It’s hard to imagine a world where Apple and Google (Alphabet) aren’t dominant. These two tech giants have been at the centre of our digital lives for nearly two decades - Apple through its control of the smartphone ecosystem, and Google through its command of online search. But history reminds us that no company, no matter how dominant, is completely immune to disruption.

The rise of artificial intelligence (AI) could pose the greatest threat these businesses have ever faced, and opens a plausible path for this dominance to be challenged.

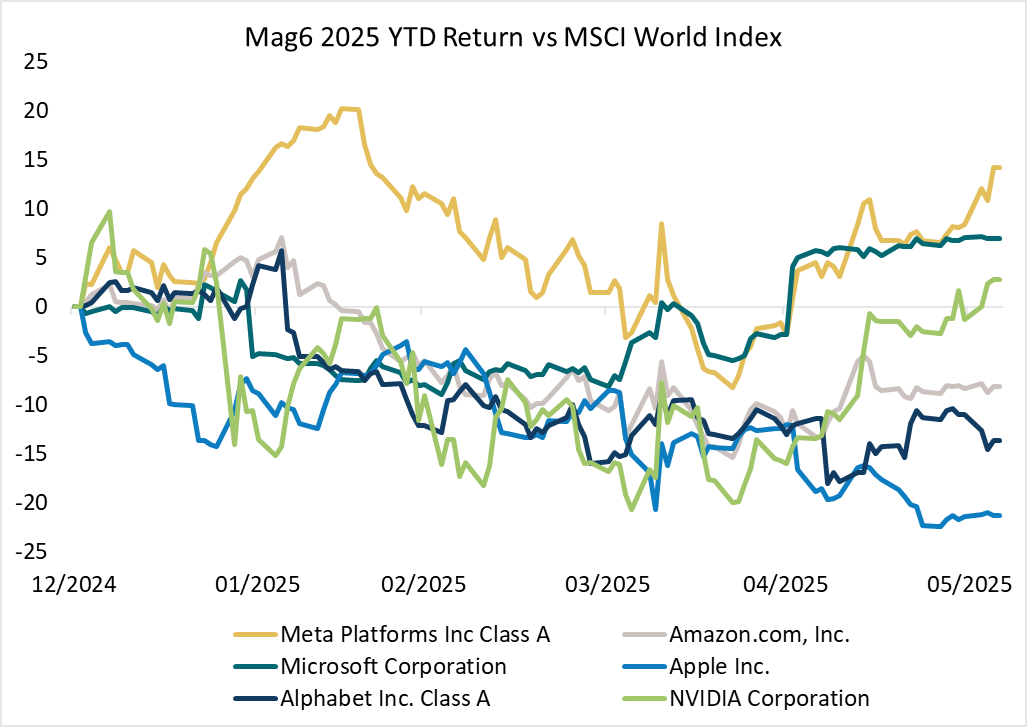

Divergence within the Mag6 – Apple and Alphabet underperforming YTD

Source: Factset, 5 June 2025

Google’s grip on search is under threat

Google has long enjoyed an unshakable position in internet search, capturing more than 90% of global market share. But this near monopoly is no longer as impregnable as it once was. The emergence of large language models (LLMs) like OpenAI’s ChatGPT and newer players like Perplexity introduces a very different way to access information - one that doesn’t rely on the traditional ‘10 blue links’ model of search.

These AI systems offer more direct, conversational answers. They aggregate information across sources and present it in a more human and contextual way. For many types of queries, particularly research, how-tos, and summaries, they can be faster and more useful than Google. And these new LLM’s are beginning to take their conversational interface into commercial search, the very core of Google’s business. If users increasingly turn to LLMs for commercial queries, ad revenue will begin to migrate with this shift in engagement.

