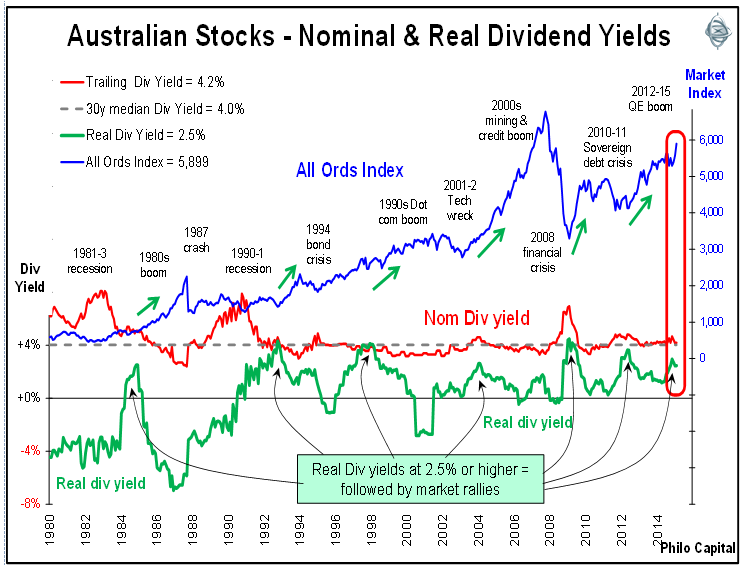

Over the past seven decades in Australia the level of ‘real’ dividend yields across the market has provided a pointer to broad stock market rallies ahead.

The ‘nominal’ dividend yield is the aggregate level of dividends for the market over the most recent 12 month period divided by the current market index level. The ‘real’ dividend yield is the ‘nominal’ dividend yield less the current or most recent annual inflation rate. A similar measure also works for the US market. The chart shows the Australian market since 1980 noting the booms and busts.

When the real dividend yield reaches 2.5%, the market has rallied for the next several quarters. This measure considers all of the rallies through the 2000s credit/mining boom, the GFC, the sovereign debt crisis and QE boom, and it has also worked in all prior cycles since World War 2, except in the high-inflation 1970s.

In 2014 the Australian market was flat but at the end of 2014 the real dividend yield once again reached 2.5% indicating the market was likely to rally, and it has indeed risen strongly. At the end of February 2015, the real dividend was still 2.5% (4.2% nominal yield less 1.7% inflation), and this has provided further support to our bullish stance on shares.

Local investment markets are being driven by three main factors – monetary, fiscal and political. On the monetary front the Reserve Bank has had to keep cutting interest rates to try to bring down the dollar and to stimulate business investment. The plan is not working as intended. The dollar is still too high and business investment has stalled. Banks are not lending to businesses and businesses are not borrowing or investing. Lending growth is showing signs of growth but it is mainly housing lending, and investment property lending in particular.

Investment has collapsed in the resources sector (thanks to falling commodities prices, over-supply and weak demand), and it has also stalled in other sectors due largely to political uncertainty and the budget crisis.

Instead the rate cuts have fuelled asset price booms driven by foreign and local investors. Foreign investors have so far not been deterred by currency losses. They continue to chase our relatively high interest rates and yields on bonds, commercial property and shares, which are still high compared to the rest of the world. Local investors are shifting money out of bank deposits and chasing higher yields in ‘risky’ assets at high prices.

The government has been canvassing various measures to cut back spending – eg charging for previously ‘free’ doctors’ visits, counting the family home in assets tests for welfare, and means testing childcare subsidies. The Federal Treasurer has also signalled that a whole range of taxes and tax breaks are on the table for the upcoming May budget - including capital gains tax, negative gearing, franking credits, GST and superannuation tax breaks. These may sound logical and sensible but they will cost votes the government cannot afford to lose. The labour market is weakening, the unemployment rate is rising, wage growth rate is slowing, and inflation is declining.

But for investors, the extraordinarily loose monetary policy (low interest rates) and fiscal policy (budget deficit blowout) are supporting asset prices (shares, bonds and property).

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is educational only and is not personal financial advice, and does not consider the circumstances of any individual.