It’s not universally known (but nor is it a secret) that MSCI, the major provider of performance indices on global equity markets, understates the performance of its global indices calculated for Australian investors. On the surface you may think this doesn’t mean much, but there are actually many flow-on effects worth tens of millions of dollars.

Index calculation trickier than it seems

The job of an index calculation group is much more complex than you think. At first blush, it may seem that all they do is take the index weightings, and account for dividends, corporate actions and stock movements to get the total performance. Well, not really, especially when it comes to global indices. When one invests offshore there are a variety of taxes such as withholding taxes and stamp duties which must be paid on dividends earned in different countries.

Where it gets really complex is that different countries have different tax treaties between them which need to be accounted for. It can also depend on whether they apply to a personal or institutional investor. Should an index provider like MSCI calculate a separate index for the performance of a global equities index based on the experience of different investor types in each country around the world? They don’t because there would be many indices to calculate. Rather they calculate the performance using the most conservative set of assumptions. Of all possible combinations, they select the one that has the highest tax / lowest performance. Because Australia has many double tax treaties in place, the performance experience of an Australian investor using a passive approach would be higher (ignoring transaction and management fees).

Understatement is a significant issue

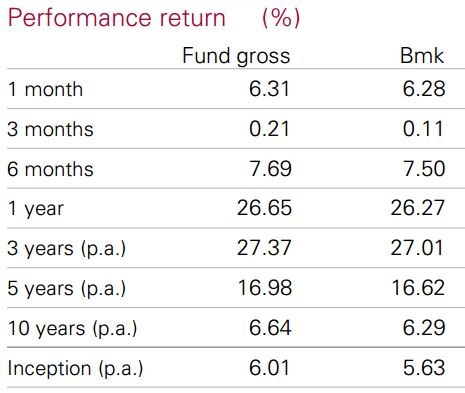

The performance understatement has averaged between 30bp to 40bp per annum. The understatement is larger when dividend yields are high, making it an even larger problem for indices on higher-yielding sectors such as REITS and infrastructure. The simple way to provide some evidence is to look at the reported gross performance of index funds against the index.

Below I have snipped the gross performance numbers for Vanguard’s International Shares Index Fund (refer to Vanguard’s website for appropriate performance disclaimers etc.). We can see that the fund has consistently outperformed the benchmark, yet it is being run in a passive manner. (The fund is the MSCI World ex-Australia Index in AUD, and Bmk means benchmark).

Is this valuable information or just trivia?

Consider the ways we use such performance data:

Assessing the relative merits of active versus passive investment

Global equities make up a large part of many portfolios. Across institutional super funds, the average allocation is around 20% worth up to $300 billion of capital. The debate about active or passive investing in global equities is fierce and the numbers look tight: there appears to be little outperformance on average. However, once we account for the data issue, the average global equities fund underperforms (because the index is doing better than we think). Assuming an average active management fee of 50bp (above index fees) for institutional investors, then up to $1.5 billion p.a. is the possible fee pool being spent on active global equities. How well informed and how efficient is this decision?

Calculation of performance fees or bonuses based on outperformance

Some funds charge performance fees, commonly relative to the performance of the benchmark. A fund that mirrors the holdings of the index is likely to outperform the index by say 30bp. If we assume a performance fee of 10% above index, then this results in 3bp of performance fees. This isn’t a big number in the context of an individual, where many other factors will impact more greatly upon their performance. However, the system wide costs can be large, simply because the assets under management can be so large. A fund with assets of $10 billion will unfairly earn an extra $3 million p.a. in performance fees.

Furthermore, investment staff at super funds are often paid a bonus based on performance relative to benchmark. They too participate in this free ride. There can be gaming issues if the quirk is known by some but not by all within a fund. For instance, the portfolio manager in charge of selecting global equity funds, if solely aware of the quirk, may just invest passively, outperform the benchmark and receive a handsome bonus which is undeserved, at the expense of the member (directly for an industry super fund and less directly for a retail fund).

Judging different products managed by the same fund manager.

Some global equity managers offer different risk versions of their products. It is common to see the low risk product has a higher information ratio (outperformance divided by tracking error) than the higher risk version. A common explanation is that the lower risk version is more efficiently constructed. However, it is also true that the 30bp to 40bp pick-up is more significant in the context of a low risk product.

Possible solutions to improve the index

The industry could lobby MSCI to calculate an index for Australian investors, but there may be additional cost involved for users. Fund custodians could replicate the index in their systems and estimate the performance of the index on a like-for-like basis with how they calculate fund performance. Super funds could explicitly remind the investment committee and board that there is this understatement issue when it comes to assessing the performance of global shares.

Benchmarks are more difficult to calculate than a first glance may suggest. Our industry is so big that issues like this which appear minor can have impacts which cost tens of millions of dollars. It could lead to a significant amount of management fees being spent, perhaps on an uninformed basis, on actively-managed global equities. It’s a complex system, isn’t it …?

David Bell is Chief Investment Officer at Mine Wealth + Wellbeing. He is also working towards a PhD at University of NSW.