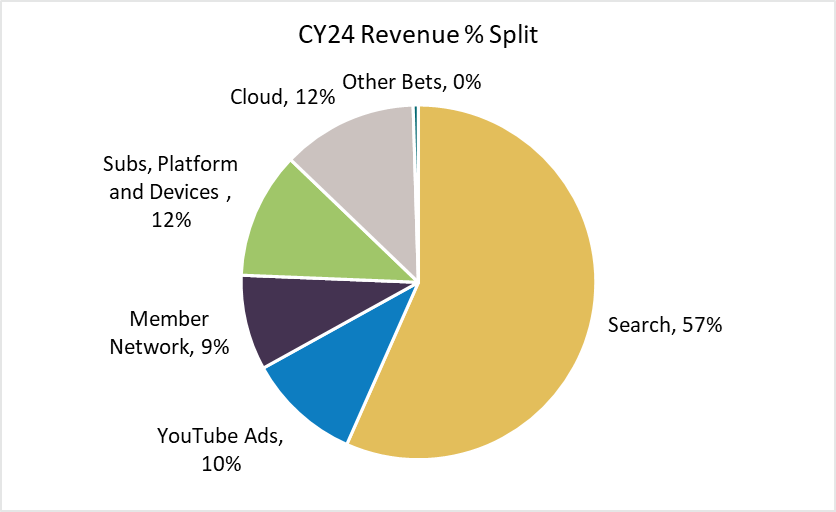

This is important as Search advertising revenue is circa 57% of Google total revenue, and given the high margin attached to it, this would translate into > 80% of Google profitability. While Youtube, Cloud and Waymo are quality and growing businesses, the key to the future value of Google remains inextricably tied to Search and this is currently under threat.

Google is investing heavily in AI through its Gemini platform, but the challenge it faces is not just technological - it’s structural. Shifting its business to meet the new paradigm of AI summaries could cannibalise its existing ad revenues. In short, Google has to disrupt itself while fending off nimbler rivals that don’t carry the same baggage - the ultimate “innovators dilemma”. To date these moves have been tentative, leaving the door ajar for competitive displacement.

‘Search’ accounts for the majority of Alphabet’s revenue

Source: Alphabet CY24 Results

Apple’s ecosystem fortress is showing cracks

Apple’s dominance has long rested on two powerful pillars: its tightly integrated hardware led by the iPhone (which still accounts for more than 50% of revenue), and its faster growing, high-margin services business. Together, they form one of the most valuable consumer ecosystems ever built. But both sides of this ecosystem are now facing meaningful threats from technological disruption, compounded by regulatory pressure.

On the technology front, Apple looks to be slipping behind in the race to define the next user interface. As AI becomes central to how we interact with devices - through voice agents and intelligent assistants - Apple’s core interface in Siri is lagging badly. While rivals like Open AI, Meta and Perplexity are rapidly advancing conversational AI, Apple’s Siri updates are continually delayed, with the next major upgrade now not reportedly arriving until 2027. If new device platforms emerge that are built around AI-first interaction, Apple’s dominance in hardware could be challenged. We are already seeing a potential alternate device state emerge in glasses, with Meta in development with Essilor Luxottica and Google announcing a deal with Warby Parker. The acquisition by Open AI of Apple alumni Jony Ive’s AI hardware startup “io” is another strand in the intensifying AI device competitive landscape.

At the same time, Apple’s services business is under legal scrutiny. Regulators in the U.S. are seeking to block its multibillion-dollar search deal with Google; a move that could curtail a major source of annual revenue and earnings. Court documents have put this payment at around $25bn per annum or 6% of revenue. Meanwhile, pressure is mounting globally to force Apple to open its App Store to alternative payment systems and third-party downloads, weakening its ability to charge developers a 30% commission (often called the “Apple tax”). Coupled together we have approx. $55bn of high margin Apple Services revenue under threat from a tightening regulatory landscape.

Together, these risks suggest that Apple’s once-unshakeable ecosystem is increasingly vulnerable. Just as Apple rose to power during the mobile revolution, the shift toward AI at a time of greater regulatory interventions could open the door for new competitors to disrupt both its hardware and services businesses.

