustrates the trend away from traditional active mutual funds. Since 2012, there have been net inflows into Active ETFs as well as passive ETFs, indicating investor preferences for the ETF structure whether or not the underlying investments are actively or passively managed.

Source: Bloomberg.

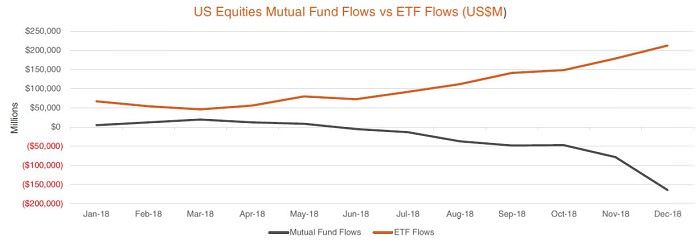

Investor preferences are perhaps even more strikingly evidenced in the chart of U.S. equities mutual fund v ETF flows. With both categories including passive and active strategies, the investor trend towards the ETF product wrapper is clear.

Source: Bloomberg.

Compared to larger and more mature markets, such as the US and Canada, Australia sits behind in terms of net inflows and size. Putting the size of the Australian industry in context, in the US, ETFs represent about 16% of the size of the broader mutual fund industry. In Australia, the penetration is far smaller, at about 1.5%. While recent local growth has been fast, we believe Australian investors are just starting to scratch the surface when it comes to ETF usage.

Who owns the sharemarket? Not ETFs

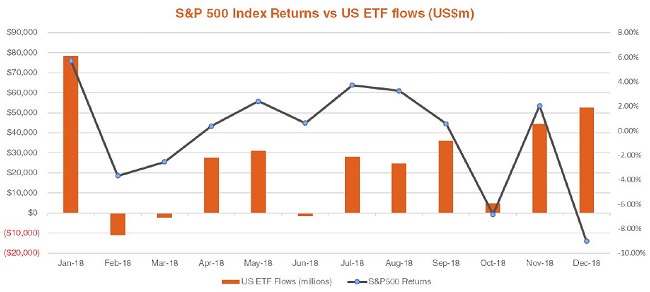

The popularity of ETFs has raised concerns that they are fuelling sharemarket volatility. These fears are unfounded. The graph below for 2018 data compares the flows of U.S. equity ETFs traded in the US versus the performance of the S&P 500 Index. Market moves were entirely independent from flows into and out of ETFs.

Source: Bloomberg

December 2018, for example, saw a strong market decline despite the positive inflows to ETFs. Saying ETFs can move markets makes little sense. They are designed to replicate what their underlying securities do. Nothing more, nothing less.

ESG and smart beta on the rise

Two of the key trends observed by our research are the rise of ESG/ethically-orientated products and smart beta strategies.

In the U.S. last year, ESG ETF AuM grew by 26% year-on-year, while inflows grew even more rapidly with a 57% annual growth. Smart beta exchange-traded products weight shares in portfolios based on a methodology other than market capitalisation. Between 2009 to 2018, flows into smart beta strategies experienced a compounded annual growth rate of 60%, reaching a record high of US$86 billion in 2018.

As the popularisation and sophistication of the ETF industry and of investors around the world continue to grow, we predict the uptake of funds with differing methodologies to continue to be adopted. The cost-effectiveness, transparency and accessibility offered by ETFs makes them appealing for all investor types, whether an institutional asset allocator, a financial adviser, a high net worth individual, or a millennial who is just starting to build an investment portfolio.

Ilan Israelstam is Head of Strategy and Marketing at BetaShares, a sponsor of Cuffelinks. This material has been prepared as general information only, without reference to your objectives, financial situation or needs. You should seek your own financial advice before making any investment decision.

For more articles and papers from BetaShares, please click here.