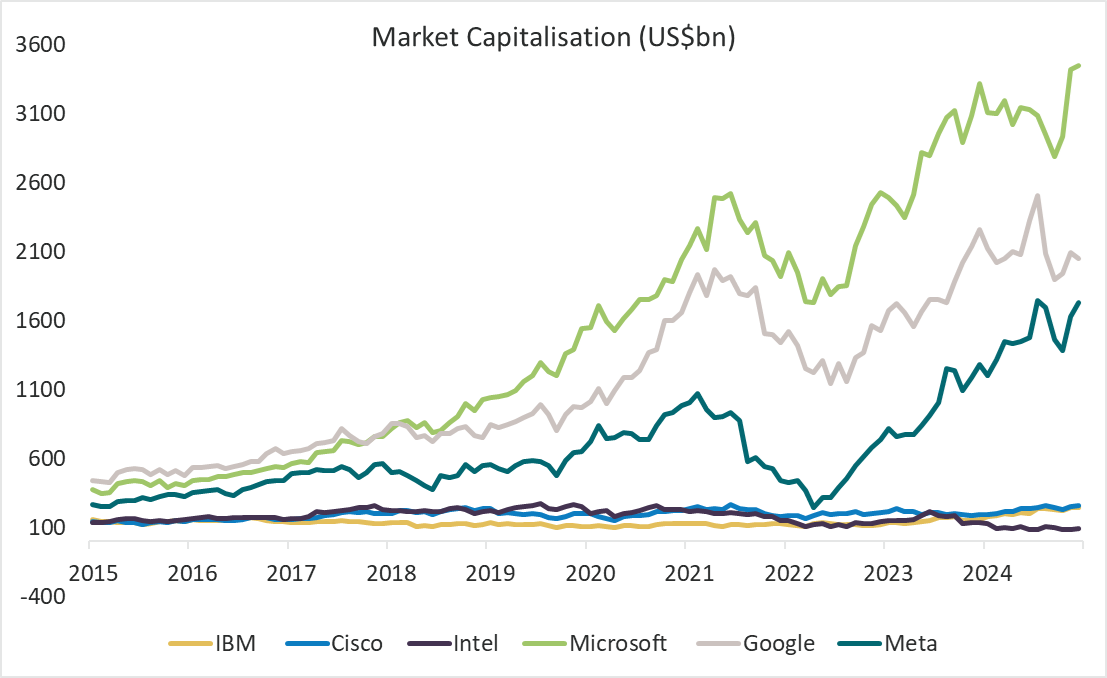

Lessons from history

While it is difficult to imagine a world where Google and Apple are not dominant, the technology sector is littered with examples of once-dominant firms that failed to adapt to technology platform shifts:

- IBM was the world’s most valuable company in 1980 but lost its lead as computing moved from mainframes to PCs and then to the cloud.

- Cisco and Intel were titans of the early internet era but struggled as the centre of innovation shifted to software and mobile.

- Nokia and BlackBerry were synonymous with mobile phones until Apple’s iPhone and Google’s Android completely upended consumer demand.

The birth of the internet gave rise to today’s giants. The birth of AI may, in turn, create the conditions for new leaders to emerge - or for today’s leaders to stumble.

The Internet gave rise to a new era of technology leaders

Source: Bloomberg, 5 June 2025

What this means for investors

As an investor it’s tempting to stick with the familiar and extrapolate what we currently see. Apple and Google have delivered years of strong returns and are still generating exorbitant levels of free cash. But dominance in tech is rarely permanent. Disruption often starts with tiny cracks and by the time it is more obvious, the market has already repriced the winners and losers.

Now this doesn’t mean it is definitely ‘over’ for these two giants. They have faced substantial risks before and managed to morph their business to adapt to the prevailing conditions. And there are competing, more positive narratives that the breadth of Google services and depth of AI skills can see it emerge as an AI winner while Apple can position as the “on-ramp” for consumer AI engagement.

For the first time in a while, however, the wind seems to be more in these companies’ faces, and while still uncertain, a path to a substantial weakening of the Apple and Google businesses is beginning to open-up. As such, a more cautious view on these companies is warranted, and it means staying highly attuned to shifts in user behaviour, the adoption of AI tools, and focusing on where the innovation is really happening.

The companies that succeed in the AI era may look very different from those that have succeeded in the internet era and the potential weakening of Apple and Google could create the space for an AI native trillion-dollar company to emerge.

Trent Masters is a Global Portfolio Manager at Alphinity Investment Management. This article is general information that does not consider the personal circumstances of any individual.